Summer travel is kicking off in full force, and that can mean only one thing (aside from school ending, barbecues and packed flights to Europe): It’s time to name TPG’s Best Airline for 2024.

This year’s rankings come as summer travel is expected to reach its highest level since 2019, if not its highest level ever.

Hundreds of thousands of Americans will be looking for airline tickets while considering details like price, service, reliability and, yes, frequent flyer points and miles.

Each traveler has their own set of preferences, but we still receive one type of question above nearly all others: Is any one airline in the U.S. the best? Does any one carrier succeed at all the things travelers really care about?

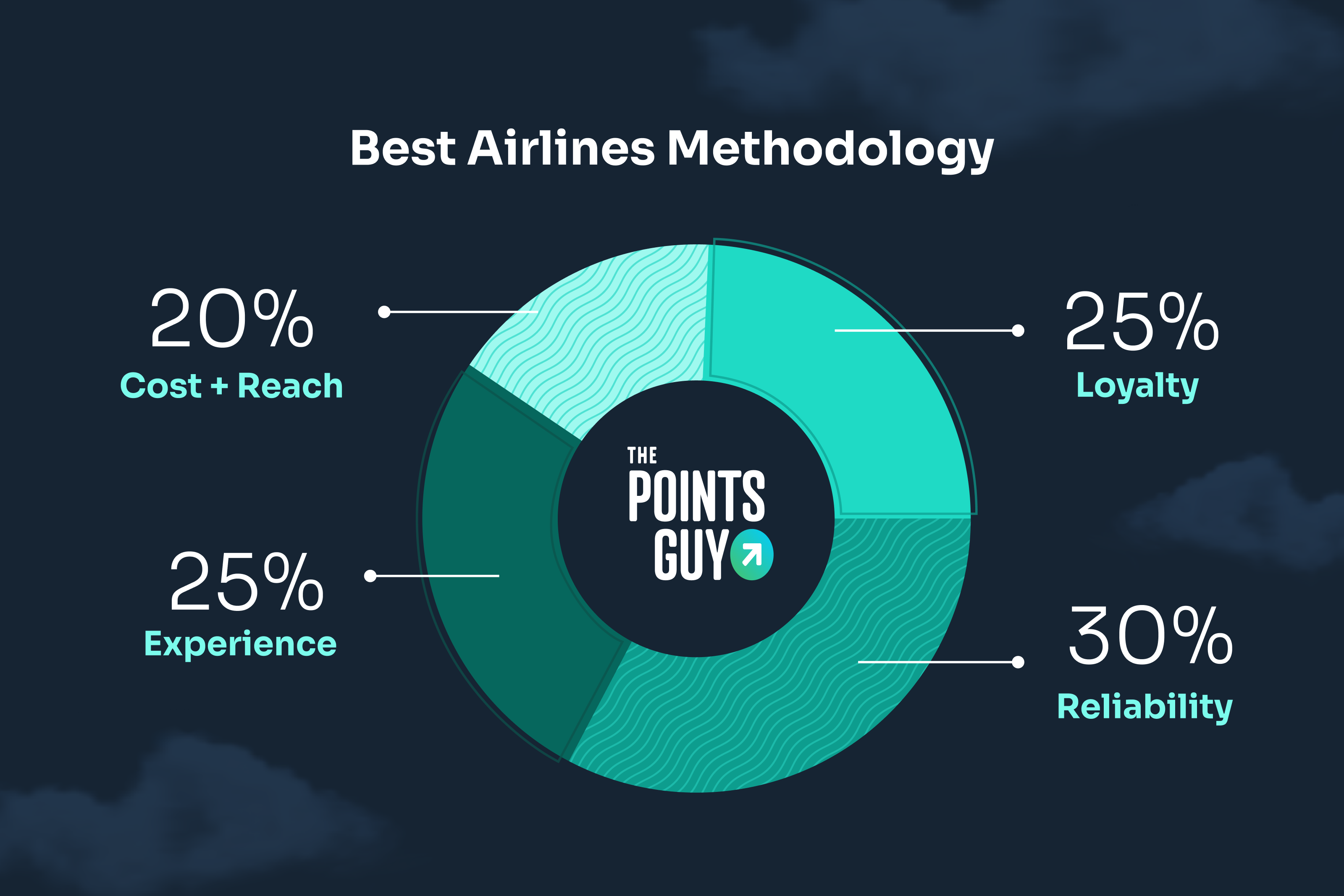

Every year, we compile thousands of objective data points to determine which of the 10 biggest U.S. airlines strikes the best balance of reliability, cost, experience and value. Our goal is to use a fair and unbiased approach to see how the airlines stack up for the average consumer.

