Editor’s note: This is a recurring post, regularly updated with new information.

Chase Ultimate Rewards points are the currency of most Chase-branded credit cards. You can earn Chase Ultimate Rewards points for everyday spending and then redeem them for a wide range of rewards.

Despite increasing competition from American Express Membership Rewards points, Citi ThankYou Rewards points and Capital One miles, Chase Ultimate Rewards points have maintained their place as one of the most valuable and useful points currencies — especially with valuable rewards cards like the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card.

Transferring Ultimate Rewards to travel partners is often the most valuable way to redeem your hard-earned points. With 14 different transfer partners, you have plenty of options since you can keep your Chase points in your Ultimate Rewards account until you can transfer them.

Here is everything to know about Chase Ultimate Rewards’ transfer partners.

Related: The best Chase credit cards

Who are the Chase transfer partners?

You can transfer Ultimate Rewards points to 11 airline programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Chase also partners with three hotel programs:

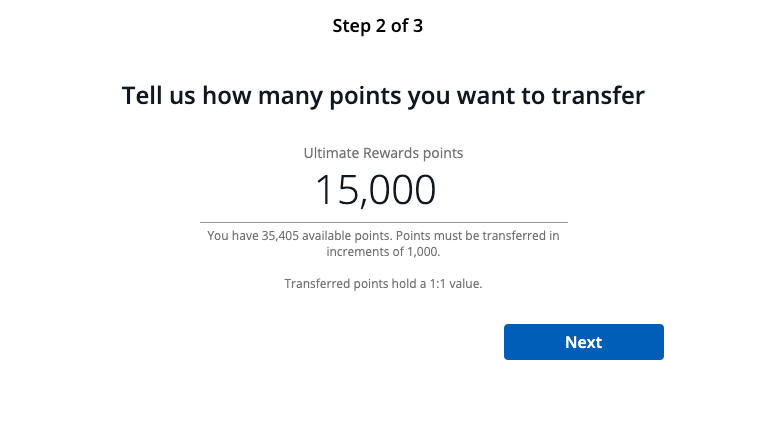

All transfer ratios are 1:1 (though there are occasional transfer bonuses), and you must transfer points in 1,000-point increments.

How long do Ultimate Rewards transfers take?

Most transfers from Chase Ultimate Rewards to its partner programs are instantaneous. However, in our most recent testing, transfers to Singapore Airlines KrisFlyer took about 48 hours.

Note that transfer bonuses can also be inconsistent. For example, when TPG’s senior editorial director Nick Ewen transferred points to Aeroplan to take advantage of a 20% bonus, the base points arrived immediately, but it took three days for the bonus points to post to his account.

While most transfers through the Chase portal should be instantaneous, delays can happen when transferring your points. To help with the transfer process, we recommend making sure that the name on your Ultimate Rewards account matches that on your loyalty program account. Additionally, make sure you have signed up with a loyalty program in advance, as a new account may also cause a delay in the transfer process.

How do I transfer Chase points to partners?

