Editor’s note: This is a recurring post, regularly updated with new information and offers.

Depending on how many credit cards you have, the list of benefits you should be using this month might feel overwhelming. Can you remember all of these perks without help? Maybe not.

Rather than trying to keep track of all of them on your own, we’ve compiled a monthly checklist of credit card perks and benefits you might be eligible for. This should take the guesswork out of your benefits, when they expire, and their value.

Here are some important reminders for the month of November.

American Express

There are numerous monthly card perks that you should be using since Amex offers many of its statement credits as monthly amounts — rather than a one-time annual benefit. It’s important to note that these values are “up to” amounts, meaning this is the maximum you will receive in statement credits. If you spend less than this amount, you will be reimbursed only for that lower amount.

Additionally, the Uber credits will disappear from your account if unused by the end of the month.

Overall, these are not benefits you can roll over for later. They are “use it or lose it” type credits.

The Platinum Card from American Express

- Up to $12.95 Walmart+ monthly membership: Pay with The Platinum Card® from American Express, then receive reimbursement in statement credits for one membership fee. Here’s how to enroll (subject to auto-renewal). Plus Up Benefits are not eligible. If you don’t receive the credit automatically, it’s worth requesting any missing credits be applied. The easiest way is via chat (online or through the Amex app; enrollment is required).

- Up to $15 in Uber credits: This can be used for Uber rides or on Uber Eats orders in the U.S. Add your card to your Uber account as a payment method to receive this benefit. Here’s how to use this benefit (enrollment is required).

- Up to $20 digital entertainment credit: This can be used for the Disney Bundle, Disney+, ESPN+, Hulu, Peacock, The New York Times and The Wall Street Journal. Enrollment is required in advance to receive the statement credit. Here’s how to use this benefit.

While not a monthly benefit, cardholders also receive two spending credits with Saks Fifth Avenue on the Amex Platinum each year. From Jan. 1 through June 31 each year, you’ll receive up to $50 in statement credits, and you’ll also have a separate up to $50 credit from July 1 to Dec. 31 in the second half of the year. Enrollment is required in advance.

You can use up to $300 in Equinox statement credits annually. These credits apply to paying for Equinox+ or any Equinox club membership (subject to auto-renewal). Here’s how to use this benefit. Enrollment is required.

These benefits and statement credits can help offset the card’s $695 annual fee (see rates and fees).

Related: 10 things to do when you get the Amex Platinum

Apply here: The Platinum Card® from American Express

The Business Platinum Card from American Express

- Up to $10 wireless credits: Pay for an eligible mobile service and receive a statement credit of up to $10. Enrollment is required in advance.

The Business Platinum Card® from American Express doesn’t award credits at Saks or with Uber, but cardholders do receive up to $400 in statement credits every year for Dell purchases (the tentative end date of benefit is Dec. 31). This is split into up to $200 in credits from January to June and another up to $200 from July to December. You can use your credits for the second half of the year now. Enrollment is required in advance.

Related: 9 things to do when you get the Amex Business Platinum Card

Apply here: The Business Platinum Card® from American Express

American Express Gold Card

Use the following benefits to help offset the card’s $325 annual fee (see rates and fees):

- Up to in $10 Uber credits: Like the perk on the Amex Platinum, this applies to Uber rides and Uber Eats orders in the U.S. Add your American Express® Gold Card to your Uber account as a payment method to receive this benefit — and note that it can stack with the monthly credit on the Amex Platinum if you have both cards. Here’s how to use this benefit. Enrollment is required.

- Up to $10 dining credit: Use your card to pay at The Cheesecake Factory, Five Guys, Golbelly, Grubhub and Wine.com to receive up to $10 monthly statement credits. Enrollment is required in advance. Here’s how to use this benefit.

- Up to $7 Dunkin’ credit: Cardholders receive up to $7 in monthly statement credits to be used at Dunkin’ locations within the U.S. Enrollment is required.

