In addition to being rewarded with valuable miles, when travelers choose to fly Alaska Airlines and its partner airlines and credit flights to the Alaska Airlines Mileage Plan loyalty program, they may qualify for MVP elite status. You can access exclusive and valuable benefits and perks by achieving elite status, enhancing your overall travel experience.

Depending on which MVP elite status is achieved, you can enjoy perks like complimentary first-class upgrades and preferred seating, plus bonus miles that can be redeemed for future travel on Alaska or its airline partners.

If you are considering striving for these perks, weighing the benefits against the drawbacks of remaining loyal to one airline program is important. While pursuing elite status and remaining loyal to one carrier can be a no-brainer for some — particularly those who live near an Alaska Airlines hub — others may be better off remaining airline free agents, choosing the best carrier for each flight.

In this guide, we’ll evaluate MVP status and explain the different status tiers, how to achieve them and if striving for this status is worth the effort for the occasional or frequent Alaska Airlines flyers. Plus, with Alaska’s recent acquisition of Hawaiian Airlines and a plan to overhaul Mileage Plan in 2025, obtaining elite status with this airline may now be on your radar.

What is Alaska Airlines status?

Alaska offers different MVP status tiers based on the number of elite qualifying miles earned through the airline and its global partners and spending on Alaska’s cobranded credit card.

Your Alaska elite status is activated when you pass the required threshold for that tier, is subsequently valid for the rest of that calendar year and typically expires on Dec. 31 of the following calendar year. For example, if you reach your 2024 MVP Gold qualification in October 2024, your status will be valid through Dec. 31, 2025.

Related: Alaska Airlines overhauls Mileage Plan with milestone perks and more

Alaska elite status tiers

Anyone can join the Mileage Plan program for free online as a base member. Doing so will make you eligible to collect Alaska miles, and as you spend more time flying Alaska or its partners, you can also collect status.

Alaska Airlines’ published elite status tiers from lowest to highest are:

- MVP

- MVP Gold

- MVP Gold 75K

- MVP Gold 100K

To qualify for MVP status, you must reach varying thresholds of elite qualifying miles based on Alaska, Oneworld and global partner airlines’ flights and cobranded credit card spending.

| Status tier | Number of elite qualifying miles required |

| MVP | 20,000 |

| MVP Gold | 40,000 |

| MVP Gold 75K | 75,000 |

| MVP Gold 100K | 100,000 |

As you fly more on Alaska or spend on a cobranded credit card, you can climb the status ladder. As you remain loyal to Alaska and reach higher tiers, the perks become more lucrative. For example, you can receive complimentary lounge access or free upgrades.

The same is true for the four published elite status tiers of rival airlines United and Delta.

Related: 6 great benefits I received as an American Airlines elite flying Alaska Airlines

How to qualify for Alaska elite status

Fly on Alaska-operated or partner flights to earn EQMs

Despite many airlines moving away from calculating elite status based on actual mileage flown toward a version of the amount spent with the carrier, Alaska has been a holdout. For Alaska flyers, the elite status is calculated via the number of elite qualifying miles earned, not to be confused with redeemable Alaska base miles.

