Hilton recently expanded its portfolio with the addition of roughly 400 Small Luxury Hotels of the World properties (which were formerly part of World of Hyatt). SLH is a collection of boutique hotels ranging from romantic cliffside retreats in Greece to cowboy-themed ranches in Colorado. It prides itself on offering unique properties that reflect the local culture better than your average chain hotel.

Hilton’s partnership with SLH stands to bring together the best of both worlds, providing travelers with more memorable stays while allowing them to earn and redeem Hilton Honors points.

Not all SLH properties are part of the Hilton Honors program, though more are expected to be added as the partnership continues to grow. You can see a list of the hotels that currently participate on Hilton’s website.

Hilton Honors members can now experience these boutique hotels with all the benefits of Hilton’s loyalty program — like redeeming points, earning points and using elite status perks. Let’s dive into all the ways you can take advantage of Hilton’s new SLH collection.

Related: Hilton snatches Small Luxury Hotels of the World alliance away from Hyatt

How to redeem points at SLH Hilton properties

Since Small Luxury Hotels of the World properties are, by definition, luxurious, they often come with hefty price tags. Thus, they offer some great ways to maximize your Hilton Honors points.

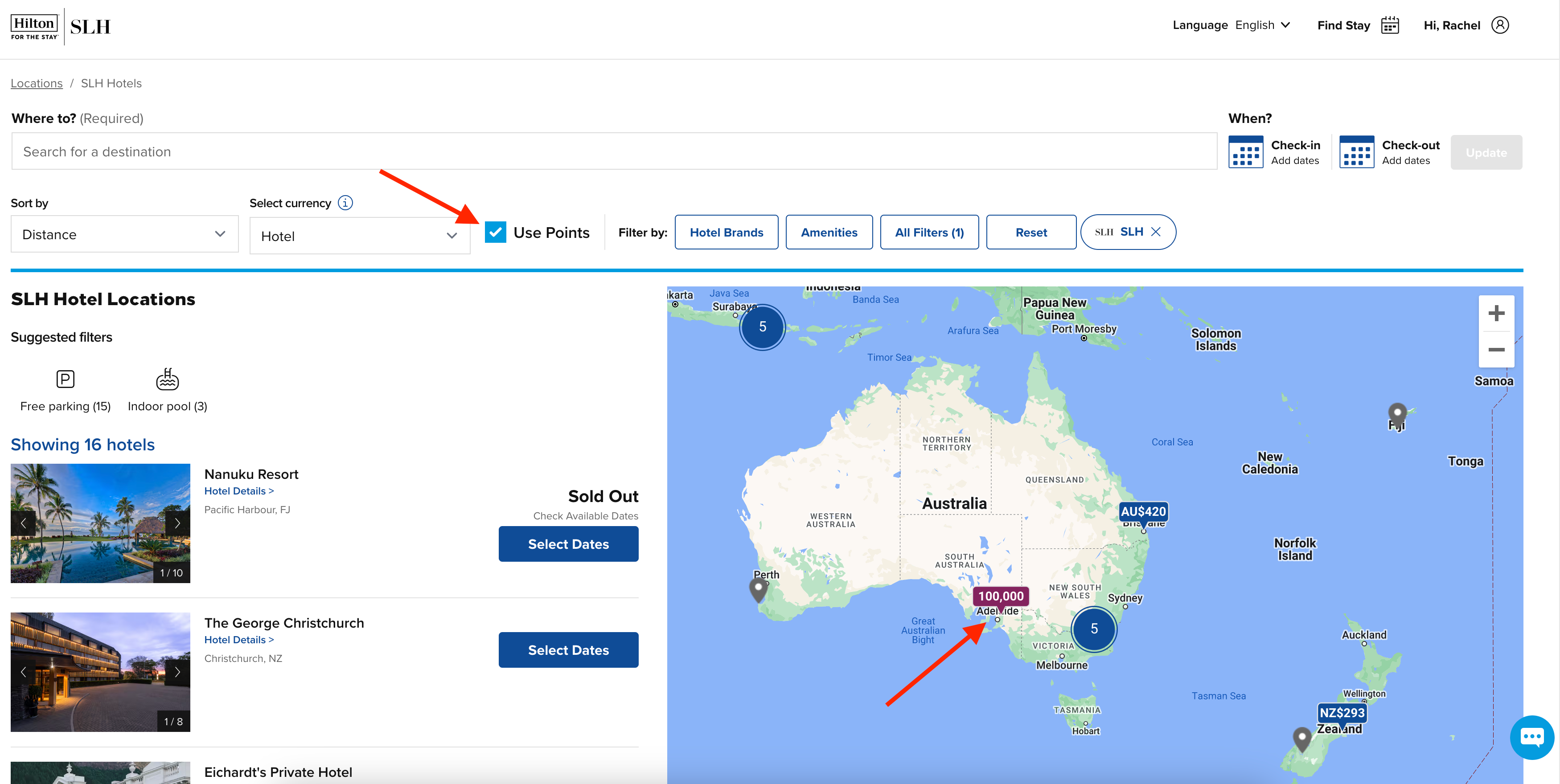

To see what SLH properties are available in your destination, pull up Hilton’s map of SLH partners.