This year’s analysis is complete, and we’re here with the results. Read on to see where your airline landed in this year’s ratings

Best US airlines of 2024

1. Delta Air Lines

2. Alaska Airlines

3. United Airlines

4. American Airlines

5. Southwest Airlines

6. JetBlue

7. Hawaiian Airlines

8. Allegiant Air

9. Spirit Airlines

10. Frontier Airlines

Keep reading for our full analysis and methodology — and to see what helped Delta top our rankings for the sixth year in a row.

Overall rankings and key takeaways

Here’s a quick breakdown of the overall scores this year, including the highest- and lowest-performing categories for each airline. We’ll include last year’s rank for each airline (in parentheses).

| Rank and airline (2022 rank) | Total score (out of 100)* | Top-performing areas | Lowest-performing areas |

| 1. Delta (1) | 65.74 | Timeliness, involuntary bumps | Affordability |

| 2. Alaska (3) | 64.38 | Timeliness, cancellations, lounges, family travel, customer satisfaction | Baggage, wheelchairs/scooters |

| 3. United (2) | 60.90 | Frequent flyer program, route network, involuntary bumps | Cancellations, affordability |

| 4. American (4) | 60.84 | Route network, award availability | Baggage, affordability |

| 5. Southwest (5) | 58.54 | Bag/change fees | Lounges |

| 6. JetBlue (7) | 49.38 | Cabin features | Timeliness, cancellations |

| 7. Hawaiian (6) | 48.91 | Involuntary bumps | Route network |

| 8. Allegiant (9) | 43.36 | Involuntary bumps, wheelchairs/scooters | Timeliness, cabin features, family travel |

| 9. Spirit (8) | 34.55 | Affordability | Wheelchairs/scooters, family travel, route network |

| 10. Frontier (10) | 22.35 | Affordability | Timeliness, cancellations, involuntary bumps, customer satisfaction, bag/change fees |

* All data was based on the 12-month period from Jan. 1 through Dec. 31, 2023, aside from customer satisfaction. Due to a reporting delay as the U.S. Department of Transportation changes its methodology for tracking complaints, this information is only available for the five-month period between Jan. 1 and May 31, 2023.

Key takeaways from this year’s analysis include:

- Delta wins for the sixth year in a row. Once again, the Atlanta-based carrier took home the top ranking. Interestingly, Delta was the top-performing airline in only one single category: timeliness. (It also tied with Allegiant for the top-performing airline in the involuntary bumps category.) However, Delta’s consistent performance across all categories — aside from affordability — made it the top pick overall.

- There were no big surprises compared to last year. Alaska and United swapped positions, as did JetBlue and Hawaiian, and Allegiant and Spirit. However, no airlines jumped or fell multiple spots, meaning there were no big gains or losses compared to last year. Overall, 2023 was a year of relative stability and continued recovery from the last of the post-coronavirus-lockdown hiccups.

- Some airlines performed better than in 2022, while others fell. Several airlines fell a point or two (or more) compared to last year: Delta (-0.57), United (-1.57), Hawaiian (-5.80), Spirit (-4.44) and Frontier (-5.39). The carriers with improved overall scores are Alaska (+3.84), American (+1.01), Southwest (+2.25), JetBlue (+1.70) and Allegiant (+6.32). Still, none of the changes were big enough to swing an airline more than one spot in the rankings.

- Consumer complaint data doesn’t tell the whole story. The U.S. Department of Transportation typically reports data covering a variety of metrics on a three-month delay. However, the agency delayed reporting of customer complaints in the middle of the year because the volume of complaints has increased compared to pre-pandemic times. As such, the agency wants to rework how it processes that information. Data were only available through May 2023, so the customer satisfaction score does not reflect passengers’ experiences during the latter part of the year, including the busy summer and holiday travel seasons.

