Editor’s note: This is a recurring post, regularly updated with new information.

Earning Choice Privileges points through stays, promotions and credit cards is relatively easy. However, once you have a stash of Choice Privileges points, you might wonder how to redeem them.

As with most points and miles, the value you’ll get when redeeming Choice points will vary. TPG’s June 2024 valuations peg the value of Choice points at 0.6 cents each, so we typically recommend aiming for at least that redemption value. Choice offers different redemption options depending on your country of residence, but here’s what U.S. residents need to know about redeeming Choice Privileges points.

Redeem Choice points for hotel stays

You’ll typically get the most value from Choice Privileges points when you redeem them for hotel stays. There are three primary ways to redeem Choice points for hotel stays: reward nights, points plus cash stays and Preferred Hotels & Resorts stays.

It’s worth noting that unless you redeem through the Preferred Hotels & Resorts partnership, you can only redeem Choice points for stays that will occur within the next 100 days.

Reward nights

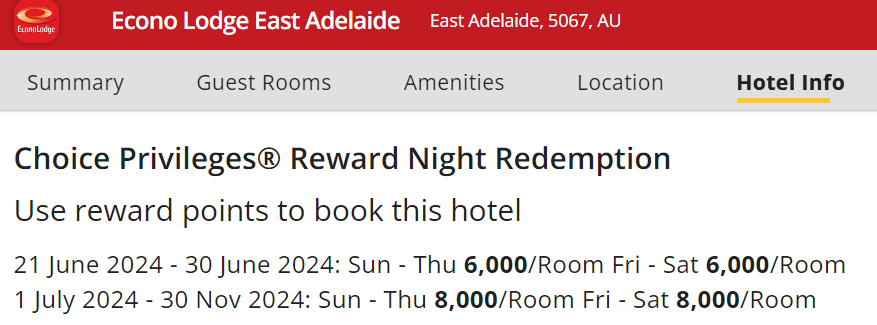

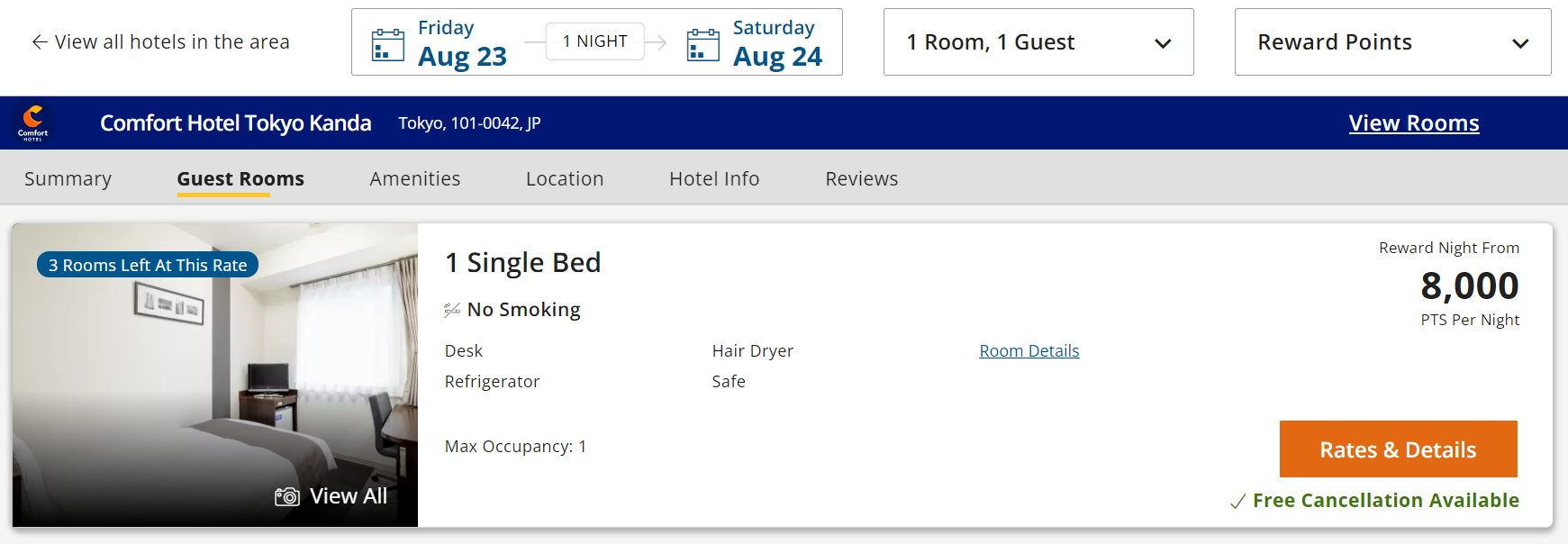

Choice Privileges defines weeknight and weekend reward night rates for each property. These award rates are displayed on each hotel or resort’s landing page. For example, you can book Choice Privileges reward nights starting at 6,000 points for stays at two Australian properties through June 30.