- Up to $100 annual Resy credits: Cardmembers receive two up to $50 biannual statement credits, one to be used from January to June and another one from July to December. Statement credits can be redeemed by dining at a restaurant (in the U.S.) that accepts Resy reservations and paying with your Amex Gold, as well as on other eligible Resy purchases. A reservation is not required to earn the statement credit. Enrollment is required.

Related: Amex Gold checklist: 4 things to do when you first get the card

Apply here: American Express® Gold Card

Delta cobranded cards

- Resy credit: You’ll receive a monthly statement credit of up to $10 for U.S. restaurant purchases on the Resy platform with the Delta SkyMiles® Platinum American Express Card and Delta SkyMiles® Platinum Business American Express Card; and up to $20 with the Delta SkyMiles® Reserve American Express Card and Delta SkyMiles® Reserve Business American Express Card. Enrollment required.

- Ride-hailing credit: You’ll receive an up to $10 monthly statement credit for U.S. ride-hailing services, including Uber, Lyft, Revel, Curb or Alto, if you have the consumer or business version of the Platinum or Reserve card. Enrollment is required.

Related: How to maximize the new statement credits on the Delta Amex cards

Hilton Honors American Express Aspire Card

- Up to $200 Hilton Resorts credit per six months: Use your Amex Aspire at participating Hilton Resorts to pay for eligible purchases, such as room charges and incidentals. This benefit is divided into two $200 biannual credits, one for use from January to June and another for use from July to December.

- Up to $50 in flight credits per quarter: Pay for a flight directly with an airline or through AmexTravel.com and receive up to $50 in statement credits each quarter. Datapoints tell us you may be able to use this credit for seat upgrades, and award taxes and fees, and to reload your United TravelBank balance.

The information for the Hilton Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Learn more: Hilton Honors American Express Aspire Card

Hilton Honors American Express Surpass Card

- Up to $50 Hilton credit per quarter: Receive up to $50 in statement credits each quarter on purchases charged directly with a property within the Hilton portfolio, including bookings and incidental charges. Datapoints tell us you may be able to use this credit for dining and gift store purchases at a Hilton property and online Hilton gift card purchases even if you aren’t staying at a property.

Apply here: Hilton Honors American Express Surpass® Card

The Hilton Honors American Express Business Card

- Up to $60 Hilton credit per quarter: Receive up to $60 in statement credits each quarter on purchases charged directly with a property within the Hilton portfolio, including bookings and incidental charges such as dining and spa services. See our advice for the Surpass credit above.

Apply here: Hilton Honors American Express Business Card

Marriott Bonvoy Brilliant American Express Card

- Up to $25 in monthly dining credits: This card offers monthly dining statement credits at restaurants worldwide. You don’t need to enroll for this benefit in advance — swipe your card at an eligible restaurant, and you should receive the statement credit within a few days.