As you zoom in, rates will pop up at each hotel. You can check the “Use Points” box at the top to see rates for award stays. (At the time of writing, point values weren’t showing up at some SLH properties, but that should change as Hilton irons out the wrinkles on its site.)

Click on the hotel that interests you, then click “Select Dates” in the pop-up box to see a calendar with rates across several months. You can toggle between cash and award rates by clicking “Special Rates” and checking or unchecking the “Use Points” box.

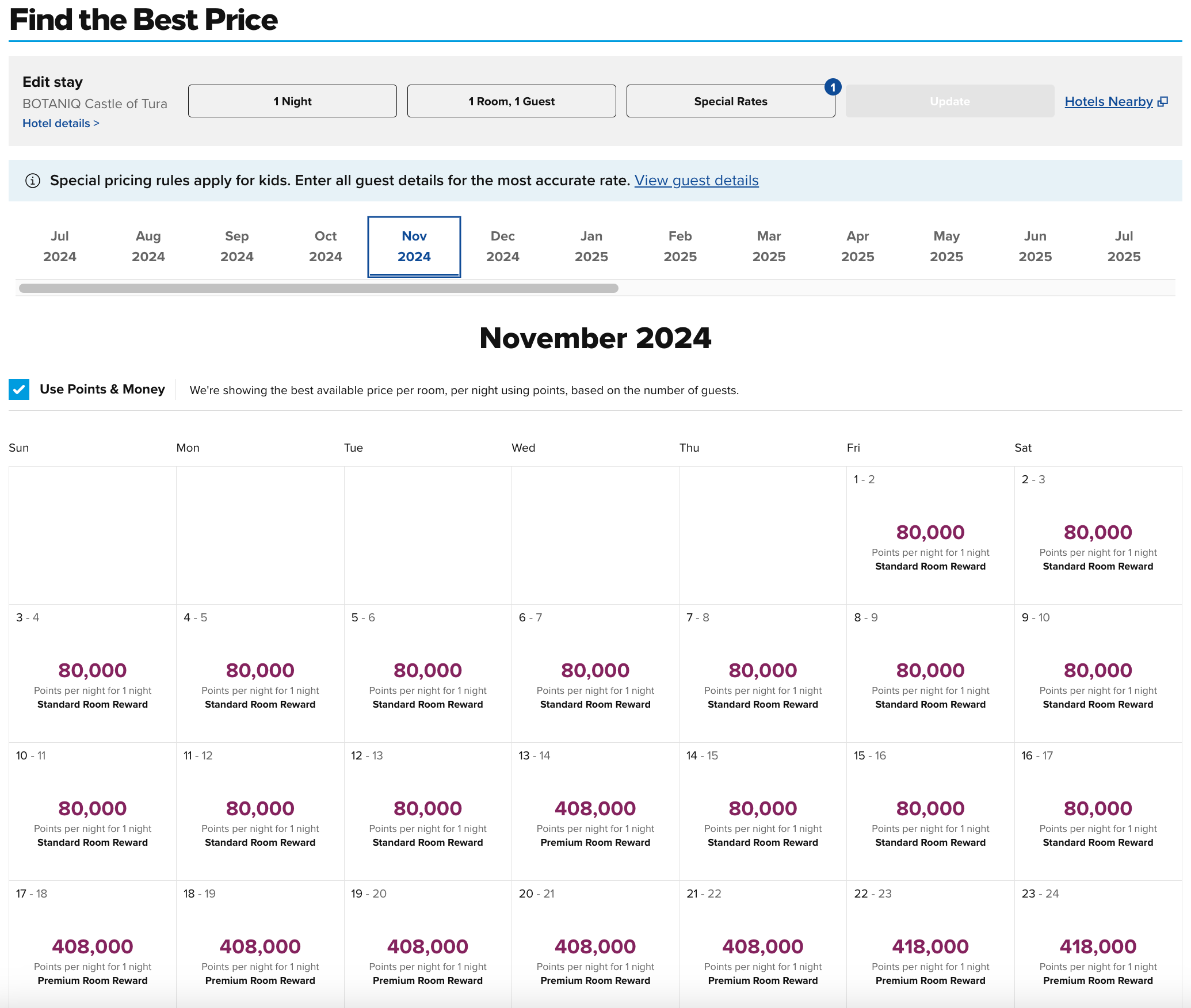

Though Hilton does not operate using an award chart, the SLH properties follow standard award room pricing. This means that rooms considered “standard” will max out at a certain number of points.