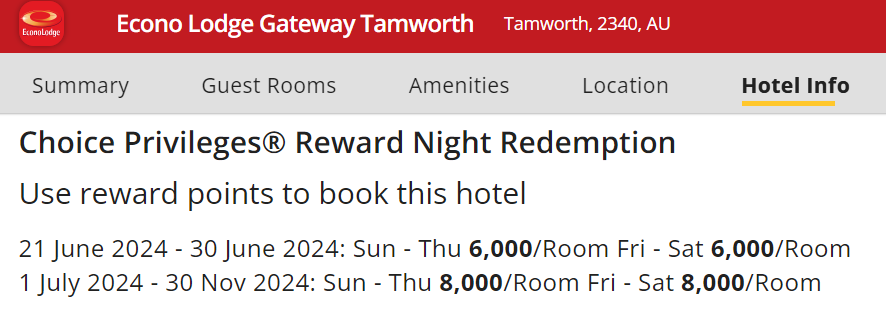

However, Choice Privileges recently updated most of its website to state that reward nights start at 8,000 points. This means Choice Privileges no longer caps reward night prices to 35,000 points in any part of the world. I recently found some hotels in Nashville and New York City pricing at 45,000 Choice points per night.

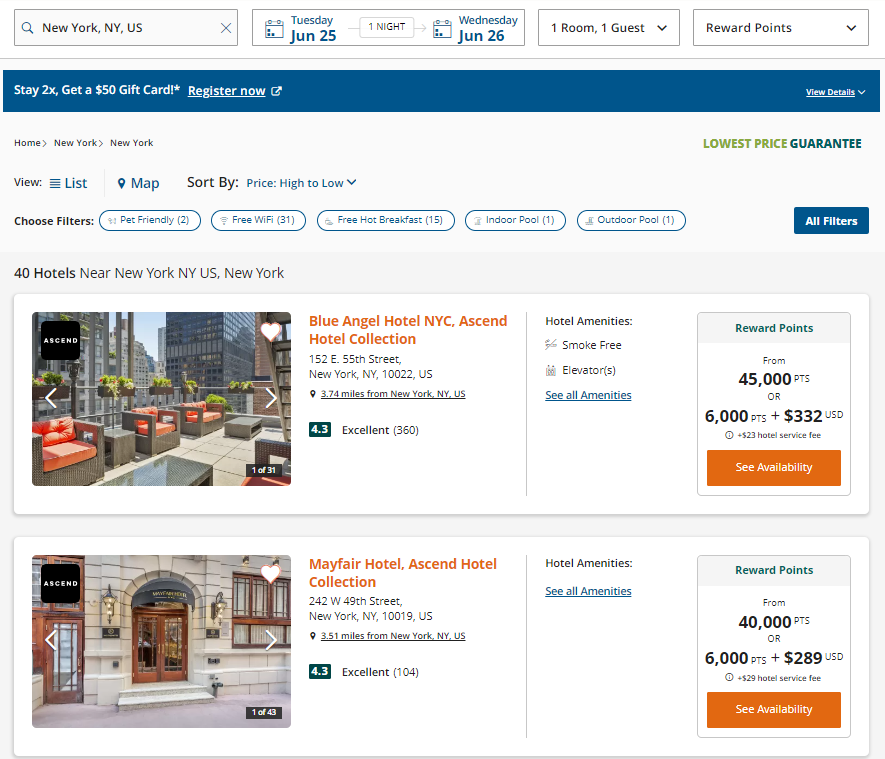

I found a property in Sweden where paid rates are about $100 per night while award rates hover around 75,000 Choice points per night. If you redeemed Choice points for this night, you’d get a terrible redemption value.

You can find good value award nights when redeeming Choice points, though. For example, I like redeeming Choice points for centrally located stays in Japan.