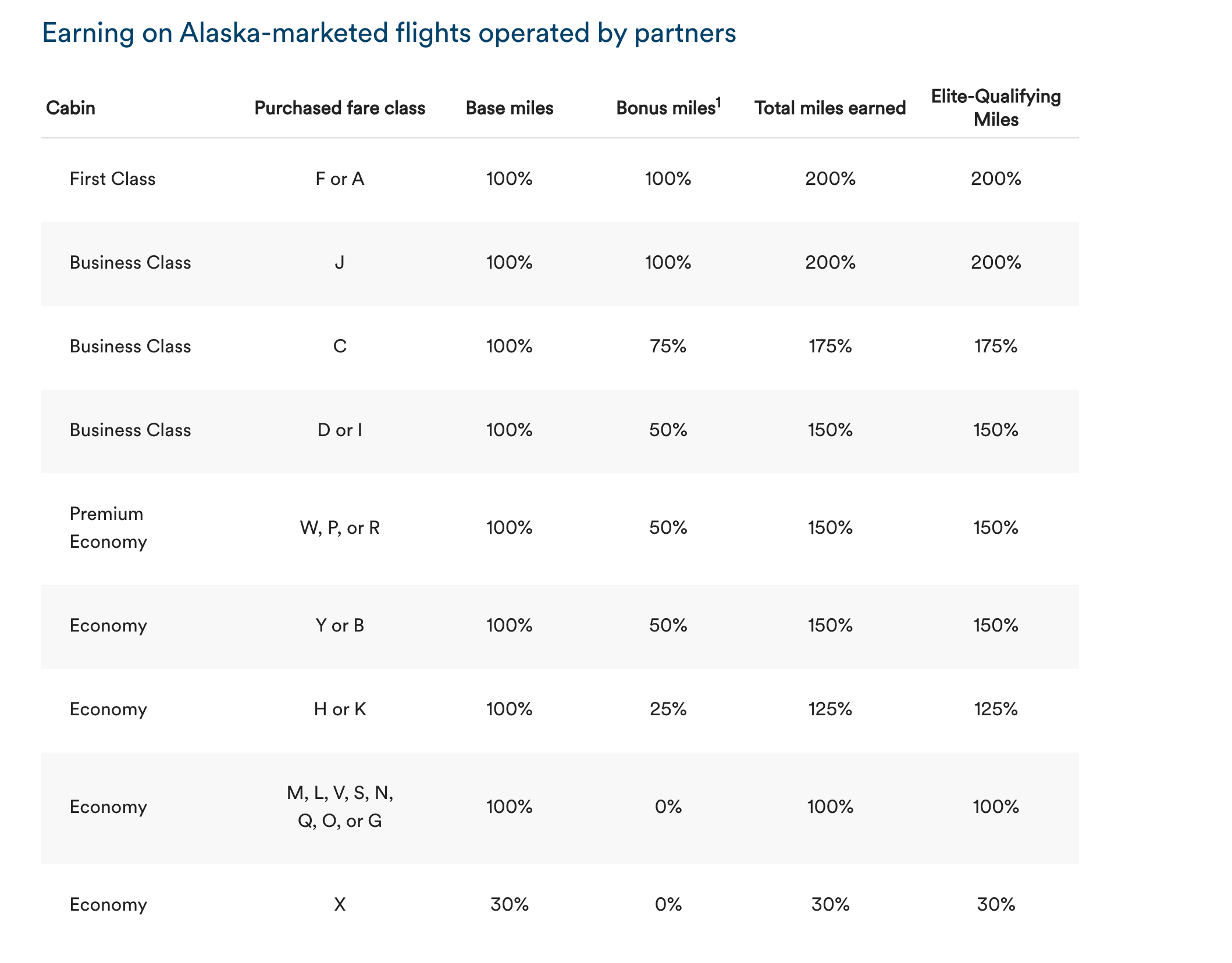

However, the number of elite qualifying miles earned is based on the carrier flown and fare class. For instance, a first-class ticket on Alaska in the J fare class earns 200% elite qualifying miles. On the other hand, a Savor economy ticket in the X fare class will earn only 30% elite qualifying miles.

Note that Alaska has unveiled its 2025 earnings charts, with notable increases to EQMs earned on international first- and business-class flights booked on partner airlines via alaskaair.com.

You can check out Alaska’s 2024 and 2025 earnings charts here.

Earn Alaska elite status through credit card spending

In 2023, Alaska announced changes to how elite members earn status. Beginning this year, earning status through elite qualifying segments is no longer possible; you’ll only earn status by accruing elite qualifying miles. Therefore, it is possible to earn Alaska elite status without ever stepping foot on an Alaska Airlines plane.

Plus, following Alaska’s acquisition of Hawaiian Airlines, the carrier expanded how members can earn EQMs from credit card spending, which is currently capped at an earning rate of 20,000 EQMs per year. Beginning on Jan. 1, 2025, Alaska Airlines Visa Signature® credit card and Alaska Airlines Visa® Business card cardholders will earn 1 EQM for every $3 spent (up to 30,000 EQMs each year on qualified purchases).

Therefore, if you spend $60,000 on your personal or business Alaska card each year, you will earn 20,000 EQMs, which means you’ll have achieved MVP status just through credit card spending.