Apply here: Marriott Bonvoy Brilliant® American Express® Card

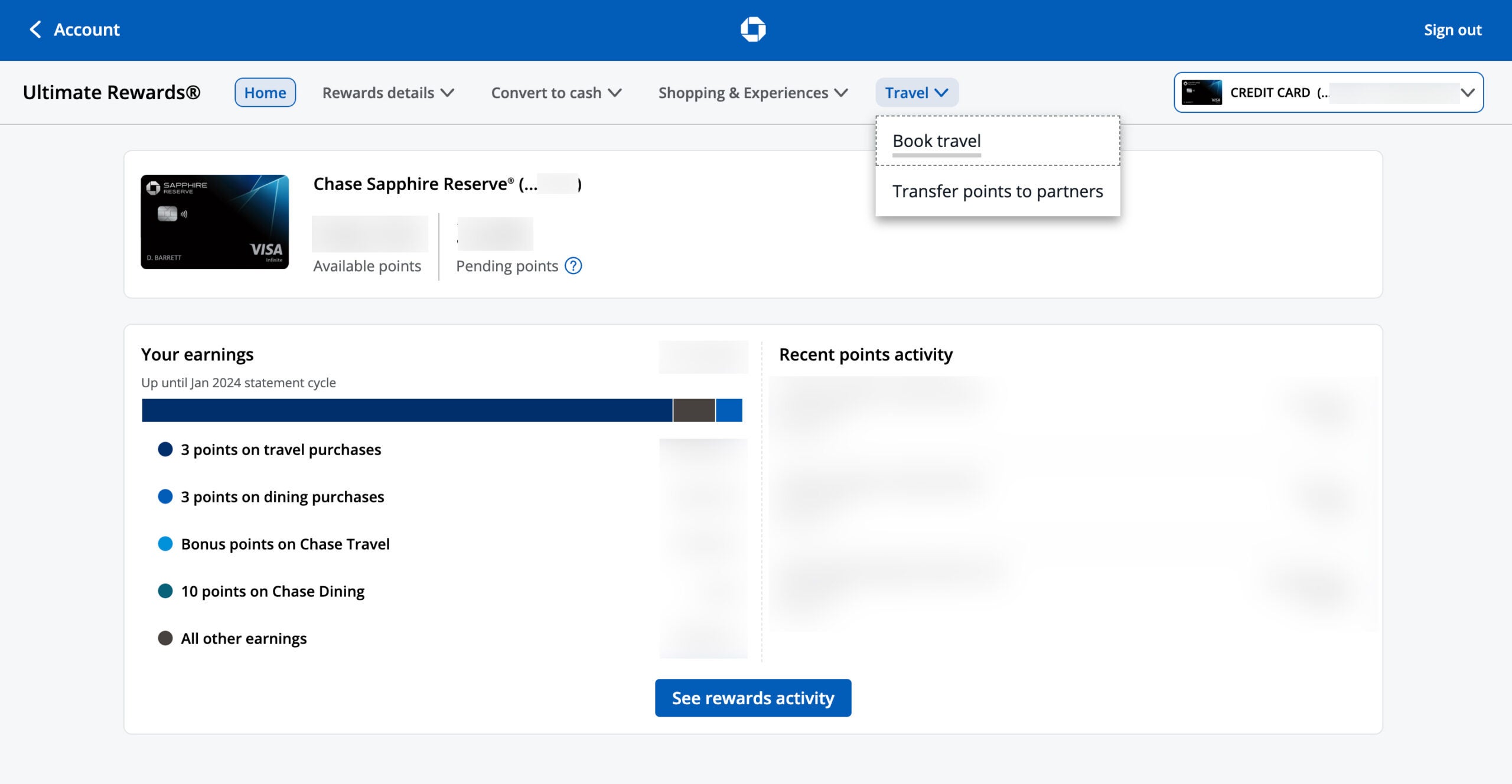

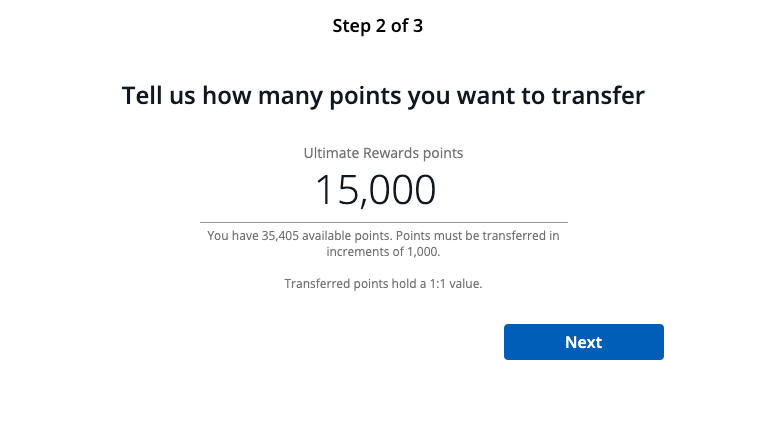

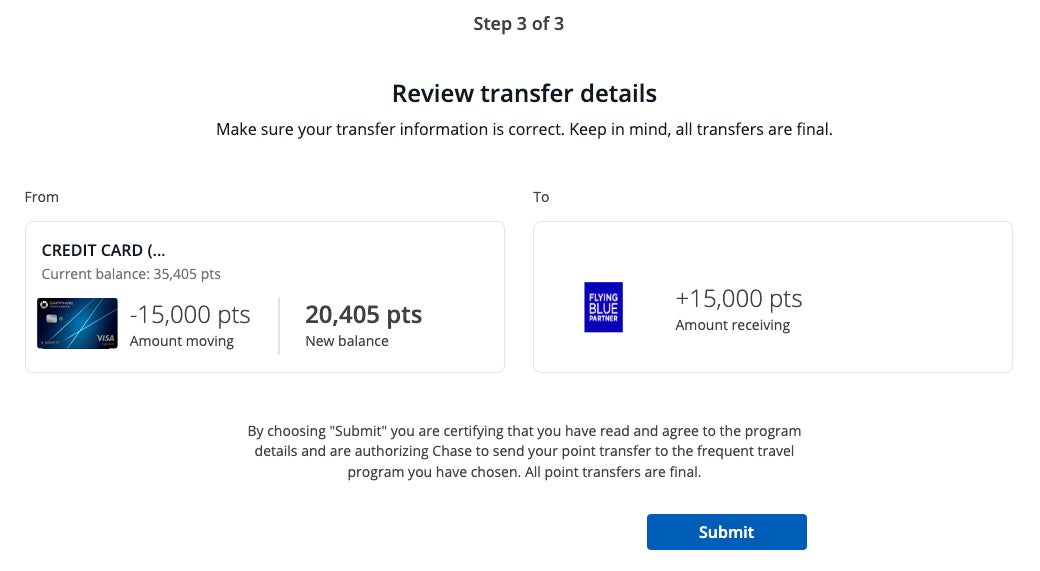

Chase

Select Chase credit cards offer perks on a monthly basis, so a new month means you have a fresh batch of credits to use.

Chase Sapphire Reserve

- $5 DoorDash credits: When you add your Chase Sapphire Reserve® card as a payment method to your DoorDash account, Chase will add $5 in credits at the beginning of each month. You can roll over a maximum of three months of credits, so you could now have up to $15 to use if you didn’t use any credits over the past two months. The $5 in-app credit applies to all orders through Jan. 31, 2025; however, beginning Feb. 1, 2025, this will change to $5 off restaurant orders only. Note that these credits are in addition to the card’s free DashPass membership.

- $20 DoorDash non-restaurant credits: With an activated Sapphire Reserve DashPass membership, cardholders receive two promos of up to $10 off each calendar month at checkout on grocery, convenience or other non-restaurant orders on DoorDash.

Apply here: Chase Sapphire Reserve®

Chase Sapphire Preferred Card

- $10 DoorDash non-restaurant credits: Cardholders with an activated Chase Sapphire Preferred® Card DashPass membership receive one promo of up to $10 off each calendar month at checkout on one grocery, convenience or other non-restaurant order on DoorDash.

