Editor’s note: This is a recurring post, regularly updated with new information and offers.

Loyalty programs are huge moneymakers for airlines and hotel companies because they support many revenue streams. One of these revenue streams is selling airline miles and hotel points directly to travelers.

Programs can get an immediate cash injection by selling points and miles as travelers prepay for future travel. However, as a traveler, keep in mind that it generally only makes sense to purchase points and miles when a discount or bonus offer is available.

This roundup of points and miles sales walks you through some of the best current offers on airline miles and hotel points, including some that may be targeted. But first, let’s discuss when it makes sense to buy points and miles.

Should you buy points and miles?

There are a couple of things to consider before taking advantage of points and miles sales.

First, buying points and miles only makes sense for certain travelers and at certain times. It’s generally a much better deal to earn points and miles for “free” through welcome bonuses tied to travel rewards credit cards.

However, buying points and miles during good promotions can make sense for those who have tapped out their credit card options and can get high value from their rewards. It can also make sense when you need more points to lock in a specific redemption.

We generally only recommend buying points or miles if you have an immediate use in mind. In that case, buying points and miles can save you thousands of dollars. However, we don’t recommend stockpiling your loyalty rewards, as programs frequently undergo unexpected devaluations.

With that, here are the current promotions for buying points and miles.

Related: What are points and miles worth? TPG’s current monthly valuations

Promotions for buying airline miles

American Airlines AAdvantage

- Current promotion: A 10% to 35% discount

- Purchase rate: As low as 2.45 cents per mile

- TPG February 2025 valuation: 1.65 cents per mile

- End date: Unknown

- Buy AAdvantage miles

American Airlines AAdvantage is offering up to a 35% discount on miles, depending on how many you buy. You must purchase at least 6,000 miles to get the 10% discount, and the discount increases as you buy more miles. You’ll get the highest discount of 35% when you buy 150,000 miles, dropping the price to 2.45 cents per mile. This is significantly higher than TPG’s current valuation of American miles, but buying American miles for specific high-end awards could still make sense.