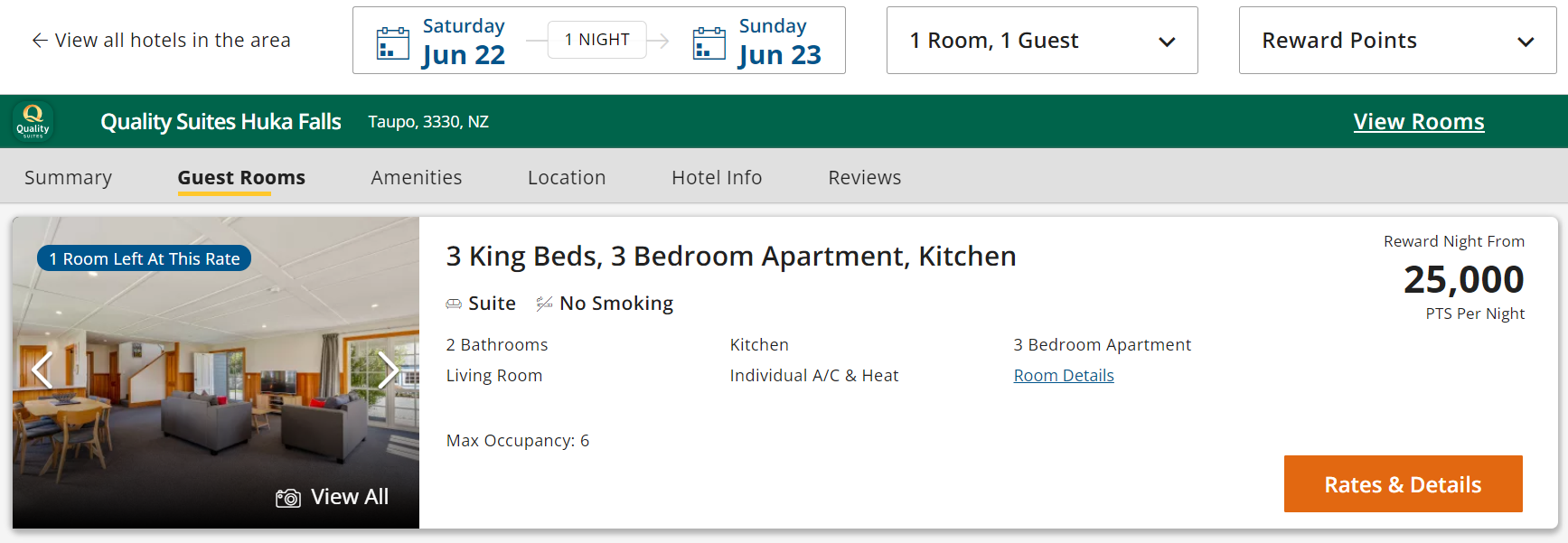

When redeeming Choice points, you can often book more than just the base room type at many properties. For example, on select dates, you can book a three-bedroom apartment at the Quality Suites Huka Falls in New Zealand for just 25,000 points per night.