However, if you’re looking to book nonstandard rooms, those are priced dynamically, which means award travelers typically won’t get the best redemption rate for their Hilton points.

For example, you can experience your own fairy tale in Hungary’s Botaniq Castle of Tura for just 80,000 points per night for a standard award room or a cash rate of $468 per night. This would give you a redemption rate of 0.59 cents per point, which is close to TPG’s July 2024 Hilton Honors valuation of 0.6 cents per point. Note that premium rooms in November start at 408,000 points per night or a cash rate of $831 per night. This would give you a value of 0.2 cents per point, which is significantly lower than our valuation.

Since Hilton prices nonstandard rooms dynamically, you can typically expect to get about 0.2 cents per point, making them not the best use of your Hilton points.

When searching Hilton’s website to redeem your points, be sure to put in specific dates, as some search results claim the hotels are “sold out” when viewed via the calendar feature.

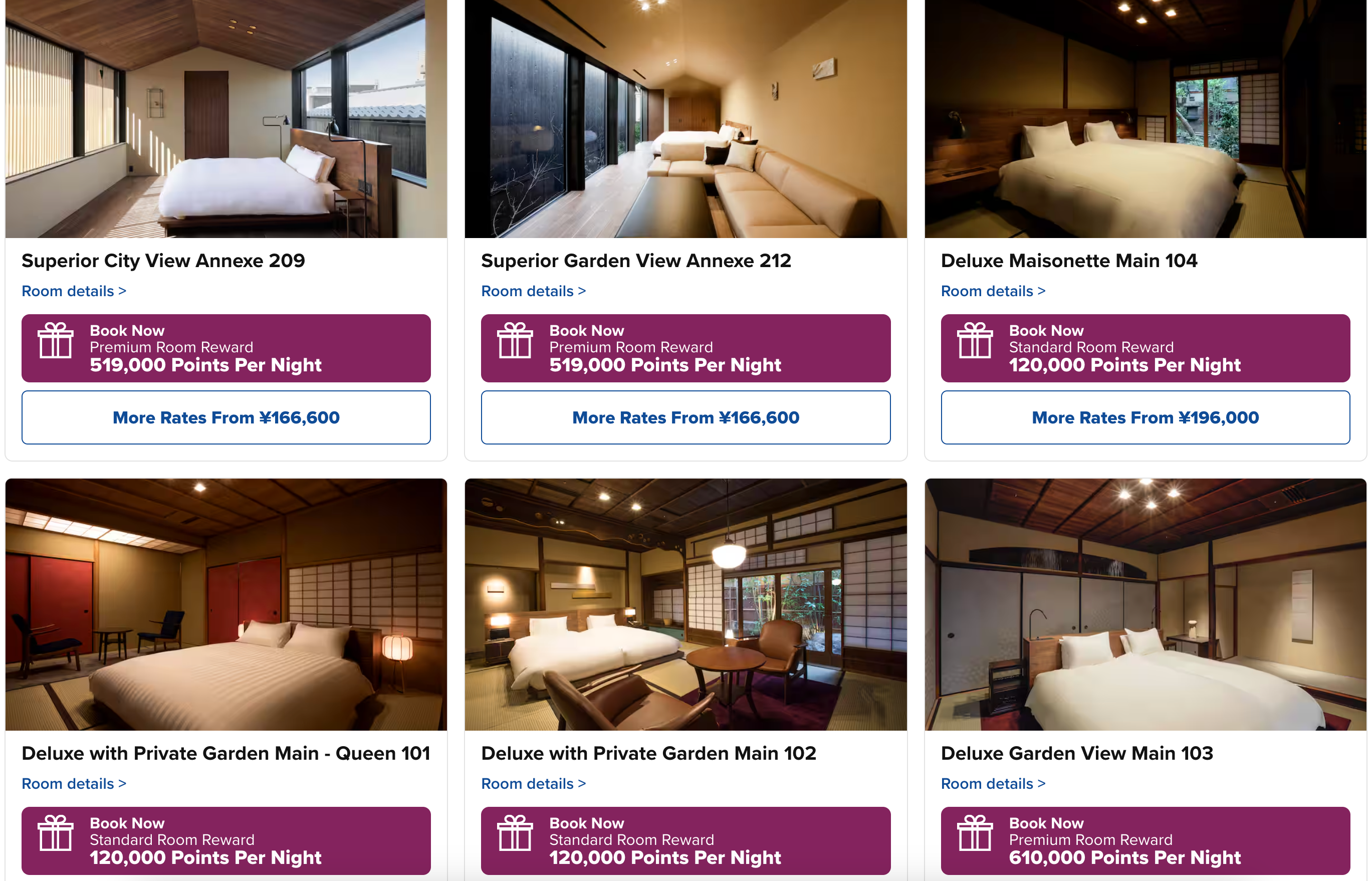

Check the “Use Points” box to show the room types available and how many points they cost (or whether you can use a standard room reward).