So, just how did these airlines fall where they did in the rankings? Read on for a closer look at each category we used to build these rankings, along with the weight we assigned to each. The full methodology is provided at the end of the report.

Best US airlines for reliability

A lot goes into the overall air travel experience, from the moment you start searching for flights until you pick up your luggage from baggage claim and head out the airport door. But at the end of the day, an airline has one main job: to get you where you pay to go roughly on the schedule it promised.

Because of that, operational reliability is the largest single category in our rankings, weighted at 30% of our total analysis. We use five factors under the umbrella of reliability:

- Timeliness: How frequently a flight on the airline was delayed

- Cancellations: How frequently a flight on the airline was canceled

- Bumps/involuntary denied boardings: How frequently an airline bumped a traveler against their will on an oversold flight

- Baggage: How frequently an airline mishandled a piece of checked luggage

- Wheelchairs/scooters: How frequently an airline mishandled a mobility device

The results here produced a winner that may come as a surprise to some: Allegiant. It scored the highest across the category’s five metrics. The full reliability rankings are as follows:

1. Allegiant

2. Delta

3. Alaska

4. Southwest

5. Hawaiian

6. United

7. American

8. JetBlue

9. Spirit

10. Frontier

The ultra-low-cost carriers — Allegiant, Spirit and Frontier — may have a generally poor reputation for reliability, along with onboard experience. However, Allegiant offers a reason to reconsider that notion after its cumulative 2023 score for reliability was the best in the industry. While Allegiant’s on-time performance was weak (ranking seventh out of 10 on our timeliness scale), it scored at the top of the other four categories under the overall reliability umbrella.

Of the 10 airlines we tracked, Allegiant had the lowest rate of flight cancellations; it cut just 782 of its 115,539 flights in 2023 (or 0.68% of its operations). Alaska wasn’t far behind, canceling 2,849 out of its 385,945 flights (or 0.74% of its scheduled flights). At the other end of the spectrum, Frontier canceled 3,774 of its 177,542 scheduled flights (or 2.13% of its operations).

Allegiant also snagged the top score for the number of passengers it bumped involuntarily — zero. It tied with Delta.

Conversely, Frontier was far and away the worst performer, denying boarding at a whopping rate of 35.06 per 100,000 passengers, a total of 10,123 out of 28,872,300 travelers. For context, the next-worst performer was American, with 5.57 involuntary denied boardings per 100,000 passengers.

Allegiant is clearly doing something right in its baggage-handling operation as well. You won’t find free checked bags here — and if you book the base fare class, you’ll be charged for a carry-on, too. However, Allegiant led the other rankings by having the fewest lost or damaged bags at a rate of just 1.89 per 1,000 checked bags. American was the worst performer here, with 7.61 mishandled bags per 1,000.

Allegiant’s strong performance carried over to wheelchairs and mobility scooters, too. The Las Vegas-based carrier mishandled checked wheelchairs at a rate of 0.37 per 100; Spirit brought up the rear with a rate of 5.35 wheelchairs mishandled out of every 100 wheelchairs checked by passengers.