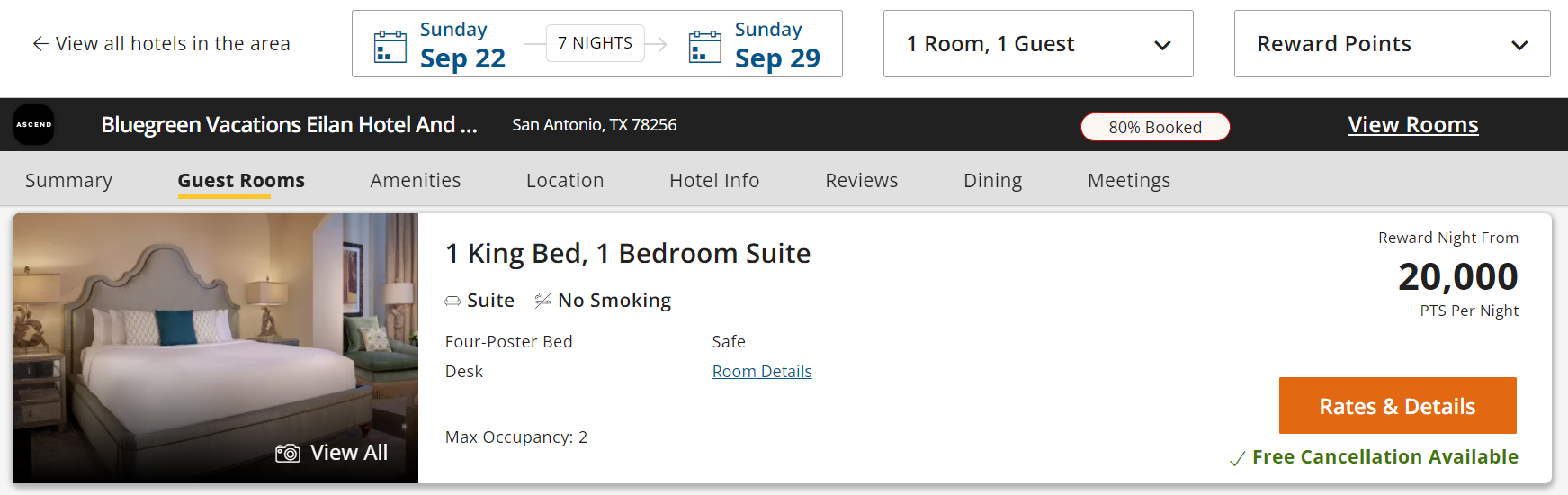

You can book far more than Choice-branded hotels with Choice points, though. For example, you can use Choice Privileges points to stay at select Bluegreen Vacations properties (see the list here). Most Bluegreen Vacations properties cost between 20,000 and 30,000 points per night.

Availability can be difficult to snag at some properties, but last-minute bookings are often possible. I found wide-open availability at Bluegreen Vacations Eilan Hotel And Spa, Ascend Resort Collection, in San Antonio.