Additionally, be sure to scroll down because the points prices may not be arranged from lowest to highest. For example, at Sowaka — a restored ryokan in Kyoto, Japan — standard room rewards cost only 120,000 points per night, but they’re hidden among much pricier options.

These rooms go for 196,000 yen (or around $1,215) per night, giving you a value of 1 cent per point — an excellent use of Hilton Honors points, which TPG values at 0.6 cents each.

If you happen to have one of Hilton’s valuable free night reward certificates, which are valid on any standard room reward (up to 150,000 points per night), the SLH collection gives you some excellent new options for redeeming it.

However, keep in mind that standard room award rates are subject to availability, so you may have to be a bit flexible with your travel plans.

Related: Everything to know about the Hilton Honors loyalty program

How to earn points at SLH Hilton properties

Redeeming points may allow you to stay at high-end properties that might otherwise be out of reach, especially on peak travel dates. But when cash rates are low, you may be better off booking paid stays at these places and watching your Hilton Honors points stack up.

Earning Hilton points at SLH properties is easy, thanks to the new partnership. All you have to do is log in to your Hilton Honors account, search for your dates and destination, and book your stay through Hilton’s site.

There are many other avenues to book SLH properties, including online travel agencies like Expedia, credit card portals and the hotel’s website. But you won’t earn Hilton Honors points if you book through any of these, and you won’t be eligible for elite benefits. You may, however, earn other rewards and perks through credit card portals like Chase Travel℠ and American Express’ Fine Hotels + Resorts. Always consider the pros and cons of each option before deciding how to book.

When you book a Small Luxury Hotel through Hilton, you’ll earn Honors points just like you would at any Hilton property. Members earn points at varying rates depending on their status tier:

- Basic members: 10 points per dollar

- Silver members: 12 points per dollar

- Gold members: 18 points per dollar

- Diamond members: 20 points per dollar

At most Hilton properties, these points accrue not only on your room rate but on eligible room charges like room service, spa treatments and parking fees. But at SLH properties, you’ll only earn Honors points on the room rate.

These points are in addition to the rewards you earn on the credit card you use to pay for your room. If you don’t have a Hilton cobranded card that earns bonus Honors points on Hilton stays, consider using one of our favorite hotel cards.

Related: Ways you can earn more Hilton Honors points

Elite status benefits at SLH Hilton properties

Thanks to the new partnership, Hilton Honors members (both basic and elite) can take advantage of several perks when staying at SLH properties. However, these benefits look a little different at the SLH collection than at other hotels.

For basic members, many key benefits are the same, including guaranteed member discounts on paid stays, waived resort fees on award stays and complimentary standard Wi-Fi. But some benefits may not be available at SLH properties, like digital check-in and room keys, the ability to choose your room, and access to Hilton Honors Experiences. And some new benefits have been added at SLH properties: complimentary late checkout and bottled water.

Silver members still get 20% tier bonus points and a fifth night free on award stays at SLH properties, which is a great perk if you want to save thousands of points. Plus, it’s easy to earn Hilton Silver status, especially if you hold the right card, such as the Hilton Honors American Express Card or The Platinum Card® from American Express, which gives cardholders complimentary Hilton Gold elite status (enrollment required).

But elite members may not have access to their usual 15% discount at all-inclusive spas.

Gold and Diamond members will still get their 80% and 100% points-earning bonus and space-available upgrades. Instead of the usual food and beverage credit, they’ll receive complimentary breakfast for up to two guests at SLH properties. Diamond members may miss out on their usual premium Wi-Fi (complimentary standard Wi-Fi is included), 48-hour room guarantee and executive lounge access.

Members also have access to special offers and promotions. We recommend checking out Hilton’s current offers before you book any stay and registering for all that apply.

If you’re working your way toward Hilton’s next status tier, stays at SLH properties now count toward this goal. Hilton status is earned by staying a minimum number of nights, completing a minimum number of stays or earning a minimum number of points. Staying at SLH properties can now get you closer to your next status tier, just like any other Hilton property.

Related: Your guide to Hilton Honors elite status

Bottom line

Hilton’s new partnership with SLH is a boost for Hilton Honors members, who can now access nearly 400 unique luxury and lifestyle properties around the world — and that number is expected to grow. SLH hotels offer plenty of ways for members to maximize their points and free night certificates, grow their Hilton Honors balance, and take advantage of elite perks.