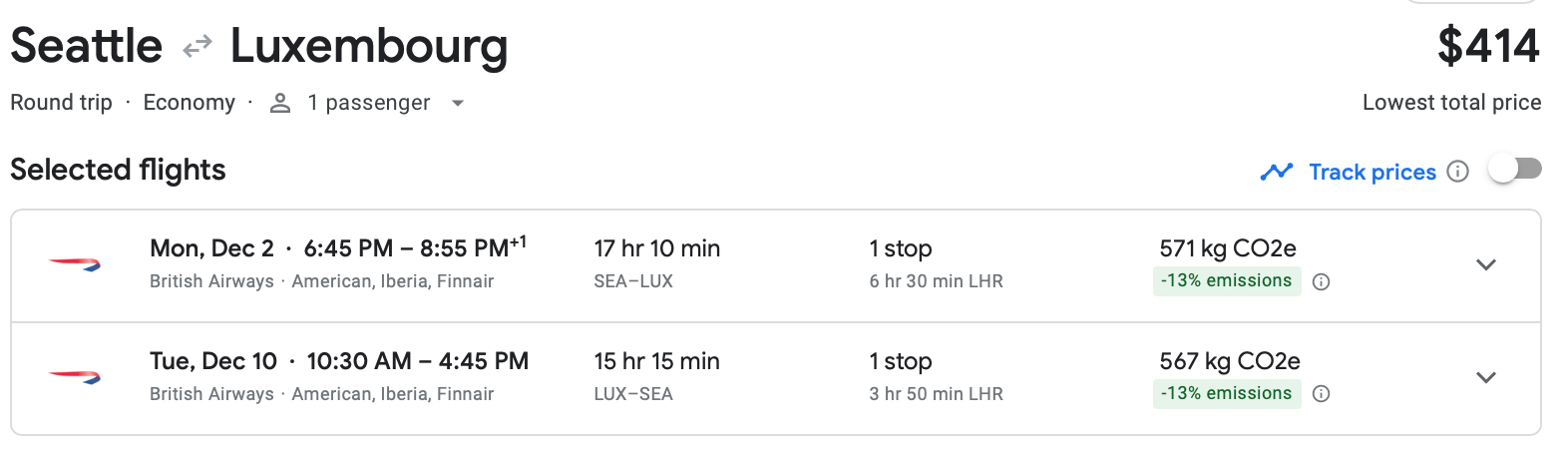

Best US airlines for the travel experience

Reliability is important, but the onboard experience is the first thing that many people think of when it comes to the “best airline.” For many, onboard snacks, meals or entertainment can make or break a journey.

Travel experience is important to us at TPG, too, so we weighted it as 25% of our overall score, just behind reliability. The travel experience score looks at four factors:

- Cabin features: What you’ll experience on board, including Wi-Fi, seat pitch/width and inflight entertainment

- Lounges: How widespread (and numerous) an airline’s lounges are and how affordable they are to access

- Family: How well an airline caters to families traveling with children

- Customer satisfaction: The rate at which passengers complain to the DOT about the carrier

Alaska took the top prize overall, with the full category rankings coming in as follows:

1. Alaska

2. Delta

3. American

4. United

5. JetBlue

6. Hawaiian

7. Southwest

8. Spirit

9. Allegiant

10. Frontier

Breaking them down by subcategory, JetBlue was the top airline for cabin features — just like it was last year and the year before. The New York-based carrier’s strong performance here is boosted since it provides free Wi-Fi across its entire fleet; it also offers seatback entertainment screens and the largest average economy seat size among all U.S. airlines.

Alaska, meanwhile, scored best for its domestic lounges — something crucial for many frequent flyers. Although the airline only has nine lounges of its own, its Alaska Lounge+ members can access dozens more across the U.S., including more than 40 American Airlines Admirals Clubs, several United Club locations and a few third-party lounges.

Alaska also ranked first for customer satisfaction, with the caveat we mentioned before: Customer complaint data was only available for the first five months of last year. The airline snagged the top spot for its family travel experience as well; that’s based on a variety of factors, such as early boarding, bag fees, onboard snacks and inflight entertainment.

Perhaps unsurprisingly, the ultra-low-cost airlines finished last for overall experience. They were dragged down by seating configurations with limited legroom, extra fees — which also dent these carriers’ family experience scores — and the lack of lounges.