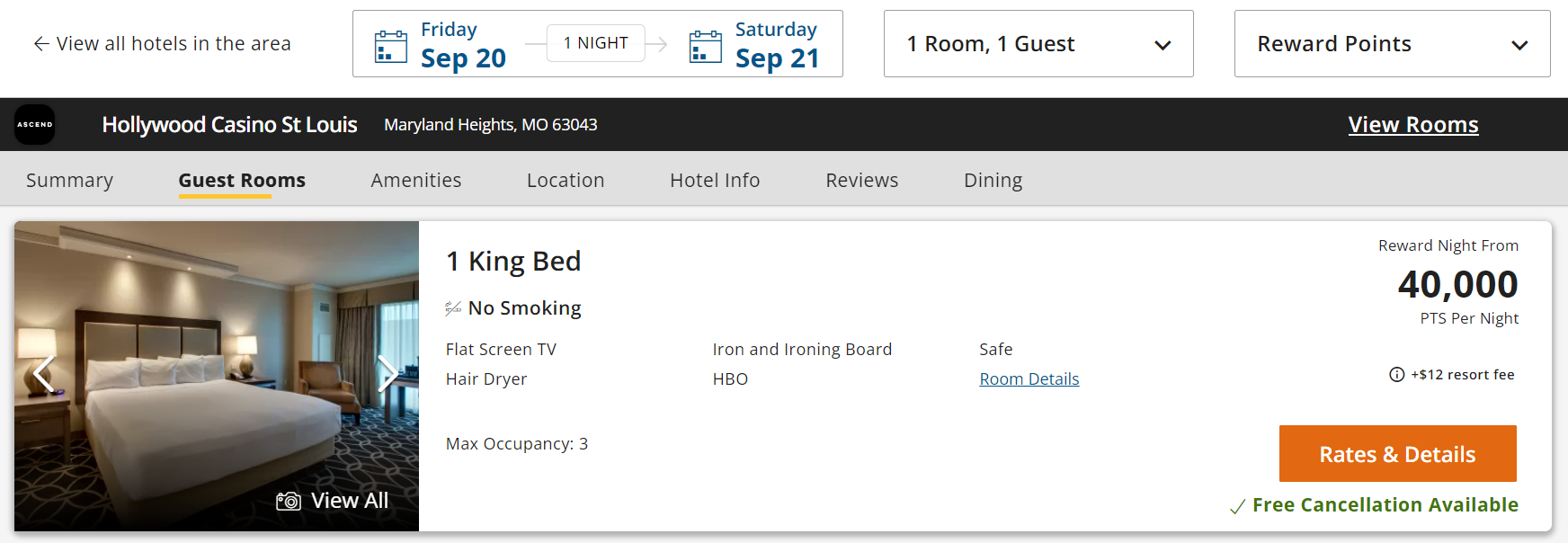

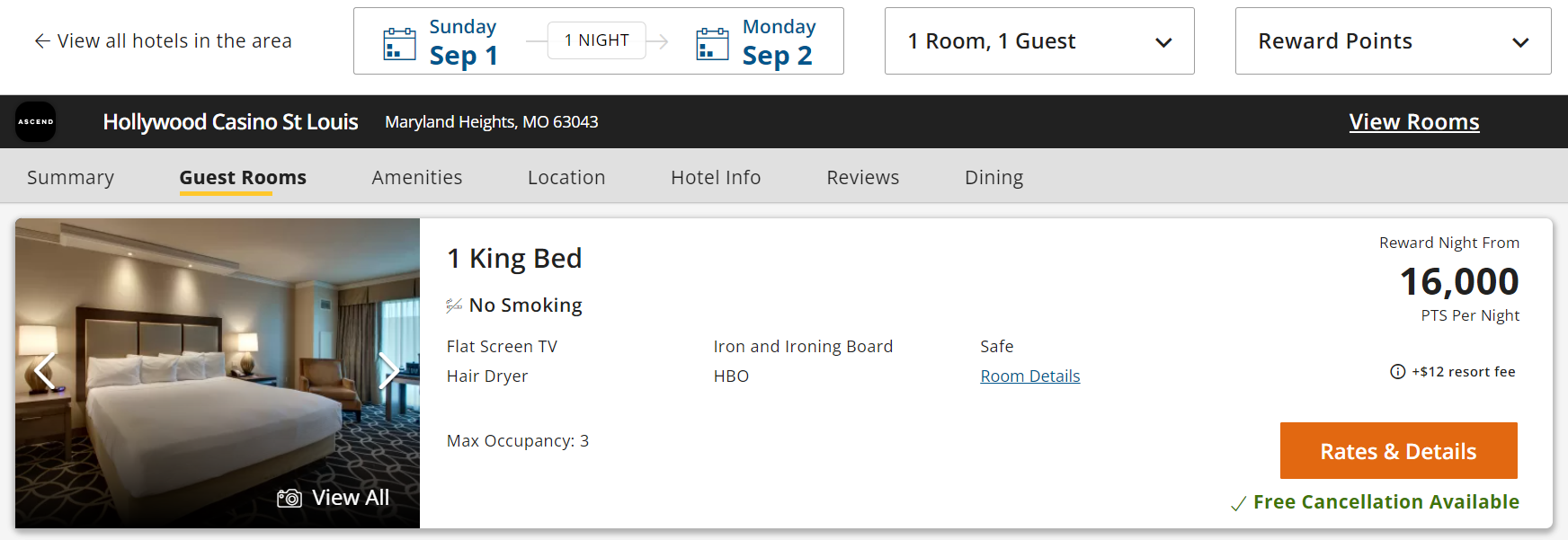

You can also use Choice points to book select casino hotels and resorts. Most casino hotels and resorts cost 40,000 points per night or less. Check here for the current casino hotels and resorts bookable with Choice points.