Earn Alaska MVP status through a status match

Following the merger of Alaska and Hawaiian Airlines, if you have status with either carrier, your status will be matched as follows:

| If you have: | You’ll be matched to: |

| Alaska Airlines Mileage Plan MVP status | HawaiianMiles Pualani Gold status |

| Alaska Airlines Mileage Plan MVP Gold, MVP Gold 75K or MVP Gold 100K status | HawaiianMiles Pualani Platinum status |

| HawaiianMiles Pualani Gold status | Alaska Airlines Mileage Plan MVP status |

| HawaiianMiles Pualani Platinum status | Alaska Airlines Mileage Plan MVP Gold status |

And, even if you don’t have status with either airline, loyalty members can combine their elite qualifying miles from both programs to achieve status.

| Combined EQM balance: | Status you’ll get with Mileage Plan: | Status you’ll get with HawaiianMiles: |

| 20,000 EQMs | MVP | Pualani Gold |

| 40,000 EQMs | MVP Gold | Pualani Platinum |

| 75,000 EQMs | MVP Gold 75K | Pualani Platinum |

| 100,000 EQMs | MVP Gold 100K | Pualani Platinum |

Additional ways to earn Alaska EQMs

In 2025, there are a few additional ways Mileage Plan members can earn elite qualifying miles. Alaska executives announced that members will earn 1,000 EQMs for every 3,000 miles earned on nonflight activities, such as through Lyft, Mileage Plan shopping portal and the dining program.

Additionally, members will begin earning EQMs on award flights. Mileage Plan members will earn the same amount of EQMs as they would on a paid ticket; however, members will not earn Alaska base miles on award redemptions.

What are Alaska’s elite status benefits?

While the perks are great for all members with Alaska Airlines elite status, as you move up the tiers, the benefits become even more worthwhile.

MVP

This is the lowest elite tier in Alaska’s program, where you will receive benefits such as:

- 50% bonus miles (changing to 25% bonus miles in 2025)

- Oneworld Ruby status

- Priority check-in, security and boarding

- Preferred seating

- Two free checked bags (through 2025; one free checked bag starting in 2026)

- Priority call routing

- Alaska Lounge membership discount

- First-class upgrades at the time of booking with Y and B fares

- Premium-class upgrades at the time of booking with Y, B and H fares

- First- and premium-class upgrades on Alaska nonqualifying fares (except Savor) 48 hours before departure

- Access to extra legroom seating on American Airlines starting 24 hours before departure

- Complimentary access to domestic upgrades on American starting 24 hours before departure

MVP Gold

As you level up with Alaska, you receive all the same perks as MVP, plus:

- 100% bonus miles (changing to 50% bonus miles in 2025)

- Two free checked bags

- Oneworld Sapphire status

- Complimentary same-day flight changes and standby for full flights

- Complimentary premium beverage or chocolate in Main Cabin

- Four first-class upgrades at the time of booking with Y, B, H and K fares (through Dec. 31, 2024)

- Premium-class upgrades at the time of booking with Y, B, H, K, M, L, V, S and N fares

- First- and premium-class upgrades on Alaska nonqualifying fares (except Savor) 72 hours before departure

- First- and premium-class companion upgrades

- First-class guest upgrades (maximum of four per year)

- Access to extra legroom seating on American Airlines at booking

- Complimentary access to domestic upgrades on American starting 48 hours before departure

MVP Gold 75K

For even more frequent Alaska flyers, you receive all the same perks as MVP Gold, as well as:

- 125% bonus miles (changing to 100% bonus miles in 2025)

- 50,000 bonus miles upon qualification (only through Dec. 31, 2024)

- Oneworld Emerald status

- Three free checked bags

- Four Alaska Lounge day passes

- First-class upgrades at the time of booking with Y, B, H, K and M fares

- Premium-class upgrades at the time of booking on all fares except Savor fares

- First- and premium-class upgrades on Alaska nonqualifying fares (except Savor) 120 hours before departure

- One one-way international upgrade certificate on American Airlines

- Complimentary access to domestic upgrades on American starting 72 hours before departure

MVP Gold 100K

This is the top tier in Alaska’s program for its most frequent travelers, where you will receive all the same perks as MVP Gold 75K, plus:

- 150% bonus miles

- 100K Choice Benefit upon qualification

- Complimentary snack or meal in Main Cabin

- Two one-way international upgrade certificates on American Airlines

For Alaska elite status members reaching the MVP Gold 100K tier, you will be invited to select one of the 100K Choice Benefits for the following year:

- 50,000 bonus miles

- Alaska Lounge+ membership

- Ability to gift MVP Gold status

- Complimentary Wi-Fi every time you fly on Alaska

- Complimentary Clear Plus membership

In 2025, Alaska is rolling out a new list of 100K Choice Benefit options, which include:

- 50,000 bonus miles

- 75,000 miles off an Extras* redemption

- Alaska Lounge+ membership

- Complimentary Wi-Fi on every flight

- Four upgrade certificates

- Nominate someone for MVP Gold status

For elite members who reach 150K, 200K and 250K milestones, you can pick two of the following perks (starting in 2025):

- 15,000 bonus miles

- 25,000 miles off an Extras redemption

- Two complimentary Alaska Lounge day passes

- Two upgrade certificates

- Roll over 10,000 EQMs to the following year

Even if you don’t reach the 100K milestone or greater, Alaska announced new milestone rewards for Mileage Plan members. In 2025, loyalty program members will be able to pick from the following list of perks when a new milestone is reached:

10,000 EQMs

Pick one of the following:

- 750 bonus miles

- Preorder a complimentary meal for your flight

- One complimentary Wi-Fi pass

- Try MVP status for a trip

- Earn double miles with nonair partners

- Upgrade your next Avis car rental

30,000 EQMs

Pick one of the following:

- 2,500 bonus miles

- $25 off a future Alaska flight

- Four Wi-Fi passes

- Try MVP Gold status for a trip

- $100 off an Alaska Lounge membership

55,000 EQMs

Pick two of the following:

- 5,000 bonus miles

- 10,000 miles off a redemption from Extras

- Gift MVP status for a trip

- One complimentary Alaska Lounge day pass

- Two upgrade certificates

85,000 EQMs

Pick two of the following:

- 15,000 bonus miles

- 25,000 miles off an Extras redemption

- Two complimentary Alaska Lounge day passes

- Two upgrade certificates

- Gift MVP Gold status for a trip

- Nominate someone for MVP status

- Roll over 10,000 EQMs to the next year

*Extras is a travel experience platform (featuring sporting events, concerts and other activities) that Alaska will launch.

Can a credit card help you earn Alaska MVP status?

Alaska has personal and business credit cards, both available through Bank of America. They offer the following benefits. (Terms apply.)

| Card | Best for | Welcome bonus | Earning rate | Annual fee |

| Alaska Airlines Visa Signature® credit card | Alaska Airlines flyers | Earn 60,000 bonus miles plus Alaska’s Famous Companion Fare ($99 fare plus taxes and fees from $23) after making $3,000 or more in purchases within the first 90 days of opening your account. | 3 miles per dollar spent on Alaska purchases; 2 miles per dollar spent on gas, local transit, electric vehicle charging stations, cable and some streaming services; 1 mile per dollar spent on everything else | $95 |

| Alaska Airlines Visa® Business card | Alaska Airlines flyers with an eligible business | Earn 50,000 bonus miles plus Alaska’s Famous Companion Fare ($99 fare plus taxes and fees from $23) after making $3,000 or more in purchases within the first 90 days of account opening. | 3 miles per dollar spent on Alaska purchases; 2 miles per dollar spent on gas, local transit, EV charging stations, shipping and local transit (including ride-hailing services); 1 mile per dollar spent on everything else | $70 for your company and $25 per card |

Currently, cobranded cardholders will earn 4,000 elite qualifying miles for every $10,000 spent; however, you can only earn a maximum of 20,000 EQMs from spending on a card. As mentioned above, starting Jan. 1, 2025, cardholders will earn 1 EQM for every $3 spent (up to 30,000 EQMs) annually.