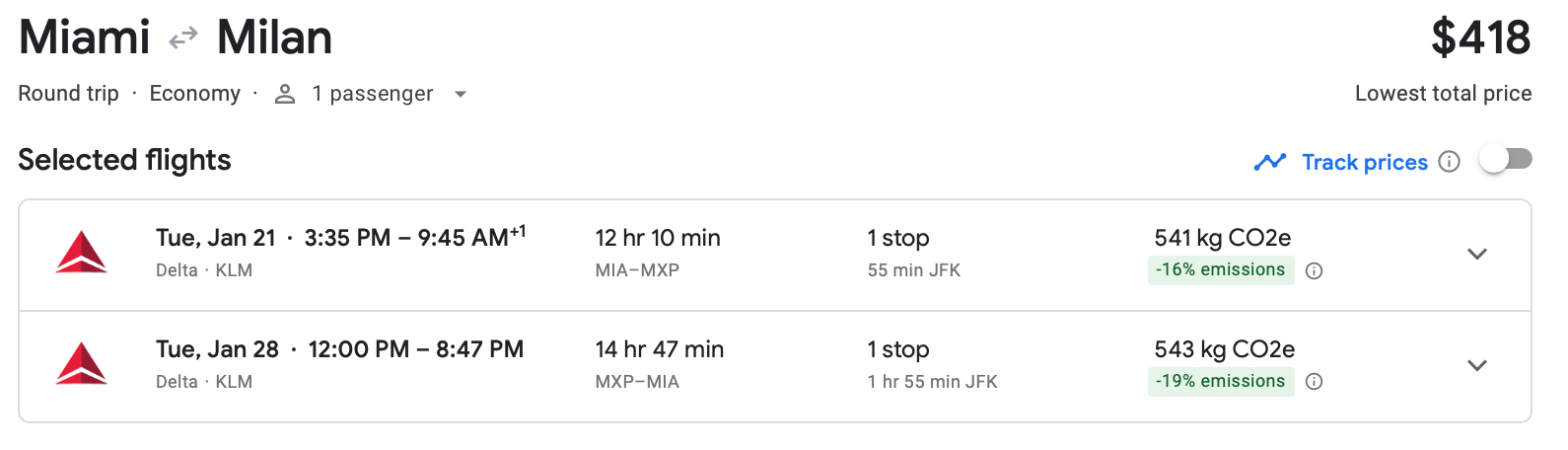

Best US airlines for cost and reach

Of course, before you can even think about reliability or the travel experience, you need to see which airlines actually go where you’re trying to go — and how much a ticket on those carriers will set you back.

We try to see which airlines have the right mix here with our cost and reach category; it looks at the prices you can expect to pay for airfare and common add-on fees. Our formula is also meant to evaluate how widespread each airline’s domestic route network is. This category is weighted at 20% of the total score and includes these three factors:

- Route network: How many domestic airports an airline serves

- Affordability: How far (in distance) you can fly for the money you’re paying, based on financial data from the Bureau of Transportation Statistics

- Ancillary fees: How much a typical passenger pays in bag and change/cancellation fees

The cost and reach category is where things can get interesting. The ultra-low-cost airlines are clearly the most affordable, but they also have high ancillary fees — and many of them. Plus, they tend to have smaller route networks than the legacy carriers.

Who strikes the balance best? Here are our results:

1. Southwest

2. United

3. American

4. Delta

5. Alaska

6. Allegiant

7. Spirit

8. Hawaiian

9. JetBlue

10. Frontier

It’s not surprising that Southwest is the overall winner here. Southwest serves about half as many domestic cities as the three biggest legacy airlines — American, Delta and United — but it nevertheless has a sizable route map. This is especially true when compared to other low-cost airlines like Spirit and Frontier, as well as East Coast-oriented JetBlue and West Coast-focused Alaska.

But where Southwest has a clear advantage is fees. Southwest doesn’t charge change or cancellation fees. Even though the other big airlines have drastically cut those fees from their pre-pandemic prices, the airlines still charged more on average for “extra” costs than Southwest did in 2023.

Southwest also famously allows two free checked bags per passenger. Passengers checking more than two bags have to pay extra, so Southwest did earn some revenue from baggage fees in 2023. However, that total was a fraction of what the other airlines collected.

In 2023, Southwest earned an average of just 43 cents in fees per passenger carried. That’s significantly less than what American, Delta and United earned for bag fees; the carriers received $6 to $9 in fees per passenger last year. Southwest held up even better compared to the ultra-low-cost airlines that make up for lower ticket prices by tacking on add-on fees. Spirit and Allegiant made an average of just under $27 in fees per passenger, while Frontier brought in a whopping $40 for every passenger it flew.

Of course, if you can travel light and avoid the fees, those budget airlines are far and away the most affordable. Frontier took in $118 in fare revenue for every domestic 1,000 miles flown per passenger, while Spirit fell just behind at $118.13. Allegiant was a distant third at $159.38.

Unsurprisingly, the legacy airlines were the most expensive. Delta landed at the bottom of our affordability rankings, with an average of $302.50 in fare revenue per 1,000 passenger miles flown. American was next at $279.03. United was the most affordable of the “Big Three” carriers at $261.76. Southwest, which is somewhere between a legacy airline and a low-cost carrier, came in at $191.74.

