Editor’s note: Some of the below offers may be targeted. This is a recurring post, regularly updated with new information and offers.

From bonus points on your next hotel stay to generous sales of airline miles, we’re always looking for travel deals that help you earn more points and miles and redeem them for maximum value. In other words, we want to help you book the vacation of your dreams.

Recently, we found round-trip flights to Europe starting at $329 on Norse Atlantic Airways and Lufthansa business-class tickets to Munich for as low as 88,000 miles. Plus, if you’re mulling over a ski trip, Vail Resorts’ New Year sale is offering rates from $119 per night at properties in Colorado, Canada, Vermont and more. But that’s not all.

We help our readers each week by rounding up ongoing promotions so they don’t have to scour the internet for the best reward redemptions and offers. This includes everything from frequent flyer programs and hotel rewards programs to credit card offers and rental car deals. Here’s our latest list of noteworthy new points and miles promotions for January.

Airline loyalty program promotions (February 2025)

Airline loyalty programs can offer trip discounts on certain dates, the chance to earn more miles for future travel and deals to rack up points toward elite status. Below are some of the best offers we found for February.

Save 30% on Aegean Airlines flights

If Greece is in your travel plans, this Aegean Airlines sale is for you.

- Get a 30% discount on your base fare when you book through aegeanair.com, olympicair.com or the Aegean app using offer code THANKYOU30.

- Discount applies to all direct and connecting round-trip flights operated by Aegean and Olympic Air to any destination in Aegean’s network. All codeshare flights and flights not operated by Aegean and Olympic Air aircraft are excluded.

- Book by Feb. 28 to take advantage of this deal, and travel between now and Dec. 31.

- See full terms and conditions here.

Related: Best airline credit cards

Hotel loyalty program promotions (February 2025)

Hotel loyalty programs occasionally offer discounted stays, ways to earn extra points and deals at various properties. Here are some February deals to consider when booking your next stay.

Earn double points at Accor hotels

Accor Live Limitless points are worth 2 cents apiece per TPG’s January 2025 valuations — and now you can earn twice as many of them at select properties in North and Central America.

- Earn double ALL rewards points when staying in North and Central America at Fairmont (including Rio de Janeiro), Sofitel, Swissotel, Novotel, Raffles and more.

- You must register for this promotion here by Feb. 28, then complete your stay at a participating hotel by March 31.

Earn up to triple points on Hyatt stays

World of Hyatt has launched its latest Bonus Journeys promotion, and it’s a good one. You can earn double or triple points on most paid stays, depending on the brand. Since World of Hyatt awards 5 base points per dollar spent on stays, you could earn up to 15 points per dollar with this promotion.

- Earn triple base points for qualifying stays at Hyatt House and Hyatt Place hotels, up to 10,000 bonus points total. Earn double base points at most other Hyatt brands, up to 20,000 bonus points total.

- An eligible stay is defined as any stay where a member pays an eligible rate or redeems a free night award.

- Register by March 10, and complete your qualifying stay(s) by March 28.

Related: Best hotel credit cards

Credit card promotions (February 2025)

Card issuers sometimes offer deals and discounts for certain cardholders on everything from airfare to dining. Here are some of the offers we’ve rounded up this week. Remember that you must activate these offers on your card and use your enrolled card to make the purchase to earn bonus rewards.