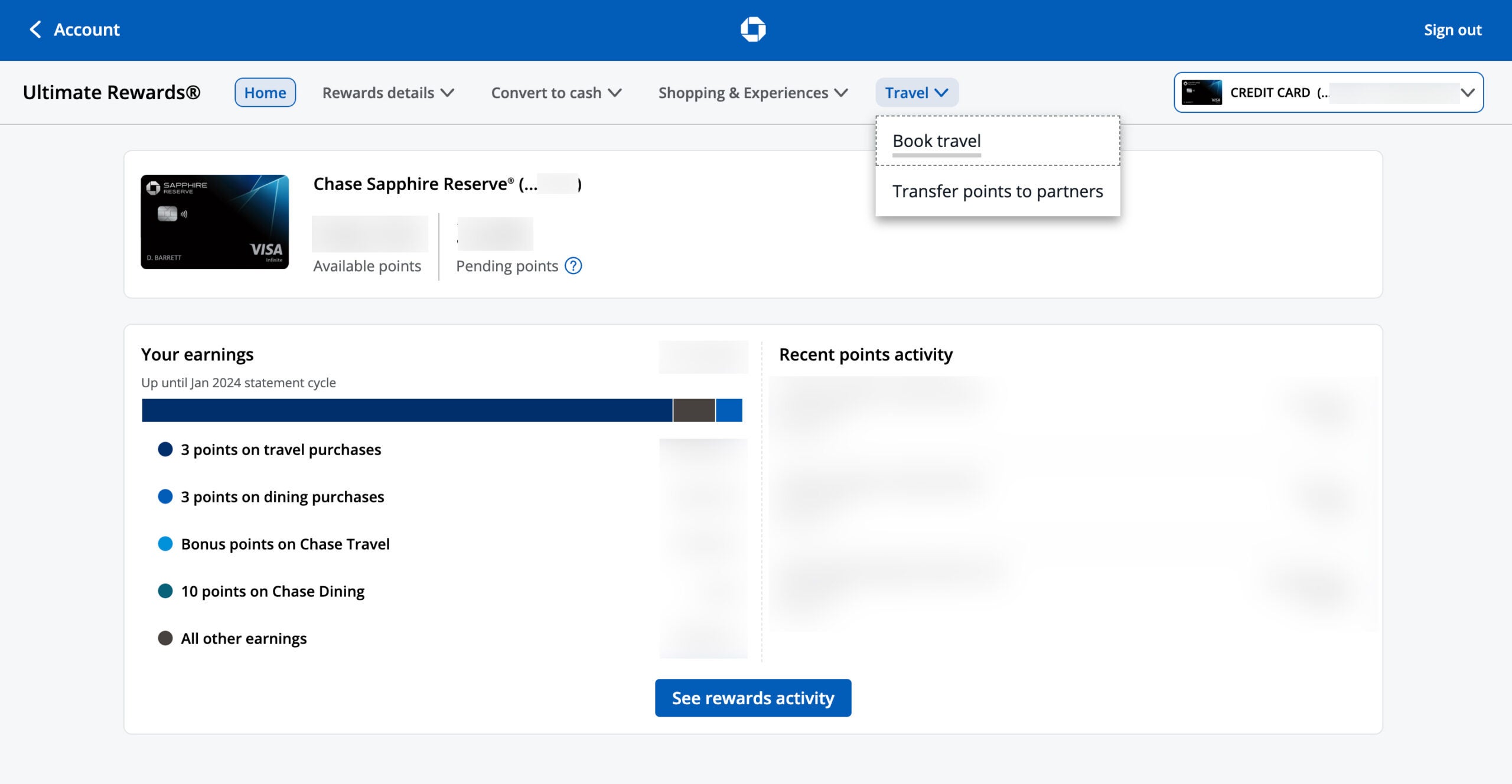

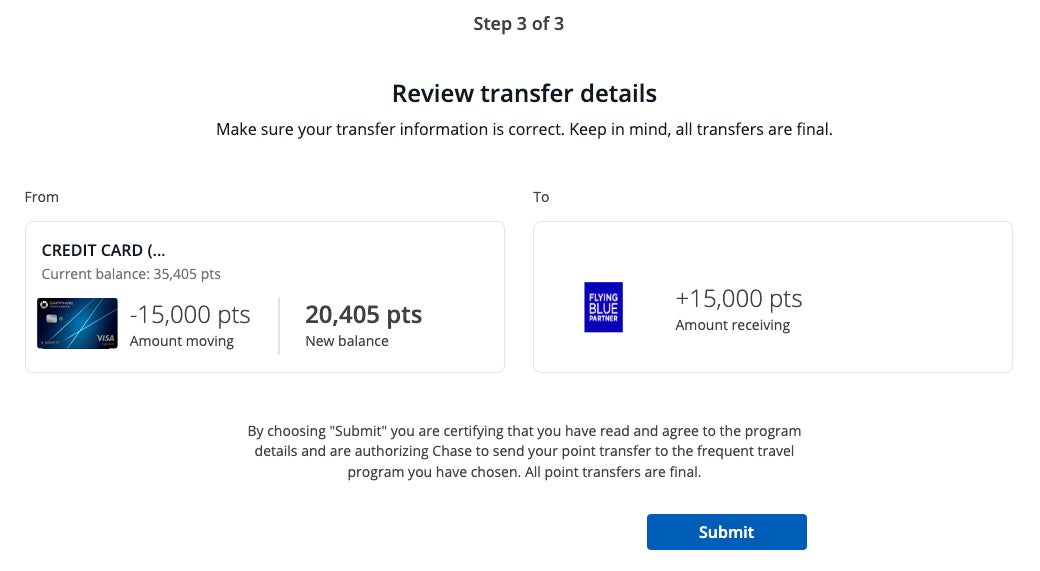

You can easily transfer Chase points online. First, log in to your Chase account and navigate to the Ultimate Rewards portal. Under the Travel drop-down, select “Transfer to Travel Partners” to access the main transfer page.