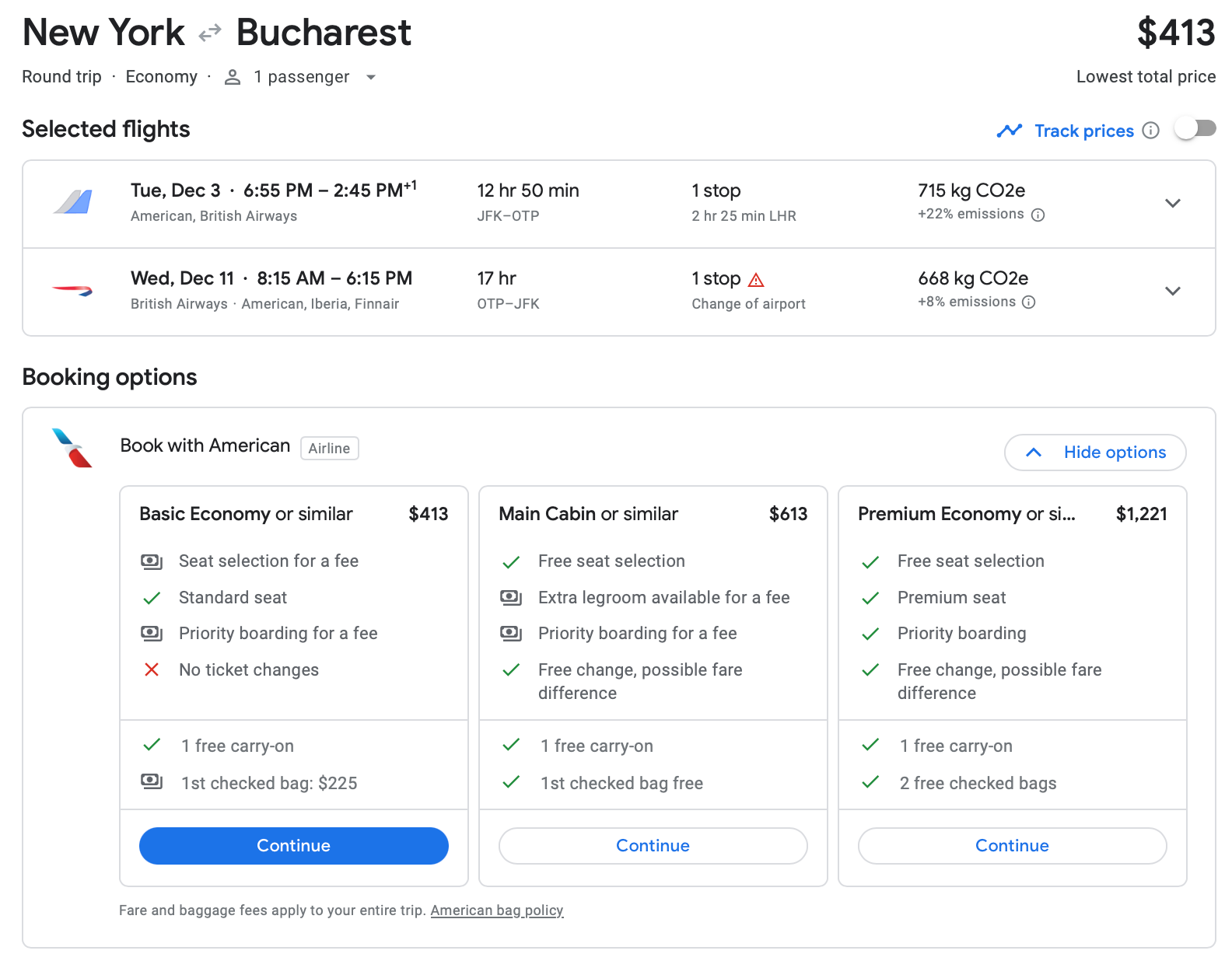

Best US airlines for loyalty

The final category for our rankings is loyalty — a key topic for TPG staff members and readers alike. We weighted this at 25% and included two specific factors:

- Frequent flyer program: How rewarding an airline’s loyalty program is based on TPG’s valuations, elite status, cobranded credit cards, partner airlines and expiration policies

- Award availability: How easy and valuable it is to redeem your rewards across popular travel times

Like last year, United came out on top. Here are the full results:

1. United

2. American

3. Alaska

4. Delta

5. JetBlue

6. Southwest

7. Hawaiian

8. Spirit

9. Frontier

10. Allegiant

The competition at the top was close, but United won out with the best rating for rewarding frequent flyers. The carrier has the greatest number of redemption and earning partners and offers four consumer credit cards. American was close behind, followed by Alaska.