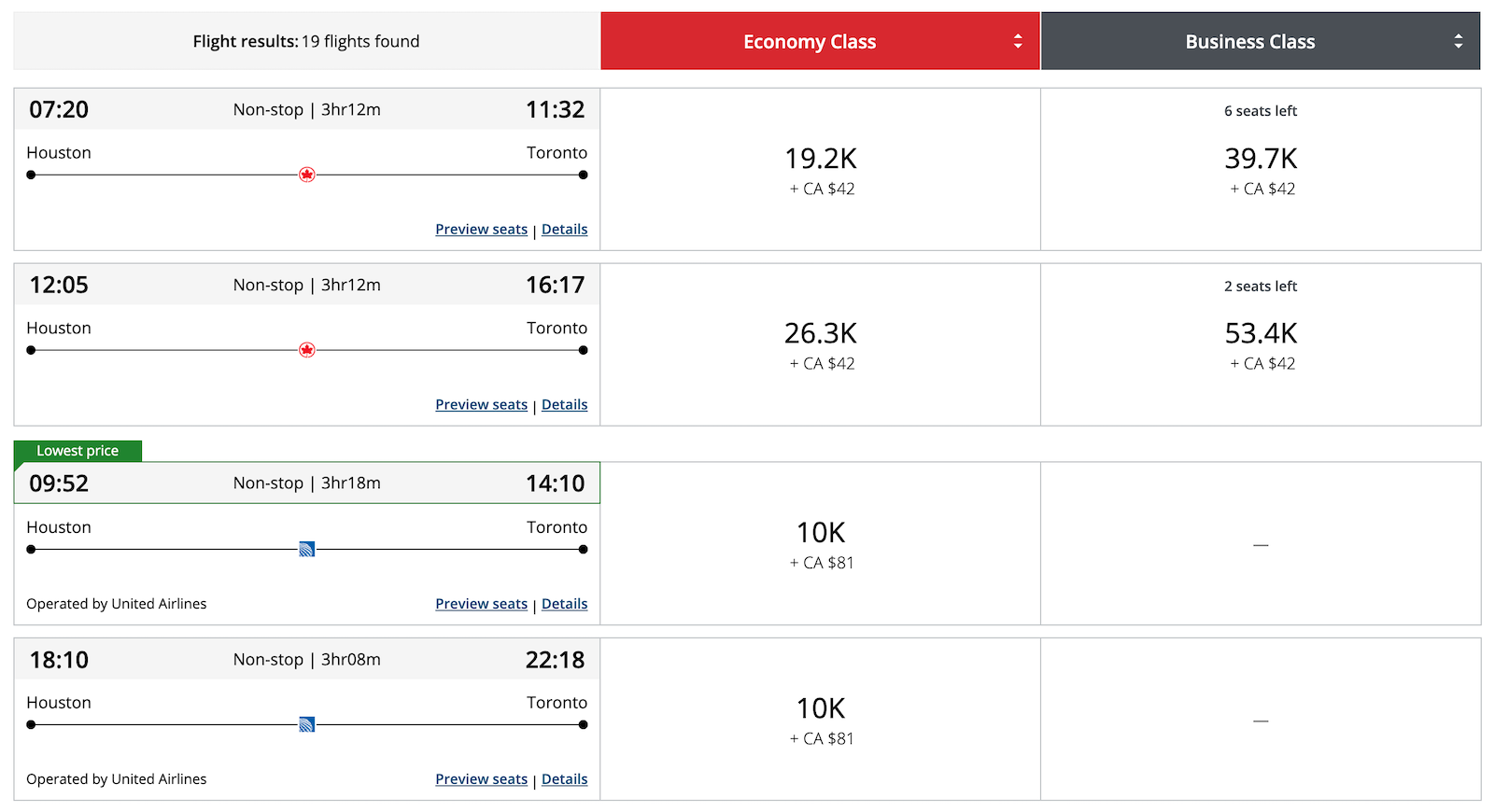

Air Canada Aeroplan

- Current promotion: A 15% to 30% discount

- Purchase rate: As low as about 1.7 cents per point

- TPG February 2025 valuation: 1.5 cents per point

- End date: Feb. 18, 2025

- Buy Aeroplan points

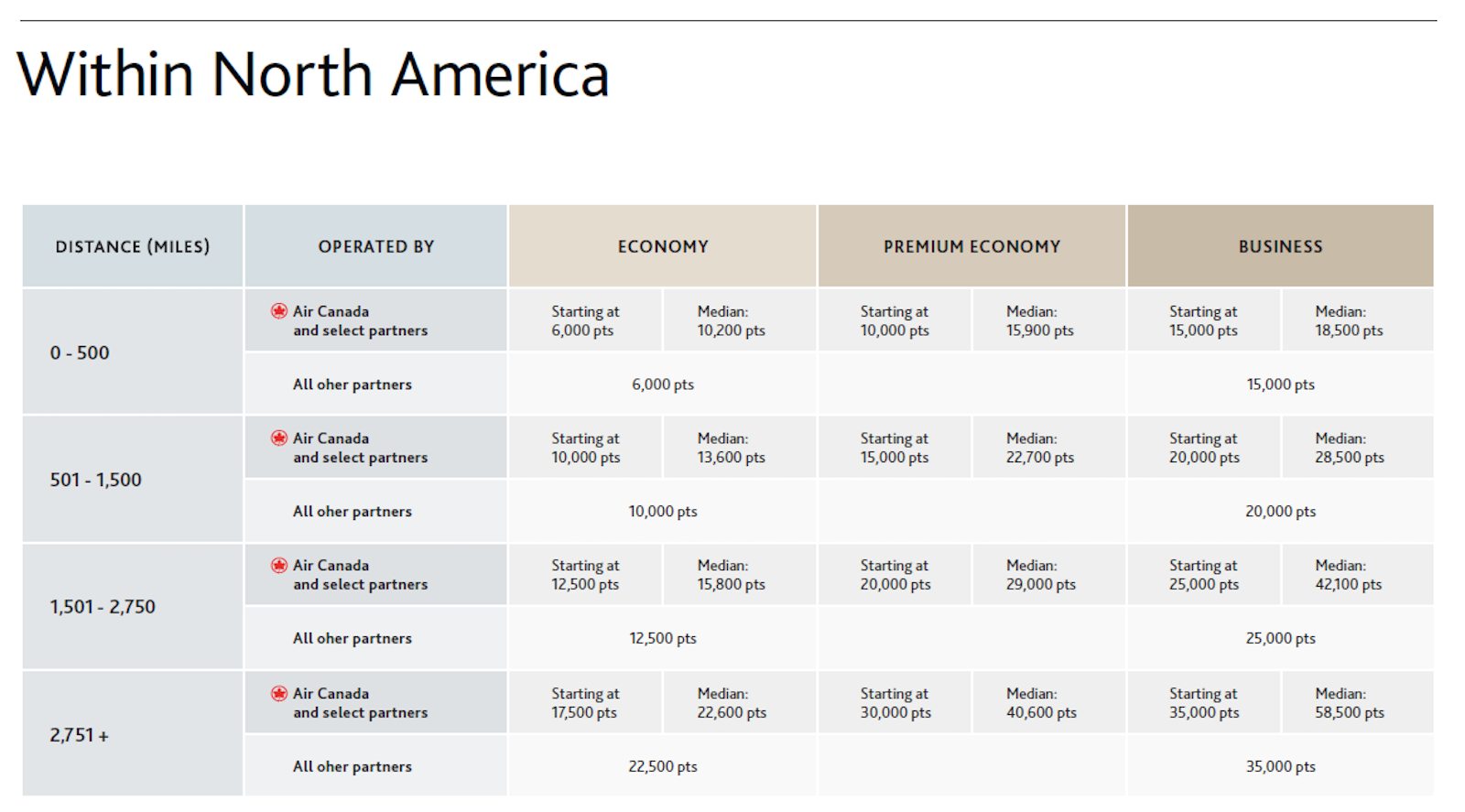

Air Canada Aeroplan is offering up to a 30% discount when you buy at least 100,000 points. If you buy at least 10,000 points, you’ll receive a 15% discount, and you’ll get a 20% discount when purchasing at least 20,000 points and a 25% discount when buying at least 80,000 points.