You will then see the list of transfer partners and any current transfer bonuses. Select your desired transfer partner, link your external account if you have not already done so, select the number of Ultimate Rewards points you wish to transfer and then submit the transfer.

Remember, Ultimate Rewards transfers cannot be reversed, so it’s best to wait until you have a specific use before transferring them.

What are the best Chase transfer partners?

Given the low award chart rates of the World of Hyatt program, many TPG staffers believe Hyatt is the best hotel transfer option for redeeming Ultimate Rewards points.

If you would prefer to transfer to one of the 11 different airline program partners, the best option may depend on which airlines fly to and from the destinations you wish to travel, who the program partners with and which airlines you like to travel with.

There are sweet spots to be found in most airline transfer options, especially those programs that have retained award charts.

Here are some of our favorite Ultimate Rewards sweet spots.

Top-tier Hyatt hotels

The World of Hyatt award chart has two appealing factors. First, its mere existence is notable, given most other hotel programs (including IHG One Rewards and Marriott Bonvoy, the other Chase hotel partners) have shifted to dynamic pricing.

Beyond that, Hyatt’s award rates can be incredibly low compared to some competitors. You can book some of the fanciest Park Hyatt properties in the entire portfolio, including the Park Hyatt New York and Park Hyatt Sydney, for just 35,000 points per night during off-peak dates. TPG values Hyatt points at 1.7 cents each (per our October 2024 valuations), so 35,000 points are worth $595.

That’s a great deal for hotels that sell for close to $1,000 per night, even when demand is low.

There’s also great value at the lower end of the Hyatt award chart. Category 1 hotels range from 3,500 to 6,500 points per night, depending on whether you travel on peak, standard or off-peak dates.

Iberia flights to Madrid

Round-trip, off-peak flights from New York’s John F. Kennedy International Airport (JFK), Chicago’s O’Hare International Airport (ORD) and Boston Logan International Airport (BOS) to Spain’s capital will only set you back 34,000 Avios in economy, 51,000 in premium economy or 68,000 in business when you transfer your Chase points to Iberia Plus. Considering that most airlines charge at least 60,000 miles for a one-way business-class award to Europe, you’re essentially getting a 50% discount.