Delta, which was last year’s runner-up, fell to fourth place. This is partly due to charging high mileage prices for award flights and recently making changes to its elite status program that have been viewed negatively by many of the company’s frequent flyers.

The low-cost carriers generally fell short in this area; they were hindered by their relatively few partners, limited or fixed value for miles, poor award availability and/or expiration policies for miles.

Methodology

TPG’s Best Airline rankings are based on scores from four broad sections, each of which consists of multiple criteria. All data points for the 2024 report were based on flights operated during the 12-month period that ran from Jan. 1 through Dec. 31, 2023.

A full breakdown of the methodology and the data used for each is as follows:

Reliability (30%)

- Timeliness (using data on delayed flights from the DOT)

- Cancellations (using data on canceled flights from the DOT)

- Involuntary bumps (using data on involuntary denied boardings from the DOT)

- Baggage (using data on mishandled baggage from the DOT)

- Wheelchairs/scooters (using data on mishandled baggage from the DOT)

Experience (25%)

- Cabin features (using data from SeatGuru and inflight amenity offerings from each carrier’s website)

- Lounges (using data on the number of lounges, the number of cities and the price of membership for each applicable lounge network)

- Family travel (using a 0-to-5 score based on boarding, perks and food/entertainment available on board)

- Customer satisfaction (using data on customer complaints from the DOT)

Cost and reach (20%)

- Route network (using the monthly average of domestic cities served by each airline from the DOT)

- Affordability (using financial data from the BTS)

- Bag/change fees (using financial data from the BTS)

Loyalty (25%)

- Frequent flyer program (using data from our monthly valuations, elite status reports and each carrier’s website)

- Award availability (using real-time award inventory for popular domestic routes across three distinct time periods)

For all criteria, the raw scores from the data were converted into scaled scores from zero to 10. In most cases, a score of zero was assigned to the lowest-performing carrier, and where possible, a score of 10 was assigned to a “perfect” airline. For example, Allegiant and Delta both scored a 10 on involuntary bumps since they had zero (or effectively zero) last year.

However, when there was no clear way to determine perfection, the highest-performing airline received a 10.

By using scaled scores (rather than a simple ranking system), we essentially “graded” each airline relative to the others. The score for each airline on each individual element was thus a numerical reflection of how much better said airline did compared to the lowest-scoring carrier.

For instance, Alaska had the fewest number of DOT complaints in the first five months of the year, with Delta not far behind (2.94 per 100,000 passengers versus 3.70).

We normalized these numbers by comparing them to the lowest-performing airline (Frontier, with 38.76 per 100,000 passengers) and the highest possible score (0 per 100,000 passengers). The resulting scaled score conversion gave Alaska a “grade” of 9.24 out of 10 and Delta an 8.09 out of 10.

Then, each individual score was weighted using the above percentages to arrive at the final, cumulative score included in the table.

Final thoughts

A lot goes into choosing a flight and an airline for your next trip. Price matters, but so do reliability, rewards you can earn and the actual passenger experience on the flight. Of course, no one airline will meet the needs of every passenger, so each of those considerations has a different level of importance for each individual traveler.

However, our report uses objective data and a fair weighting that we think best sums up a fair, broad picture for a wide range of travelers.

For the sixth year in a row, Delta has earned the title of TPG’s Best Airline for 2024.

Delta’s reign shows that sometimes, it pays not to be the best at every single thing. Instead, it’s important to focus on performing well across every area and standing out by offering a consistent and reliable product across the board.

Delta alienated some of its frequent flyers with the changes it made to its rewards program, and its fares are the highest in the U.S. by our measure. However, its reliability, performance, features and overall experience work together to keep it at the top of the pack.