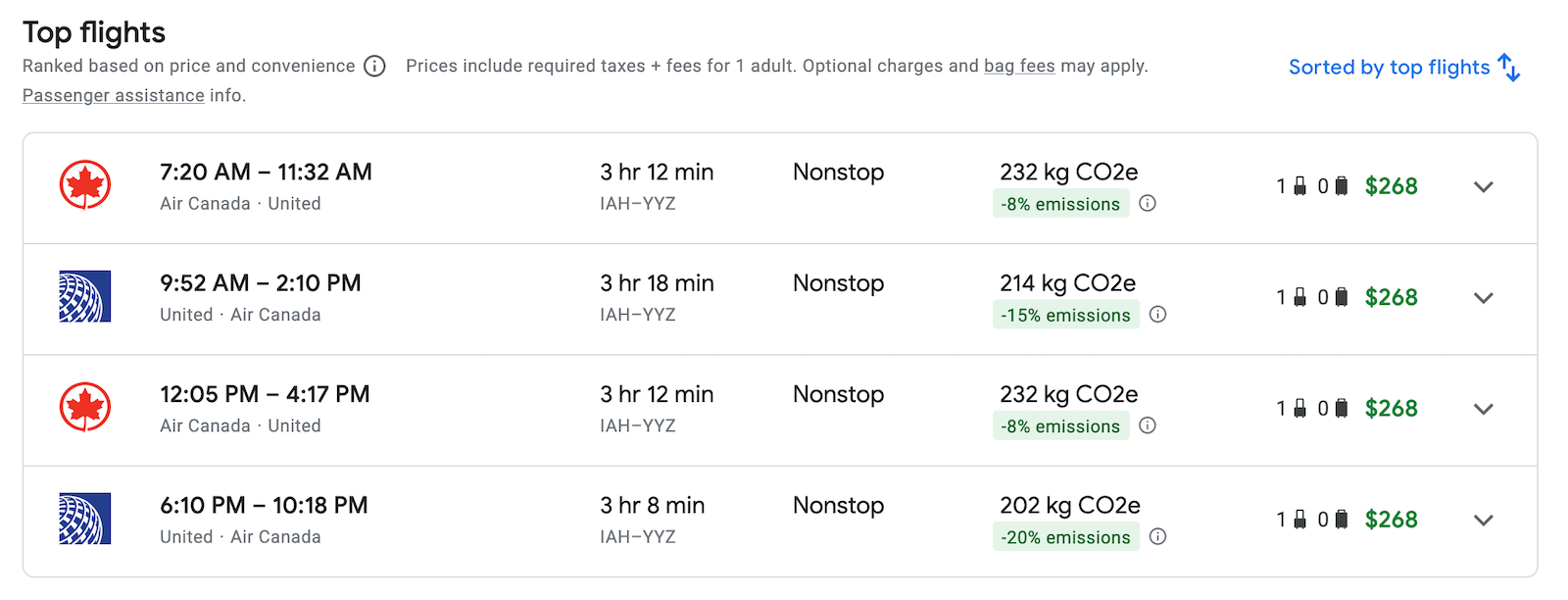

While the lowest purchasing rate you can receive is about 1.7 cents per point, this is still higher than TPG’s current valuation of 1.5 cents per point. This isn’t the best deal we’ve seen, but it could be worth topping off your Aeroplan account if you have a redemption in mind. Booking a business-class ticket, a stopover for 5,000 points or a round-trip economy ticket within North America are just a few ways to maximize your Aeroplan points.

Alaska Airlines Mileage Plan (targeted)

- Current promotion: Up to 60% bonus miles

- Purchase rate: As low as 1.72 cents per mile

- TPG February 2025 valuation: 1.45 cents per mile

- End date: Feb. 21, 2025

- Buy Alaska miles

Alaska Airlines Mileage Plan is running a “mystery bonus.” Offers may vary, but we’ve seen up to 60% bonus miles when you purchase 40,000 or more. You’ll get a 50% bonus if you buy at least 20,000 miles and a 40% bonus if you buy at least 3,000. Even with the maximum 60% bonus, the price per mile is still well above TPG’s valuation for Alaska miles, so we wouldn’t recommend purchasing miles in most cases.

JetBlue TrueBlue (targeted)

- Current promotion: Up to 120% bonus points

- Purchase rate: As low as 1.36 cents per point

- TPG February 2025 valuation: 1.35 cents per point

- End date: Feb. 24, 2025

- Buy TrueBlue points

JetBlue TrueBlue is offering an impressive 120% bonus promotion to targeted members who purchase at least 3,000 points. This bonus brings the cost per point down to a flat rate of 1.36 cents each, just a hair over TPG’s current valuation of 1.35 cents. This isn’t a terrible purchase rate, as TrueBlue points typically cost 3 cents apiece when you purchase them from the airline. If you have a JetBlue redemption in mind and are short a few points, this is a solid option.

Note that this offer is targeted, and some TrueBlue members may receive a different bonus.

Finnair Plus Avios (targeted)

- Current promotion: Varies

- Purchase rate: About 1.8 to 2.3 cents per Avios

- TPG February 2025 valuation: 1.4 cents per Avios

- End date: Unknown

- Buy Finnair Plus Avios

Finnair Plus is targeting select members with promotions when you buy at least 5,000 Avios. These offers vary, but we’ve seen both a 10% discount and a 20% bonus. These drop the price to roughly 1.8 to 2.3 cents per Avios, still well above TPG’s valuation.