Targeted Chase Offer at Marriott Homes & Villas

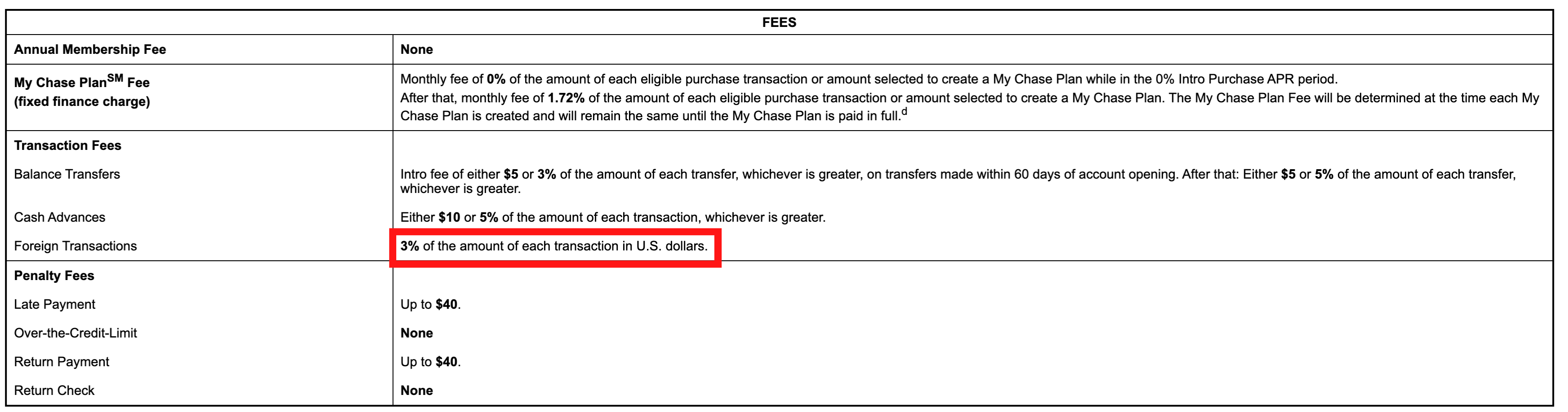

If you prefer home rentals to hotels, we found this deal on the Chase Freedom Unlimited® that could help you save on your next Marriott vacation rental stay.

- Earn $75 cash back on your Marriott Homes & Villas stay when you spend $250 or more in a single purchase directly with the merchant.

- Complete payment for your stay must be made by Feb. 15.

Targeted Amex Offer at Four Seasons

If your travels will take you to a Four Seasons property this spring, you could potentially save up to 22% with this Amex Offer, which we found on the The Platinum Card® from American Express.

- Earn a one-time $200 statement credit after spending a minimum of $900 in one or more purchases on room rate and room charges at Four Seasons Hotels and Resorts in the U.S. and select international destinations.

- Book at fourseasons.com.

- This offer expires May 29.

Targeted Amex Offer at Sonesta

Here’s another Amex Offer that could help you save on your next domestic stay.

- Earn $60 back as a statement credit when you spend at least $300 on one or more purchases on room rate and room charges at select Sonesta brands and destinations in the U.S.

- You must add this offer to your eligible card by Feb. 28, then redeem by March 31.

Targeted Amex Offer at Virgin Atlantic

Planning a trip abroad in 2025? This Amex Offer could save you money on one or more Virgin Atlantic flights.

- Earn $200 back as a statement credit when you spend $1,200 or more on Virgin Atlantic-marketed flights only through Amex Travel.

- Flight and hotel packages are not eligible.

- This offer ends Feb. 28.

Remember that if you hold The Platinum Card from American Express you’ll earn 5 Membership Rewards points per dollar on purchases through Amex Travel (up to $500,000 in on purchases per calendar year on the Amex Platinum, then 1 point per dollar). With the Business Platinum Card® from American Express, you’ll earn 5 membership rewards points per dollar on flights booked on AmexTravel.com. So a purchase of $1,200 on Virgin flights through the portal would earn you 6,000 Membership Rewards points, worth $120 per TPG’s January 2025 valuations.

10% back on travel bookings with Rakuten

Rakuten, one of TPG’s favorite online shopping portals, is offering a potentially lucrative flash sale. On Feb. 9 and 10, you can earn an impressive 10% cash back on purchases through select travel booking sites.

- Earn 10% cash back on purchases at Expedia, Hotels.com and Viator when you start your shopping at Rakuten or use Rakuten’s browser extension on Feb. 9 and 10 only.

- There is no limit to how much cash back you can earn through this sale.

Related: The ultimate guide to saving money with Amex Offers

Ongoing travel deals

In addition to these new offers, many others from previous weeks are still available:

- Earn 25 Alaska Airlines Mileage Plan miles per dollar spent at 1-800-Flowers and Harry & David when you use promo code “AKA4.” There is no published end date for this offer.

- Earn double Marriott Bonvoy base points on all qualifying Homes & Villas by Marriott Bonvoy stays of three or more nights, with a minimum spend of $1,500 (or equivalent). Register and book by Feb. 13; you’ll have until Dec. 30 to complete your stay.

- Earn one free Avis Preferred rental day for every two two-day rentals you complete in an intermediate-class car or above. You can use this promotion multiple times, up to a maximum of five free days earned each month. Register here and complete your rentals by Feb. 28.