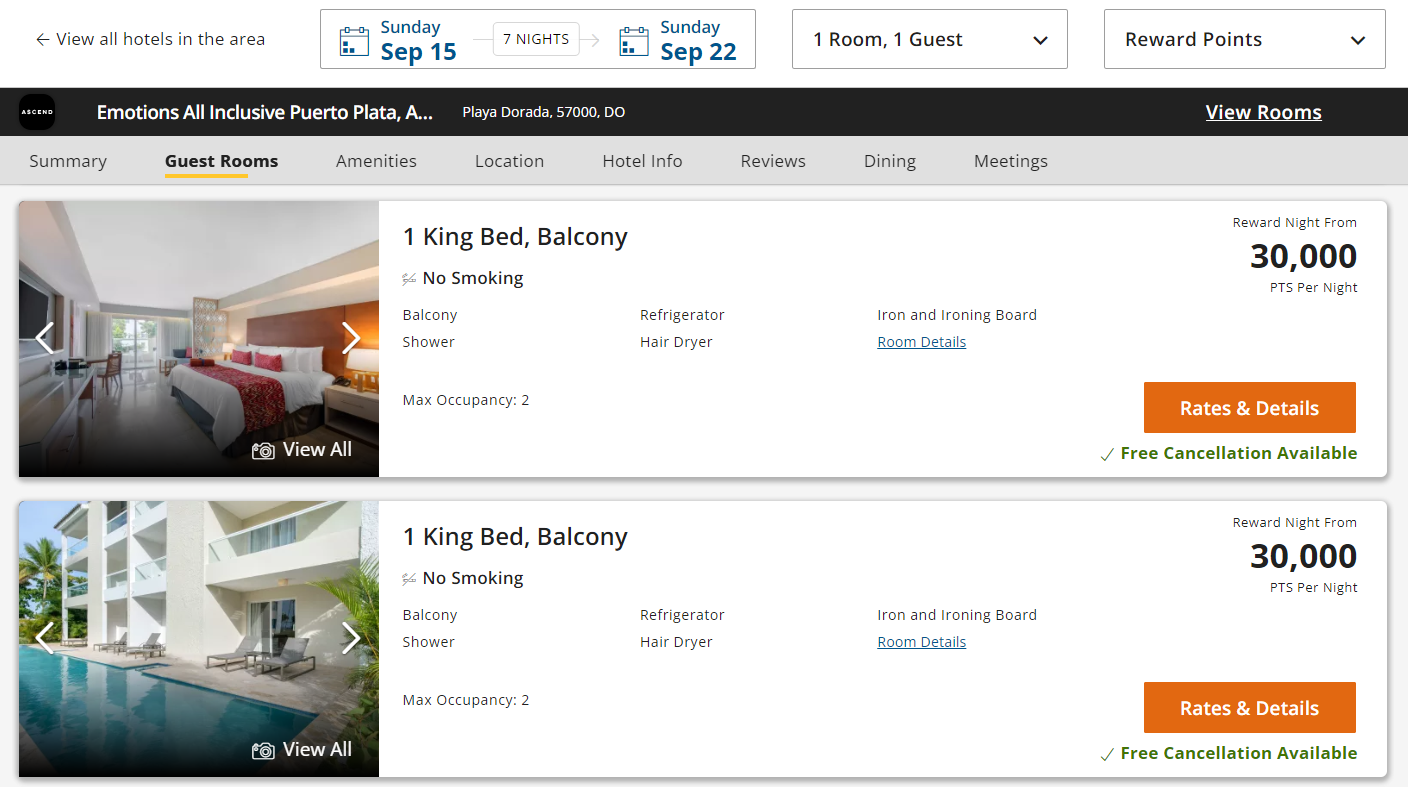

You can also book all-inclusive resorts with Choice Privileges points. When searching the Choice Hotels website, you can see the current options by selecting all-inclusive resorts as the hotel type. At the time of writing, Choice Points are redeemable at all-inclusive resorts in Mexico and the Dominican Republic for 20,000 to 45,000 points per night.

Award availability can be difficult to find at some resorts. Still, I found ample availability at the Emotions All Inclusive Puerto Plata, Ascend Hotel Collection in the Dominican Republic, where I once stayed for an entire month. Reward nights at this resort now cost 30,000 points but include rooms with direct pool access and a sitting area, balcony and whirlpool.

The Choice Hotels website also lists an all-inclusive resort in Dominica. However, this resort does not have an award rate listed, and I couldn’t find any award availability.

Finally, keep an eye on Choice Privileges Sweet Spot Rewards. Choice frequently discounts award rates at top select properties through this program.

Related: 14 ways to earn Choice Privileges points

Points plus cash

Choice also offers points plus cash rates if you have at least 6,000 Choice points in your account. Log into your account, search for a reward night and select a result that shows a points-plus-cash rate.