Cardholders can also use a $50 hotel credit each year when booking through the Chase travel portal. If you haven’t used yours yet this year, here’s how to use this benefit.

Apply here: Chase Sapphire Preferred Card

Chase Freedom (not open to new applicants) and Chase Freedom Flex

- Up to 5% cash back: Current categories include McDonald’s, PayPal, pet shops, veterinarian services and select charities. You must activate your categories to enjoy higher earning rates. The quarter ends on Dec. 31 (and you must activate by Dec. 14), so you have until then to register and maximize these earnings.

- $10 DoorDash non-restaurant credits: Cardholders of any Chase Freedom or Slate family cards receive one promo of up to $10 off each quarter at checkout on one grocery, convenience or other non-restaurant order on DoorDash.

Remember: Even though the Freedom and Chase Freedom Flex® cards are technically cash-back products, you can turn these earnings into fully transferable Ultimate Rewards points if you also have a premium Chase card like the Sapphire Preferred or Sapphire Reserve.

The information for the Chase Freedom card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Apply here: Chase Freedom Flex®

Citi

Citi / AAdvantage Executive World Elite Mastercard

The Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) card has several benefits, including the following monthly credits:

- $10 in monthly Lyft credit after three rides: Use your card as the payment method in your account and get a $10 Lyft credit after taking three rides in a month.

- Up to $10 back with Grubhub: When you use your card for Grubhub purchases, you’ll receive up to $10 in monthly statement credits.

Citi recently devalued the annual up to $120 Avis-Budget car rental credit on this card. If you applied for the card before July 15, 2024, you can still use this year’s and next year’s credits on both prepaid and postpaid rentals. Those who applied for the card from July 15, 2024, onward must prepay for their reservation to receive the credit.

Apply here: Citi® / AAdvantage® Executive World Elite Mastercard®

Citi® Dividend Card (not open to new applicants)

- 5% cash back: You can earn 5% cash back each quarter on rotating categories. Unlike other cards that limit your bonus earnings within the quarter, Citi Dividend cardholders can earn 5% bonus cash back on up to $6,000 of spending across the year (then 1% back thereafter), meaning you could maximize your 5% earnings for the whole year during a quarter where the bonus categories are more advantageous for you. Remember to activate your current categories, which include Citi Travel℠, and are active through Dec. 31.

The information for the Citi Dividend has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Discover

Discover it Cash Back

- 5% cash back: Each quarter, you can earn 5% cash back on up to $1,500 in combined spending on rotating categories, then unlimited 1% cash back. Remember to activate your current categories, including Amazon.com and Target, through Dec. 31. Eligible Amazon.com purchases include those made through the Amazon.com checkout, like digital downloads, Amazon Fresh orders, Amazon Local Deals, Amazon Prime subscriptions, and items sold by third-party merchants through Amazon.com’s marketplace. This also includes purchases in-store at Amazon Go and Amazon Fresh. Purchases made online and in-store with Whole Foods Market are not included in the promotion. Target purchases include those made in-store at Target and Target.com and through the Target app.

The information for the Discover it® has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

U.S. Bank

U.S. Bank Cash+ Visa Signature Card

- 5% cash back: Each quarter, you can earn 5% cash back on up to $2,000 in combined spending on rotating categories, then an unlimited 1% back on other purchases made with your U.S. Bank Cash+® Visa Signature® Card. You must choose your categories each quarter and activate them for the bonus to apply. The current quarter runs through Dec. 31, and categories include: cellphone providers, department stores, electronics stores, fast food, furniture stores, ground transportation, gyms/fitness centers, home utilities, movie theaters, select clothing stores, sporting goods stores and TV, internet and streaming services.

The information for the U.S. Bank Cash+® has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

World Elite Mastercards

World Elite Mastercards

Numerous banks issue a World Elite Mastercard. Common products under this umbrella include the Citi Strata Premier℠ Card (see rates and fees), the IHG One Rewards Premier Credit Card and the Chase Freedom Flex. Here’s what cardholders can use each month on these cards:

- $5 in monthly Lyft credit after three rides: Use your card as the payment method in your account and get a $5 Lyft credit after taking three rides in a month. This benefit runs through Sept. 30, 2025.

- Up to $5 off monthly Peacock subscriptions: Use your eligible card to pay for a monthly Peacock streaming subscription and enjoy a $3 statement credit every month for Peacock Premium or a $5 statement credit every month for Peacock Premium Plus (the ad-free version). This benefit runs through March 31, 2025. If you have Instacart+, perhaps through an eligible Chase card, then you get Peacock Premium (with ads) for free.

- $10 off your second Instacart order: Join with your eligible card to enjoy two free months of Instacart+ membership plus $10 off your second order placed each month. This benefit runs through March 31, 2025.

Related: The 9 most valuable World Elite Mastercard benefits

Bottom line

Using the perks and benefits on your credit cards is critical for maximizing their value and justifying the cards’ annual fees. Some credit cards make this easy, offering your benefits as a one-time perk to use each year. Other benefits must be used in monthly increments, and it can be easy to forget about them.

This monthly checklist of credit card perks will help you remember to use them now that it’s the start of a new month.

For rates and fees of the Amex Gold, click here.

For rates and fees of the Amex Platinum, click here.