In addition to the valuable redeemable miles earned, Alaska’s cobranded cards come with perks like free checked bags, discounts on inflight purchases and the ability to work toward MVP elite status. As such, it can easily make sense to keep one of the airline’s credit cards in your wallet year after year.

Related: Your complete guide to earning and redeeming with Alaska Airlines Mileage Plan

Is Alaska Airlines elite status worth it?

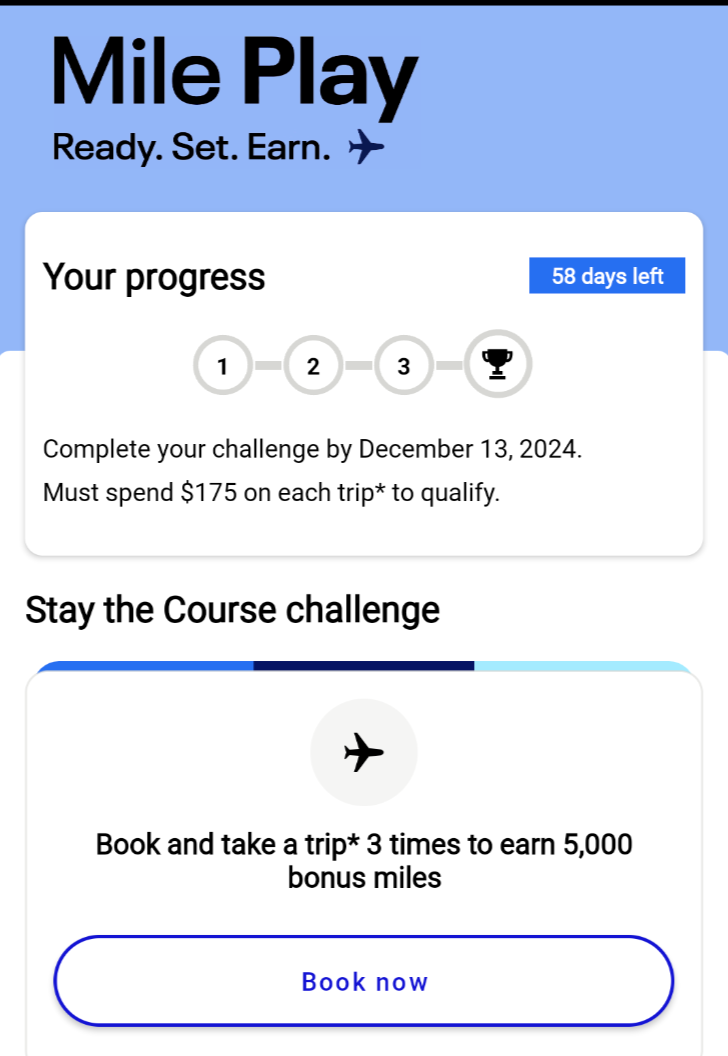

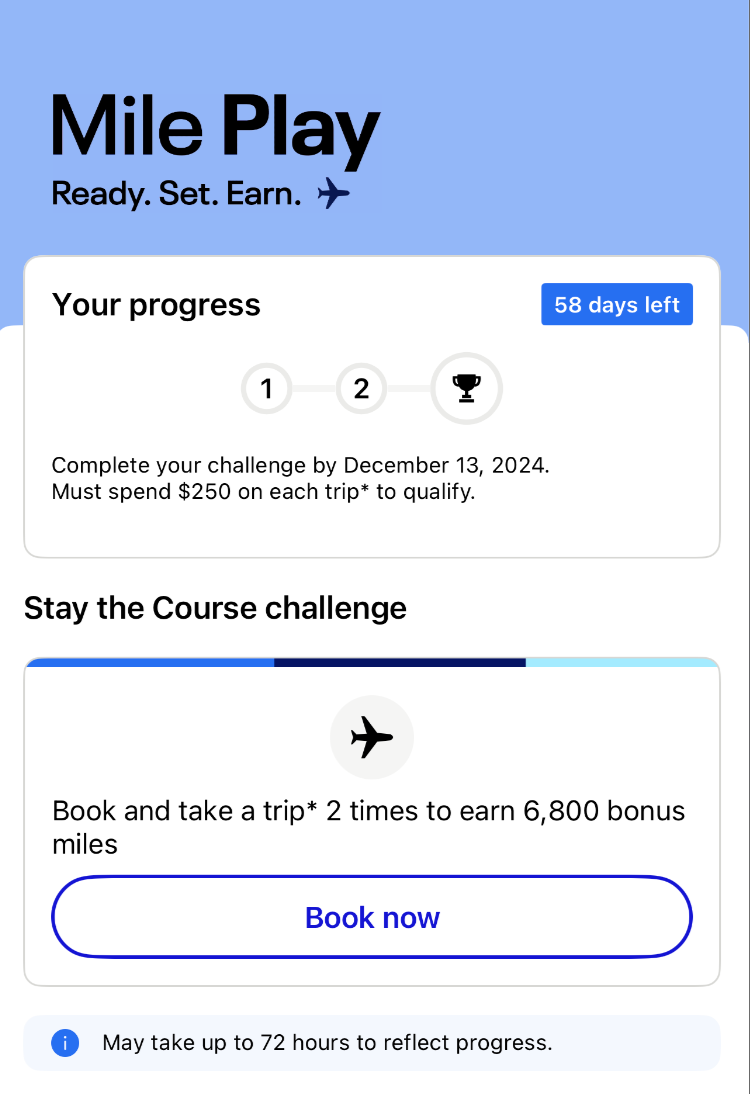

If you already fly Alaska regularly or plan to in 2025 and are perhaps considering adding an Alaska Airlines credit card to your wallet, you might find it easy to earn elite status in the Mileage Plan program and find the benefits well worth the effort. Plus, with the additional perks and new status-earning opportunities in 2025, you may be even more convinced to qualify for elite status.

However, it is worth noting that Alaska and Hawaiian Airlines will eventually merge into one loyalty program. At this time, it is expected that the specific details and benefits of that joint program will not be revealed until 2025.

If you earned Alaska elite status in 2023, it’s valid through Dec. 31, 2024. To decide whether to pursue extending your status into 2025 or 2026, it is crucial to consider how much you’ll be traveling on Alaska and Oneworld partners in the future. If you push hard to earn MVP Gold 100K status, for example, the valuable perks outlined, including upgrades and free checked bags, are only beneficial if you fly frequently enough the following year to use these perks.

Additionally, there is no point in pursuing elite status with an airline if you can’t feasibly fly it (or its partners) regularly. Be sure to consider Alaska’s service from your home airport(s) and how easy it is to get to your desired destination with the carrier.