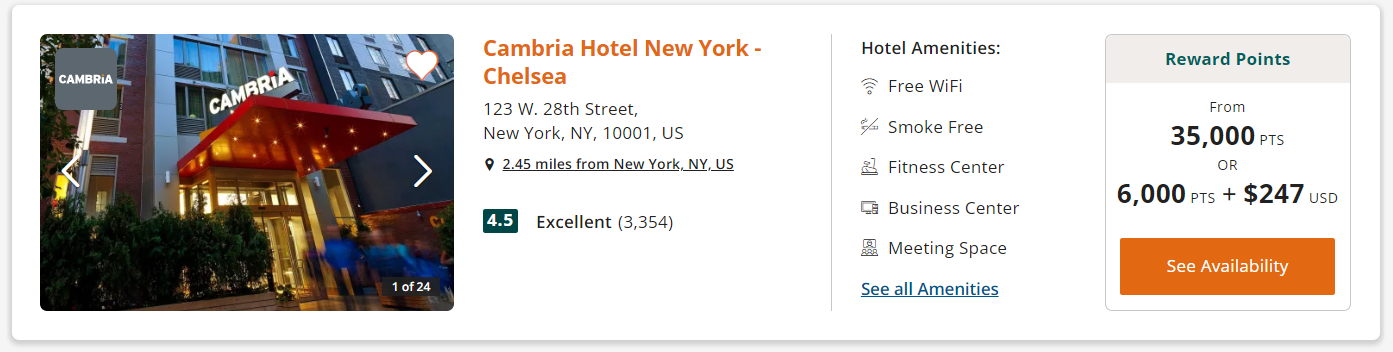

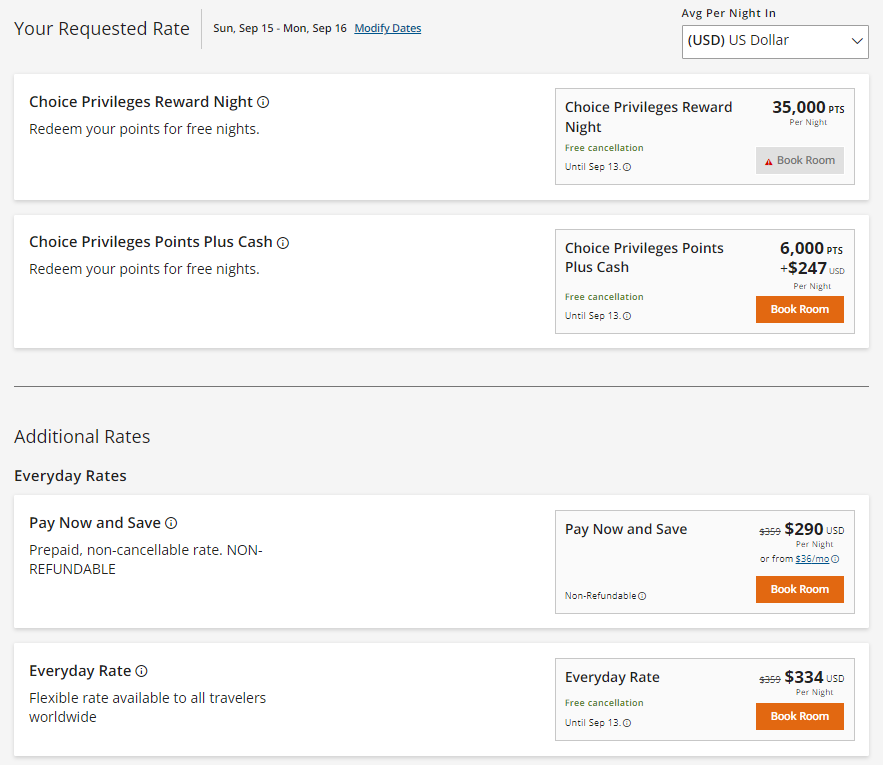

Once you click “See Availability” for the property you want to book, you can compare the reward night, points plus cash and paid rates for each room type.

In the above example, you could pay 35,000 points, $386.62 cash (once taxes and fees are included) or 6,000 points plus $247 per night for a rate that allows you to cancel until shortly before your stay. If you redeem 35,000 points, you will get a redemption rate of 1.10 cents per point. If you redeem 6,000 points plus $247, you’d use fewer points and get a better redemption rate of 2.33 cents per point.

Related: Register for Choice Hotels Your Extras to earn gift cards or other perks on weekday stays