- Get 20% bonus points back when you redeem World of Hyatt points for free nights at participating Homes & Hideaways by World of Hyatt properties and complete your stay by March 9. See the full terms and conditions here.

- Targeted ANA Mileage Club members can earn double base miles on select routes to or from North America. Check your email to see if you’re targeted, then register, book and fly by March 12.

- Earn 3,000 bonus World of Hyatt points per night (up to 30,000 bonus points total) at participating Hyatt Vacation Club properties. Register here by March 24; complete your stay by March 30.

- Enjoy up to 25% off and complimentary breakfast at participating Fairmont properties around the world. Book by March 30 for stays through May 31.

- Earn double IHG One Rewards base points starting on your second paid stay, then keep earning double on unlimited stays through March 31. Register here before booking.

- Earn 2,000 bonus miles (valid for one year) when you join Emirates Skywards. Register at this link using code “CONDOR” by March 31.

- Earn 20% bonus ALL points on qualifying bookings you make through the app by June 30. Download the app here.

Additionally, there are many stand-alone Amex Offers and Chase Offers still available across a variety of credit cards.

Targeted Amex Offers

- Get $150 back as a statement credit when you spend at least $750 on one or more room rate and room charge purchases at participating Omni Hotels & Resorts in the U.S. and Canada. Enroll by Feb. 20, and complete your stay by March 20.

- Earn a one-time $100 statement credit after spending $500 or more on room rate and room charge purchases at the Hard Rock Hotel New York in New York City. This offer is valid until Feb. 28.

- Get $100 back as a statement credit when you spend at least $500 on one or more room rate and room charge purchases at participating Hilton properties in Nevada. This offer expires March 17.

- Earn $150 back as a statement credit when you spend $750 or more at participating Hilton properties in Mexico, the Caribbean and Latin America by March 31.

- Earn 10% back (up to $125 back) on prepaid hotel purchases at Expedia by using this link. This offer expires April 6.

- Earn a $250 statement credit after spending $1,000 or more on property rates and charges incurred at the time of reservation for Homes & Villas by Marriott Bonvoy properties. This offer expires April 13.

- Earn an extra 5 Membership Rewards points per eligible dollar spent (up to 50,000 bonus points) on your AmaWaterways purchase. This offer ends May 6.

Targeted Chase Offers

- Earn 5% or 10% cash back (up to $40 cash back) on your Southwest Airlines purchase when you spend $50 or more directly with the merchant by Feb. 15. Earn 10% cash back on purchases of flights that occur in February or 5% cash back for other qualifying purchases.

- Earn 10% cash back (up to $32 cash back) on your Best Western stay when you spend $100 or more directly with the merchant by Feb. 15. This offer is valid at domestic Best Western, Best Western Plus, Best Western Premier, Vib, GLo, Aiden and Executive Residency properties; SureStay Hotels and WorldHotels are excluded.

- Earn 10% cash back (up to $80 cash back) on your Marriott Bonvoy stay when you spend $100 or more by Feb. 15.

- Earn 10% cash back (up to $62 cash back) on your Autograph Collection stay when you spend $100 or more directly with the merchant by Feb. 15.

- Earn 10% cash back (up to $75 cash back) on your Renaissance Hotels stay when you spend $100 or more directly with the merchant by Feb. 15.

- Earn 10% cash back (up to $68 cash back) on your Westin Hotels & Resorts stay when you spend $100 or more directly with the merchant by Feb. 15.

- Earn 10% cash back (up to $43 cash back) on your SpringHill Suites stay when you spend $100 or more directly with the merchant by Feb. 15.

- Earn 10% cash back (up to $57 cash back) on your Sheraton stay when you spend $100 or more directly with the merchant by Feb. 15.

Keep in mind that these offers are targeted. You need to activate them prior to making an eligible purchase to receive cash back, bonus points or miles.

Targeted Wells Fargo Offer

- Earn 10% cash back (up to $32 cash back) on your stay at participating Best Western brands when you spend $100 or more directly with the merchant. This offer ends Feb. 15.

Targeted BankAmeriDeals

- Earn 15% cash back (up to $150 cash back) on your cruise when you book with Silversea by Feb. 14.

- Earn 15% cash back (up to $150 cash back) on your cruise when you book with Celebrity Cruises by Feb. 14.

- Earn 15% cash back (up to $150 cash back) on your cruise when you book with Royal Caribbean International by Feb. 14.

Related reading: