World of Hyatt is one of TPG’s favorite hotel loyalty programs, and in our November 2024 valuations, we value its points at 1.7 cents apiece.

You can stay at some amazing Hyatt properties with reasonable redemption rates. So, it’s worth saving up now if you have your eye on an aspirational stay. Seriously, redeeming Hyatt points for your next hotel stay can save you thousands of dollars.

Not sure where to start when it comes to earning World of Hyatt points? Keep reading to learn our tips and tricks for racking up a bunch of Hyatt points so you can use them to book your next vacation.

Earn Hyatt points on travel

World of Hyatt rewards its members for each hotel stay across its global portfolio. You can earn points on all Hyatt hotel stays booked directly through Hyatt’s website, which includes Mr & Mrs Smith properties, the Thompson and JdV brands — added as part of the Two Roads Hospitality integration — and a portfolio of more than 100 all-inclusive resorts.

Related: Glamping on points: Under Canvas is now live on World of Hyatt

Hyatt awards 5 points per dollar spent on Hyatt hotel stays and qualifying room charges (room service, bar tabs, spa services, etc.). This number is consistent across the brand’s portfolio, so you’ll earn the same amount of points for a stay at a Hyatt Regency as you would at a Hyatt Centric, if the prices are the same.

Aside from hotels, you’ll earn 10 World of Hyatt points for every eligible dollar spent on Find experiences.

Travelers with World of Hyatt elite status will earn bonus points on all hotel stays. Here’s how many extra points each tier earns:

- Discoverist: 10% bonus

- Explorist: 20% bonus

- Globalist: 30% bonus

So, if you’re a World of Hyatt Globalist member staying at a Grand Hyatt hotel for three nights at $150 per night, you’d earn 2,925 points on your hotel stay.

For example, $150 (per night) times three (for the number of nights stayed) equals $450. Then, $450 times five (for the number of points earned per dollar spent) equals 2,250 points. To calculate your Globalist elite status bonus, you’d multiply 2,250 points by 30%, which equals 675 points. Therefore, you’d earn a total of 2,925 Hyatt points for this three-night stay.

While your points-earning potential may seem smaller compared to other hotel loyalty programs like Hilton Honors and IHG One Rewards, Hyatt has lower award redemption rates.

Award nights at World of Hyatt brands start at just 3,500 points per night on off-peak dates at Category 1 hotels.

Related: How and why to get Hyatt lifetime Globalist status

Earn Hyatt bonus points through promotions

For qualifying stays at select new hotels in the Hyatt portfolio, you can earn 500 extra points per night within the first few months of opening.

The list of eligible properties, including the Thompson Palm Springs, Hyatt House BWI Airport / Baltimore and Hyatt Centric Delfina Santa Monica, can be found here.

For additional Hyatt offers, check out the current World of Hyatt promotions page to find out if you can boost your earning potential. TPG advises registering for the promotions even if you’re not sure you’ll stay at a Hyatt hotel. That way, you’ll be all set to earn bonus points if a last-minute trip arises.

Related: Current Hyatt promotions: Earn bonus points, double elite night credits and more

Earn Hyatt points with meetings

Holding meetings and events at Hyatt hotels can help you earn points and status. You’ll earn 1 point per dollar spent (up to 50,000 points) on eligible expenses like meeting rooms and event spaces. You can also earn World of Hyatt elite status by hosting meetings:

- Discoverist: 3 meetings

- Explorist: 10 meetings

- Globalist: 20 meetings

However, the ability to earn elite status through hosting qualified meetings is being discontinued Dec. 31, 2024. Starting in 2025, individuals may earn elite night credits based on eligible event charges. You will earn 2 tier qualifying night credits for every $5,000 of eligible event charges.

Note that a company account or individual can earn a maximum of 60 elite night credits each calendar year.

Earn Hyatt points through credit cards

The easiest way to boost your Hyatt balance is with the right credit card. Two cobranded Hyatt credit cards from Chase are currently open to new applicants: the World of Hyatt Credit Card and the World of Hyatt Business Credit Card.

World of Hyatt Credit Card

Annual fee: $95

Welcome offer: You can earn up to 60,000 bonus points — 30,000 bonus points after you spend $3,000 on purchases in your first three months from account opening, plus up to 30,000 additional bonus points by earning 2 points per dollar spent in the first six months from account opening on purchases (up to $15,000 spent).

Category bonuses: Earn 4 points per dollar spent when you use your card on qualified purchases at Hyatt hotels; 2 points per dollar spent at restaurants, on airline tickets purchased directly from the airline, on local transit and commuting, and on fitness club and gym memberships; and 1 point per dollar spent on all other eligible purchases.

Perks: You’ll receive one free night every year after your cardmember anniversary, valid at any Category 1-4 property. You can earn a second free night by spending $15,000 on the card in your card membership year. The card also provides automatic Discoverist elite status for as long as your account is open. You’ll enjoy five tier qualifying night credits annually, plus two additional credits for every $5,000 you spend on the card.

World of Hyatt Business Credit Card

Annual fee: $199

Welcome offer: Earn 60,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

Category bonuses: You’ll earn 4 points per dollar spent on qualified purchases at Hyatt hotels; 2 points per dollar spent in your top three spending categories each quarter and on fitness club and gym memberships; and 1 point per dollar spent on all other eligible purchases.

Perks: You’ll get up to $100 in Hyatt credits each anniversary year (given as a $50 statement credit up to two times each anniversary year when you spend $50 or more at any Hyatt property with your card). You’ll also get automatic World of Hyatt Discoverist status for as long as you hold your card, as well as the ability to gift Discoverist status to up to five employees. And for every $10,000 you spend in a calendar year, you’ll earn five tier qualifying night credits toward earning higher tiers of Hyatt elite status.

Earn Hyatt points with partners

If you don’t have any upcoming Hyatt stays and aren’t in the market for a new credit card, don’t worry. There are still ways to collect Hyatt points.

Transfer credit card rewards points to World of Hyatt

You can transfer Chase Ultimate Rewards points from cards like the Chase Sapphire Reserve® and the Chase Sapphire Preferred® Card to World of Hyatt at a 1:1 ratio. Best of all, the transfer should process instantly.

TPG values Chase Ultimate Rewards points at 2.05 cents each and World of Hyatt points at 1.7 cents each, per our November 2024 valuations. However, transfers are irreversible, so we recommend only transferring points if you have a specific redemption in mind.

Additionally, if you are a Bilt Rewards member, you can instantly transfer Bilt Rewards Points to World of Hyatt at a 1:1 ratio.

Related: When and how to transfer Ultimate Rewards points to World of Hyatt

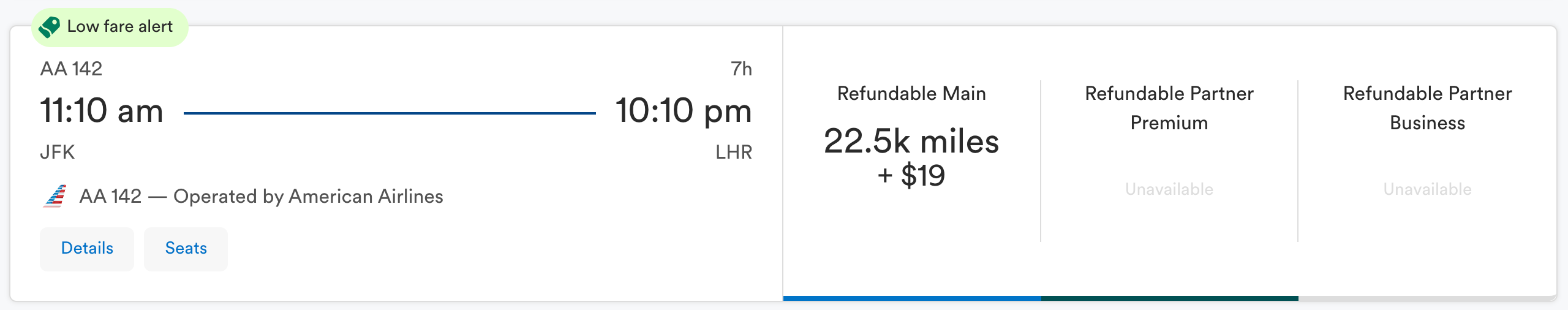

Earn on American flights

If you have elite status with the World of Hyatt program, you can earn Hyatt points when you fly on American Airlines. Thanks to the partnership, Hyatt elite members earn 1 Hyatt point per dollar spent on qualifying American Airlines flights.

This earning is in addition to the American Airlines AAdvantage miles you’ll earn. All you need to do is link your Hyatt and AAdvantage accounts through this link. Unfortunately, this reciprocal loyalty-earning privilege will be ending Dec. 31.

Rent cars from Avis

Like most hotel chains, renting a car can earn World of Hyatt points. Rent with Avis and use the code “K817700” to get 500 World of Hyatt points per rental.

You can also receive discounts for each qualifying rental at participating Avis locations with the code. Learn more about this here.

Transfer points between family and friends

World of Hyatt members can transfer points between accounts free of charge. However, you can only send or receive points once every 30 days. And unfortunately, you can’t complete this transfer online. You must fill out this form (PDF link) and submit it via email. Both the member transferring the points and the recipient must sign the form before you submit it. Hyatt will complete the transfer once the form is received and reviewed.

Buy Hyatt points

The final method of earning Hyatt points is to purchase them directly. Generally speaking, you should rarely (if ever) purchase points or miles of any kind without a bonus or discount. Luckily, Hyatt runs somewhat frequent promotions for purchasing points. If you have a high-end redemption in mind and need to top off your account, buying Hyatt points is an option.

Bottom line

The World of Hyatt program is a favorite among award travelers. Despite a comparatively small (but growing) global footprint, the World of Hyatt program can offer a luxurious experience and a rewarding value proposition.

If you combine credit card spending with a handful of paid stays, you’ll be well on your way to a free room for your next trip.