Related: 7 of the best airline award chart sweet spots

Flights to Hawaii with Alaska and American

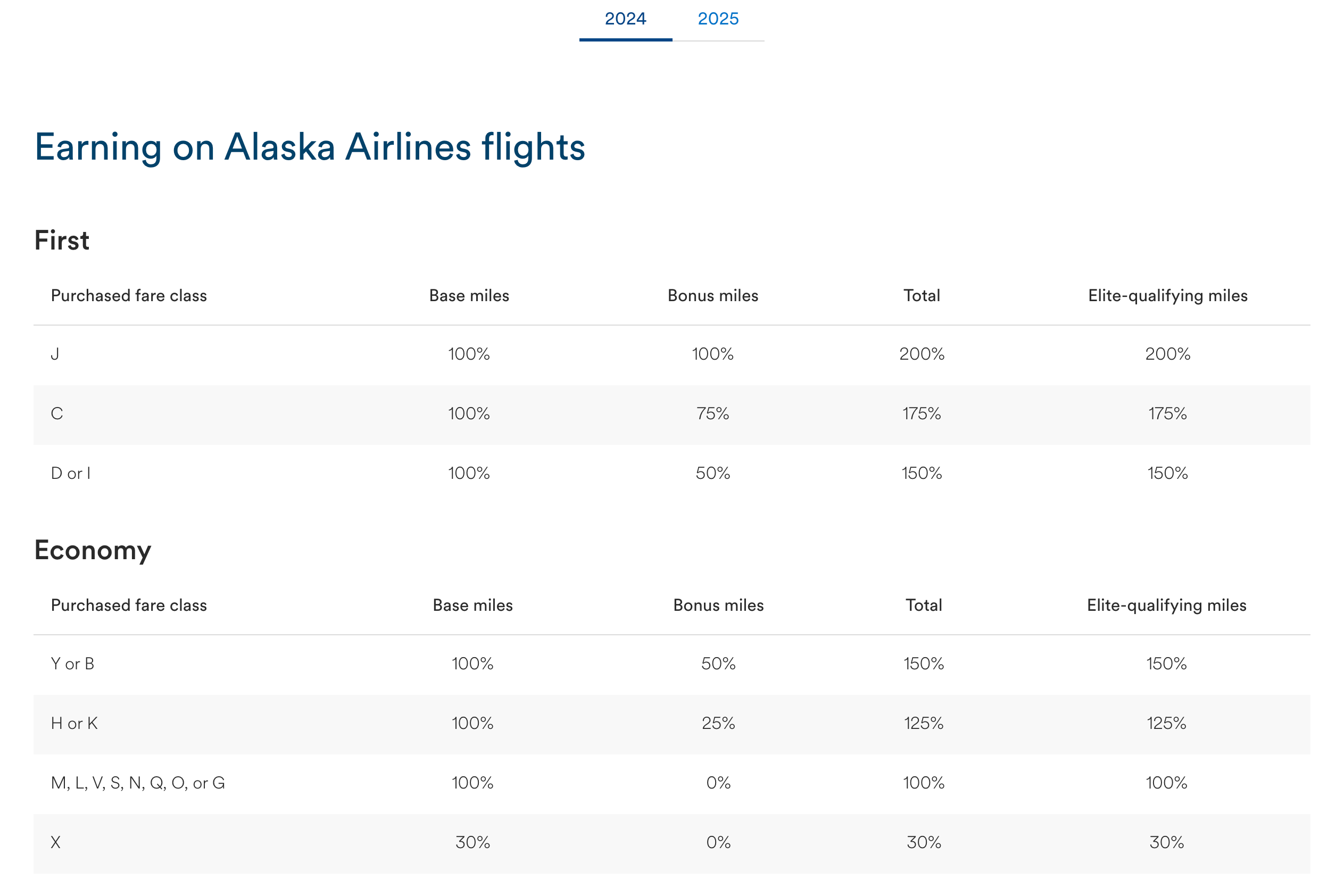

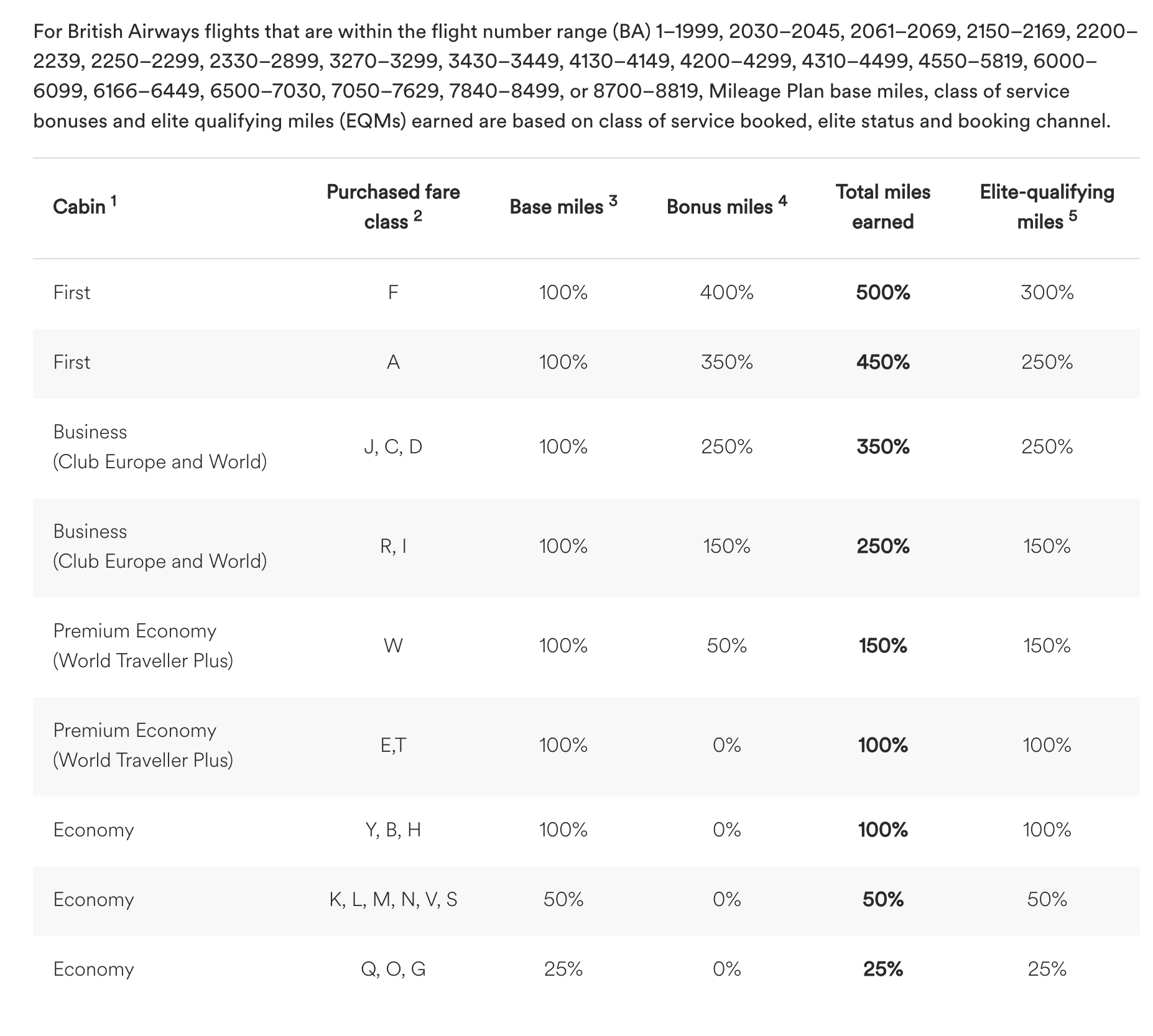

By transferring your Ultimate Rewards to British Airways, you can book awards with Oneworld partners American Airlines and Alaska Airlines. As long as your nonstop flight distance is under 3,000 miles each way (and saver-level award space is available), you can leverage British Airways’ distance-based award chart to fly from any West Coast gateway to Hawaii for 40,000 Avios round-trip — after a December 2023 and July 2024 devaluation that saw prices increase.

ANA flights booked through Virgin Atlantic

For just 145,000 Flying Club points, you can fly round-trip in All Nippon Airways first class between the West Coast and Tokyo. Flights from other U.S. gateways only cost an extra 25,000 points (170,000 points round-trip). Business-class redemptions are an even better deal, costing just 105,000 to 120,000 points round-trip, depending on your U.S. departure airport. If possible, you’ll want to route through New York-JFK and fly ANA’s industry-leading “The Room” business class, which is only available on select routes.

However, availability can be difficult to come by.

Short-haul flights to Canada

Aeroplan stuck to an award chart for partner redemptions but added dynamic pricing for Air Canada flights. As a result, you can often find super-cheap short-haul tickets from the U.S. to Canada. For example, New York to Toronto Pearson Airport (YYZ) can be booked for under 6,000 miles one-way on many dates.