With that in mind, it is important to consider the trade-offs in pursuing status. One of the most common is deciding whether to use your preferred airline when it is not the most convenient or cheapest option. Would you book a one-stop Alaska flight if Delta had a cheaper nonstop option? If the answer is no, it may not be worth going out of your way to earn status with Alaska.

Additionally, if you have already obtained elite status with another airline and wonder if Alaska’s elite status is worth it, you could apply for a status match challenge. You can submit your frequent flyer status with one of the airlines listed on Alaska’s website to receive the equivalent Mileage Plan status for 90 days.

Related: Alaska Airlines baggage fees and how to avoid paying them

Bottom line

Alaska Airlines is widely considered a top airline in the frequent flyer community thanks to its MVP elite status and valuable mileage currency. Plus, with the acquisition of Hawaiian Airlines and the rollout of new milestone benefits and program perks coming in 2025, Alaska Airlines’ elite status is tempting even loyal AAdvantage TPG staff members.

However, the carrier has made some unwelcome changes recently, such as introducing a distance-based structure and charging sky-high redemption rates for new partners.

While reciprocal upgrade benefits with American Airlines are valuable for Alaska elite members flying American, it could also mean upgrades will be more challenging to score, particularly for lower-tier elite members. When considering whether it is worth achieving MVP status, it is important to look at where your travels will take you this year and next year to see if the perks outweigh the costs. If you are working hard to earn elite status benefits, you will want to ensure you will travel enough with Alaska and its partner airlines once you reach your desired status tier to make that hard work worthwhile.

Overall, having MVP status can be a nice boost to make an enjoyable Alaska Airlines flying experience even more seamless.

Updated as of 10/22/2024.