Editor’s note: This is a recurring post, regularly updated with new information and offers.

We often say the Chase Sapphire Preferred® Card is the best first credit card for those learning about the points and miles hobby. That’s not because the card is a “beginner” card — quite the opposite. Many of us at TPG still have the Sapphire Preferred because it’s integral to our travel rewards strategy.

We highlight it for a few reasons:

- Chase Ultimate Rewards points are versatile and easy to use. Anyone getting started in credit card rewards will have no trouble saving a lot of money with them.

- The card has solid ongoing benefits that are not points-related.

- The card typically comes with a generous sign-up bonus.

In fact, right now, new applicants for the Chase Sapphire Preferred Card can earn a limited-time bonus of 75,000 Ultimate Reward points after spending $4,000 on purchases in the first three months from account opening. The card comes with a $95 annual fee, but it’s relatively easy to cover it (and then some).

Let’s look at how you can maximize the Chase Sapphire Preferred benefits to ensure you’re saving the most money — and earning the most points — as organically possible. It’ll help you gauge whether the card is worth keeping year after year.

Overview of the Chase Sapphire Preferred benefits

Here are the notable benefits of the Chase Sapphire Preferred:

- $50 annual credit on hotel stays purchased through Chase Travel℠

- 10% points bonus each year based on your card spending (e.g., if you spend $10,000, you’ll receive 1,000 bonus points)

- 5 points per dollar on Lyft (through March 2025) and travel booked through the Chase travel portal

- 5 points per dollar on each Peloton equipment and accessory purchases of $150 or more — with a limit of 25,000 points (through March 2025)

- At least 12 months of complimentary DashPass for use with both DoorDash and Caviar (when you activate by Dec. 31)

- 3 points per dollar on dining. select streaming services and online groceries (excluding Walmart, Target and wholesale clubs)

- 2 points per dollar on all travel not booked through the Chase travel portal

- 1 point per dollar on everything else

- Primary rental car insurance

- Trip delay insurance

- Baggage delay insurance

- Extended warranty protection

- No foreign transaction fees

You don’t have to be a points and miles enthusiast to appreciate the card. These perks make the Chase Sapphire Preferred a very practical card for anyone who vacations even just once or twice per year.

With a $95 annual fee, the travel protections alone make this card worth the price tag. And because the card quickly racks up rewards, you’ll have a small fortune in Chase points by the time you’re confident enough to use them.

Related: Chase Sapphire Preferred review

Strategies for maximizing the Chase Sapphire Preferred

The Chase Sapphire Preferred’s current limited-time bonus is 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. TPG values that bonus at $1,538 — though you can get significantly more than that if you learn the Chase Ultimate Rewards sweet spots.

But once you’ve used the bonus, what’s the best way to maximize this card?

Use your Chase Sapphire Preferred to pay for airfare

The Chase Sapphire Preferred earns 5 points per dollar on airfare booked through the Chase travel portal and 2 points per dollar when booked through an online travel agency or directly with the airline. However, amassing points is not the primary motivator for using the card.

The Chase Sapphire Preferred will automatically give you two significant benefits (among others) when booking air travel:

- Trip delay insurance: You are covered for up to $500 per ticket when your flight is delayed 12 hours or more (or if your delay/cancellation results in an unexpected overnight).

- Baggage delay insurance: You and your immediate family are entitled to up to $100 per day in reimbursement (for up to five days) to cover the purchase of necessary expenses like clothes, toiletries, etc. This benefit kicks in when your bags are delayed six hours or more.

These perks alone are enough for many to keep the card year after year.

Use your Chase Sapphire Preferred to pay for hotels via the Chase travel portal

Each anniversary year, the Chase Sapphire Preferred comes with a $50 statement credit for a hotel stay booked via the Chase travel portal. You’ll also receive 5 points per dollar for booking travel through the Chase travel portal (though the $50 credit won’t earn points). That’s a great pair of benefits capable of wooing anyone who normally books hotels via an online travel agency like Expedia or Priceline.

Just note that this may not be the best option if you’re booking a major chain that’s part of a hotel loyalty program like Marriott Bonvoy or Hilton Honors. Chase is considered a third-party platform for these reservations, which means you likely won’t earn points on the stay (and you may not be able to enjoy any elite status perks either).

You could always call the individual property after booking (or try to add your loyalty number at check-in), but it may not work. Your best bet is to use this perk for non-chain hotels or boutique properties.

Use your Chase Sapphire Preferred to pay for rental cars

Here’s another stand-alone benefit that may justify the Chase Sapphire Preferred’s $95 annual fee for many travelers: when you pay for a rental car with the card, you can waive the in-house rental agency’s pricey Collision Damage Waiver (CDW) insurance — which can cost upward of $15 per day — and you’ll still receive primary rental car insurance, courtesy of Chase.

Note that this covers damage and theft to the card without going through your personal insurance company. You’ll also earn 5 points per dollar if you book your rental through the Chase Travel Portal. However, this doesn’t include liability insurance (damage to the car you crashed into, for example).

Use your Chase Sapphire Preferred to pay at restaurants

The Chase Sapphire Preferred earns 3 points per dollar at restaurants — whether you’re ordering takeout or dining in. That’s a great benefit to stack with the fact that the card offers one complimentary year (at least) of DashPass membership with DoorDash (when you activate by Dec. 31, 2024). You’ll get free deliveries on orders totaling more than $12 and earn 3 points per dollar on your purchase. That equates to 6% back on your meal.

Related: Just got the Chase Sapphire Preferred? Do these 6 things next

When not to use the Chase Sapphire Preferred

Sometimes, your Chase Sapphire Preferred is best left in its holster.