However, you can also find very reasonable award rates on Star Alliance partners through Aeroplan — including Lufthansa, Swiss and EVA Airways.

Related: Your complete guide to Star Alliance benefits

What are Chase Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents apiece, per our October 2024 valuations, and we believe you will receive the best value by transferring points to airline and hotel partners.

However, you’ll get varying values for Chase points if you pursue other redemption opportunities. For example, Ultimate Rewards points are worth 1.5 cents apiece through the Chase Travel℠ portal for Sapphire Reserve cardholders or 1.25 cents for those with the Sapphire Preferred or Ink Business Preferred card. You’ll also have access to Chase Pay Yourself Back as a cardholder of any of the above cards, and there are occasionally offers to use Chase points for Apple products or gift cards at an enhanced value.

Finally, Chase points are worth 1 cent apiece if used for simple cash back.

How do I earn Chase Ultimate Rewards points?

There are many ways to earn Chase points at 1-10 points per dollar spent, depending on the specific Chase credit card you carry.

The first three cards below earn fully transferable Ultimate Rewards points by themselves, while the remaining four are technically billed as cash-back credit cards.

However, if you have an Ultimate Rewards-earning card, you can effectively convert your cash-back rewards into Ultimate Rewards points. For this reason, having more than one Chase card can make sense to maximize your earning and redeeming potential.