Since Finnair adopted Avios as its loyalty currency in 2024, you can transfer Avios between the following programs at a 1:1 ratio: British Airways Executive Club, Iberia Plus, Aer Lingus AerClub and Qatar Airways Privilege Club. If you need a few more Avios for a redemption on one of these airlines, it could make sense to purchase Avios from Finnair — otherwise, we wouldn’t recommend it.

Frontier Miles

- Current promotion: 150% bonus miles

- Purchase rate: 1.08 cents per mile

- TPG February 2025 valuation: 1.1 cents per mile

- End date: Feb. 12, 2025

- Buy Frontier miles

Frontier Miles‘ latest promotion gives you a whopping 150% bonus miles when you purchase 3,000 miles or more. This is a solid deal, bringing the price per mile down to just below TPG’s current valuation of 1.1 cents each. If you have an award ticket in mind (be sure to confirm availability first), now could be a great time to buy. But you’ll need to act fast — this offer ends Feb. 12.

HawaiianMiles

- Current promotion: Up to 50% bonus miles

- Purchase rate: As low as 1.83 cents per mile

- TPG February 2025 valuation: 1.2 cents per mile

- End date: Feb. 21, 2025

- Buy Hawaiian miles

Hawaiian Airlines is running a promotion when you purchase at least 3,000 HawaiianMiles. You’ll get a 30% bonus on up to 9,000 miles, a 40% bonus on 10,000 to 19,000 miles and a 50% bonus when you buy 20,000 or more.

The maximum 50% bonus lowers the purchase rate to 1.83 cents per mile. Though this is higher than TPG’s current valuation of HawaiianMiles, keep in mind that loyalty program members can transfer Hawaiian miles to Alaska Airlines Mileage Plan at a 1:1 rate following the merger. Since TPG values Alaska miles at 1.45 cents each as of February 2025, this is still not the best deal, but it could be worth it if you’re eyeing an Alaska sweet spot redemption.

Southwest Rapid Rewards (targeted)

- Current promotion: Up to a 50% discount

- Purchase rate: As low as 1.5 cents per point

- TPG February 2025 valuation: 1.35 cents per point

- End date: Feb. 23, 2025

- Buy Rapid Rewards points

Southwest’s mystery offer lets Rapid Rewards members save 40%, 45% or 50% on their points purchase. The minimum number of points required may vary as well: Some TPGers must buy at least 3,000 points to get the discount, while others have seen a minimum of 7,000 points. Even with the maximum 50% discount, the sale price of 1.5 cents per point is still above TPG’s current valuation of 1.35 cents, so purchasing points will only make sense if you’re planning a redemption soon.

United MileagePlus

- Current promotion: Up to 95% bonus miles

- Purchase rate: As low as 1.79 cents per mile

- TPG February 2025 valuation: 1.3 cents per mile

- End date: Feb. 28, 2025

- Buy MileagePlus miles

United MileagePlus is running an up to 100% bonus miles promotion. MileagePlus members can receive a 35% bonus when purchasing at least 5,000 miles, a 65% bonus when buying at least 20,000 miles and a 95% bonus when buying at least 45,000 miles. The most you can buy is 102,000 miles; with the 95% bonus, that brings you almost to the 200,000-mile annual purchase cap.

The 95% bonus reduces the price to 1.79 cents per mile, considerably higher than TPG’s valuation of United miles. Therefore, unless you have a specific redemption in mind and want to top off your account balance, we wouldn’t recommend purchasing additional miles.