Don’t use your Chase Sapphire Preferred to pay for non-bonus purchases

The card earns 1 point per dollar on all expenses that don’t fall into a bonus category. That’s not a reasonable return rate. There are plenty of cards (some with $0 annual fees) that will better serve you for these transactions. If you want to stay focused on collecting Chase Ultimate Rewards, swipe your Chase Freedom Unlimited® to earn a minimum of 1.5% cash-back (1.5 points per dollar) on all purchases.

Don’t forfeit other card benefits by using your Chase Sapphire Preferred

If you’ve got other credit cards that provide valuable benefits for specific purchases, don’t use the Chase Sapphire Preferred out of loyalty.

D3SIGN/GETTY IMAGES

D3SIGN/GETTY IMAGES

For example, you can receive a free checked bag with United Airlines when you use your qualifying United Airlines credit card to pay for your flight. That could save you $60 round-trip and is worth using your United card.

Or if you book the same hotel brand often and elite status is important to you, use the hotel’s cobranded credit card to pay for your stays instead of the Sapphire Preferred. You’ll earn more points that way. For instance:

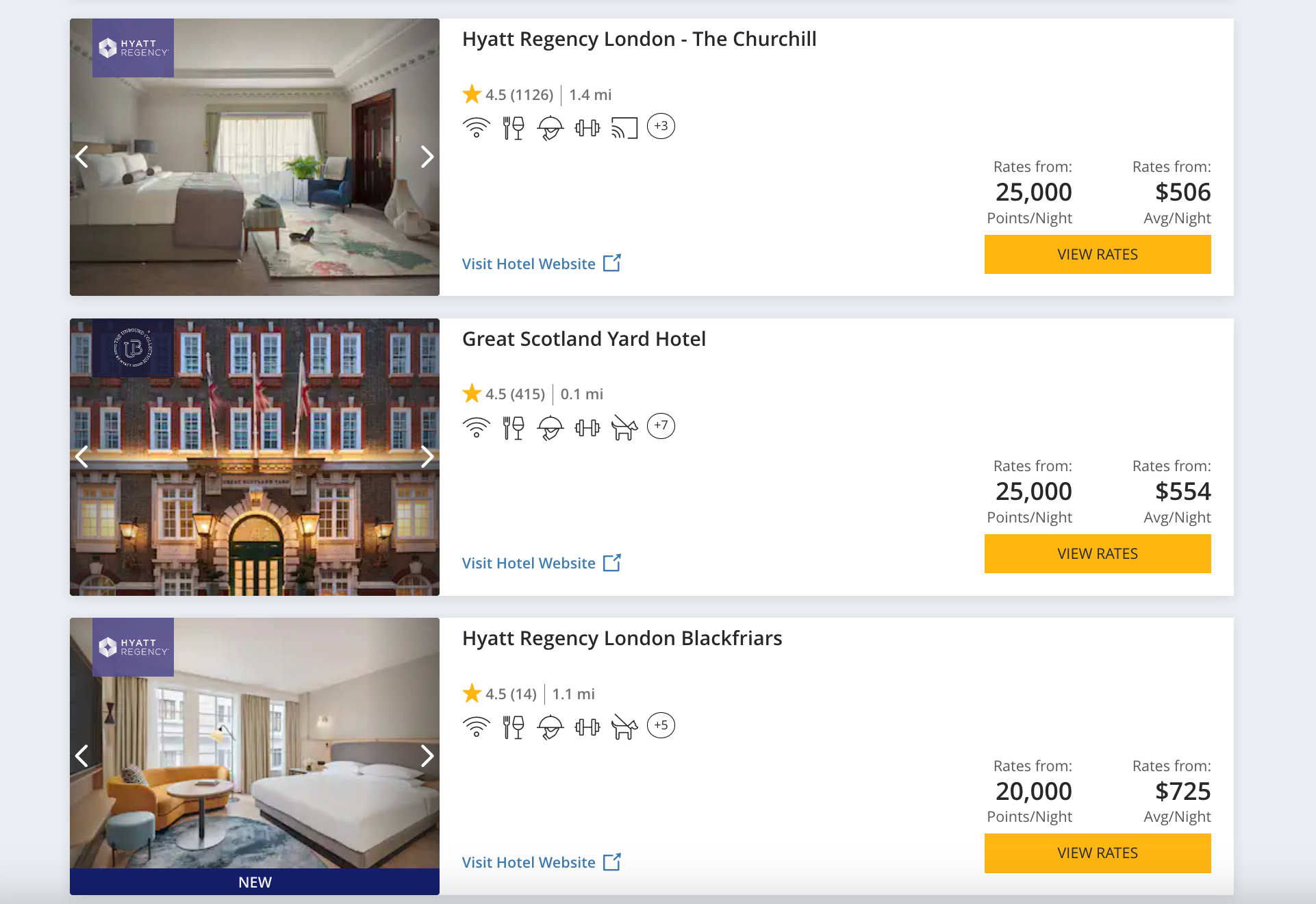

- The World of Hyatt Credit Card earns 4 points per dollar at Hyatt hotels (6.8% return based on TPG valuations).

- The Hilton Honors American Express Surpass® Card earns 12 points per dollar on eligible Hilton purchases (7.2% return based on TPG valuations).

Bottom line

The Chase Sapphire Preferred is well worth the $95 annual fee each year if you know how to maximize the card. The card packs a punch between its annual $50 hotel credit, the myriad travel insurances and its generous earning rates. And considering the solid welcome bonus, applying right now is a no-brainer.

Apply here: Chase Sapphire Preferred with limited time 75,000 bonus point offer after you spend $4,000 on purchases in the first three months from account opening.