Here are the cards that allow you to earn Chase Ultimate Rewards points.

Chase Sapphire Preferred Card

Welcome bonus: Earn 60,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months of account opening, plus a $300 statement credit on Chase Travel℠ purchases within the first year.

Why you want it: This is a fantastic all-around travel credit card. It earns points at the following rates:

- 5 points per dollar on Lyft (through March 2025)

- 5 points per dollar on all travel purchased through Chase Travel

- 3 points per dollar on dining, including eligible delivery services, takeout and dining out

- 3 points per dollar on select streaming services

- 3 points per dollar on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 2 points per dollar on all other travel

- 1 point per dollar on all other purchases

The Sapphire Preferred has no foreign transaction fees and has many travel perks, including delayed baggage insurance, trip interruption/cancellation insurance and primary car rental insurance.

Annual fee: $95

Application link: Chase Sapphire Preferred® Card

Chase Sapphire Reserve

Welcome bonus: 60,000 points after you spend $4,000 on purchases in the first three months from account opening.

Why you want it: The Sapphire Reserve offers earning power paired with travel perks that can easily cover the annual fee. It earns points at the following rates:

- 10 points per dollar on Lyft (through March 2025)

- 10 points per dollar on Chase Dining booked through Ultimate Rewards

- 10 points per dollar on hotel and car rental purchases through the Chase Travel

- 5 points per dollar on airline travel booked through Chase Travel

- 3 points per dollar on travel not booked through Chase

- 3 points per dollar on other dining purchases

- 1 point per dollar on all other eligible purchases

Other perks include an easy-to-use $300 annual travel credit, a fee credit for Global Entry or TSA PreCheck (up to $120 once every four years) and Priority Pass Select lounge access as well as the growing list of new Sapphire lounges. Cardholders also get primary car rental coverage, trip interruption/cancellation insurance and other protections.

Annual fee: $550

Application link: Chase Sapphire Reserve®

Ink Business Preferred Credit Card

Welcome bonus: 90,000 points after spending $8,000 on purchases in the first three months from account opening

Why you want it: This is one of the best credit cards for small-business owners, earning 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, advertising made with social media sites and search engines each account anniversary year. You earn 1 point per dollar on all other purchases, and points don’t expire as long as your account is open.

Annual fee: $95

Application link: Ink Business Preferred® Credit Card

Cash-back Chase credit cards

Four Chase credit cards are technically billed as cash-back products. However, suppose you have one of the three cards noted above. In that case, you can combine your points in a single account, converting these cash-back rewards into fully transferable Ultimate Rewards points.

Even better? None of these cards charge an annual fee.

Here are the four cards that offer this functionality:

- Chase Freedom Flex®: Earn $200 after you spend $500 in the first three months of account opening. Earn 5% back on select bonus categories, which rotate every quarter and apply on up to $1,500 in combined spending (activation required). Plus, earn 5% on travel purchased through Chase Travel, 3% on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases.

- Chase Freedom Unlimited®: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year), worth up to $300 cash back. Plus, earn 5% on travel purchased through Chase Travel, 3% on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases. Earn 1.5% on all other purchases.

- Ink Business Cash® Credit Card: Earn up to $750: $350 bonus cash back after you spend $3,000 on purchases in the first three months, and an additional $400 when you spend $6,000 on purchases in the first six months from account opening. Earn 5% cash back on the first $25,000 in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year (then 1%). Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year (then 1%).

- Ink Business Unlimited® Credit Card: Earn $900 cash back after spending $6,000 on purchases in the first three months from account opening. Earn unlimited 1.5% cash-back rewards on every purchase.

Note that Chase also issues the Ink Business Premier® Credit Card. However, the earnings on this card can’t be combined with others in the Ultimate Rewards ecosystem.

Read more: Your guide to the Chase Ink Business credit cards

Bottom line

If you value the flexibility of choosing from 11 airline partners and three hotel partners, Chase Ultimate Rewards is one of our favorite credit card programs at TPG.

In the age of no-notice devaluations by some loyalty programs, it is smart to earn Ultimate Rewards via the range of credit card welcome offers, category bonuses and everyday spending, and then keep your Ultimate Rewards points until you are ready to transfer and book with an airline or hotel partner.