Virgin Atlantic Flying Club

- Current promotion: Up to 70% bonus points

- Purchase rate: As low as 1.48 cents per point

- TPG February 2025 valuation: 1.4 cents per point

- End date: March 7, 2025

- Buy Virgin points

Virgin Atlantic Flying Club is offering a tiered bonus on points purchases. You’ll need to buy at least 5,000 points to get the minimum 20% bonus points, 25,000 points for a 40% bonus and 70,000 points for a 60% bonus. If you buy 125,000 points or more (up to a cap of 200,000), you’ll get the highest 70% bonus, which lowers the price to 1.48 cents per point. This is still higher than our current valuation of Virgin points, so it won’t be a good idea in most cases.

Plus, Chase Ultimate Rewards is offering a 30% transfer bonus to Virgin Atlantic through Feb. 17. If you collect Ultimate Rewards points, this could be a better way to get the Virgin points you need for your next redemption.

Promotions for buying hotel points

Hilton Honors

- Current promotion: 100% bonus points

- Purchase rate: As low as 0.5 cents per point

- TPG February 2025 valuation: 0.6 cents per point

- End date: March 14, 2025

- Buy Hilton Honors points

Hilton Honors’ latest points-buying promotion is offering members a 100% bonus on the points you buy. You must purchase at least 5,000 points to get the bonus, and there’s a limit of 240,000 points purchased in a calendar year. The 100% bonus essentially halves the cost per point, which is now only 0.5 cents. This is a great deal considering TPG values Hilton points at 0.6 cents apiece.

If you want to stock up on Hilton points or have a dreamy tropical Hilton destination in mind, now is the time to buy. Plus, you can now book Small Luxury Hotels of the World properties using Hilton Honors points.

IHG One Rewards (targeted)

- Current promotion: Up to a 30% discount

- Purchase rate: As low as 0.7 cents per point

- TPG February 2025 valuation: 0.5 cents per point

- End date: Unknown

- Buy IHG One Rewards points

We’ve seen a variety of offers from IHG One Rewards’ latest promotion, ranging from 15% off across the board to a tiered discount of 20% to 30% off depending on how many points you buy. The maximum 30% discount requires buying 15,000 points or more and reduces the price to as low as 0.7 cents apiece. Unfortunately, this is still significantly higher than TPG’s current valuation of 0.5 cents, so it’s probably not worth buying points unless you’re shooting for a specific redemption.

Check out our guide to how you can redeem IHG points for maximum value.

Wyndham Rewards (targeted)

- Current promotion: Up to a 60% bonus

- Purchase rate: 0.8 cents per point

- TPG February 2025 valuation: 1.1 cents per point

- End date: Feb. 16, 2025

- Buy Wyndham points

Wyndham Rewards is running a mystery bonus of 40%, 50% or 60% when you buy at least 3,000 points. The highest 60% bonus brings the cost down to 0.8 cents per point, a bargain considering TPG values Wyndham points at 1.1 cents apiece. Though we don’t recommend stocking up on Wyndham points without having a redemption in mind, if you’re already starting to plan your 2025 travels, this could be a great promotion to help save a bit of money.

Which credit card should you use to buy points and miles?

Most of these promotions are processed through points.com rather than directly by the hotel or airline, so you won’t earn bonus rewards with most travel rewards cards. You’ll want to use an everyday spending card that offers a solid return on nonbonus spending.

The main exception to this rule is American Airlines. This airline reportedly codes mileage purchases as airfare, so you may want to use a credit card that earns bonus miles on airfare for the highest return when buying AAdvantage miles.

Or, if you’re working toward a minimum spending requirement to earn a welcome bonus on a new card, using that card may be the way to go.

Remember that you may incur foreign transaction fees on some cards when buying points or miles from a program abroad, so you may want to use one of the following cards:

- Capital One Venture Rewards Credit Card: 2 miles per dollar spent on all purchases and no foreign transaction fees (see rates and fees)

- Capital One Venture X Rewards Credit Card: 2 miles per dollar spent on all purchases and no foreign transaction fees (see rates and fees)

Bottom line

Buying points and miles isn’t always a good idea, but it can make sense in some situations, especially if you can take advantage of a current promotion. In most cases, it’s best to have a specific redemption in mind and confirm award availability before you consider paying for points and miles.