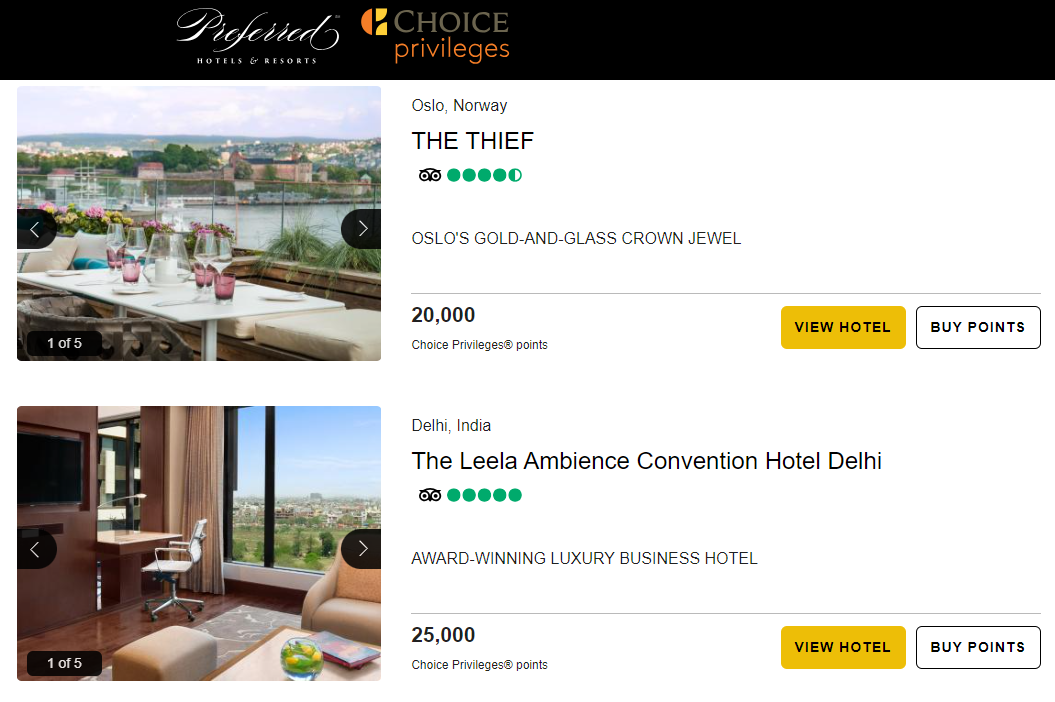

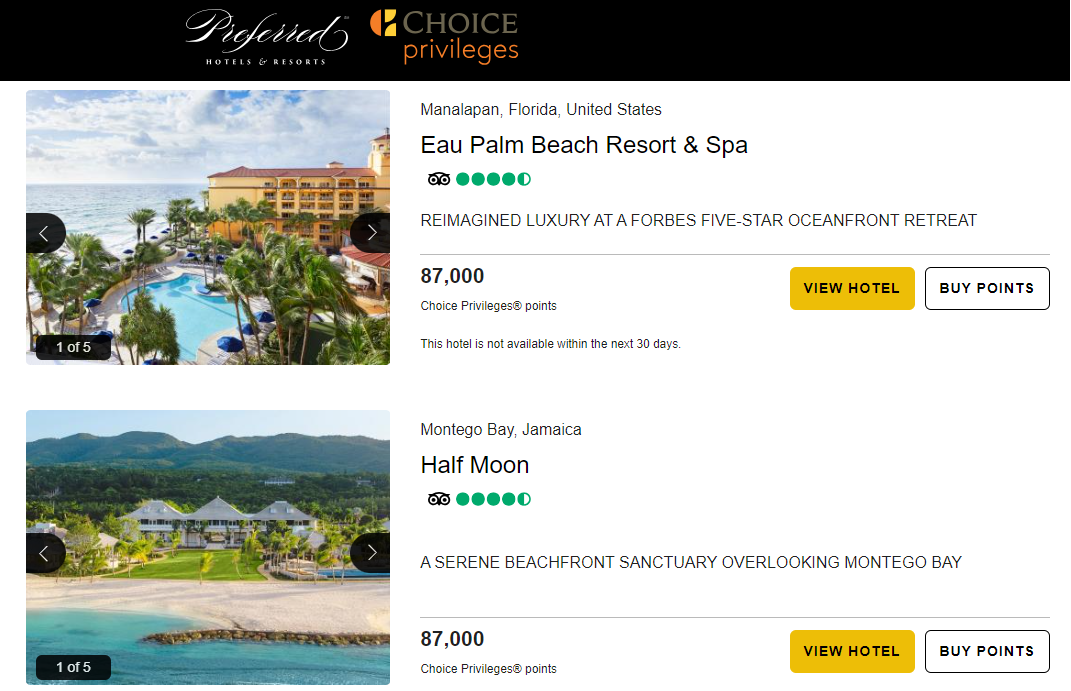

Preferred Hotels & Resorts

Choice Privileges members can redeem Choice points for stays at participating Preferred Hotels & Resorts properties. For single or double occupancy, you can expect to redeem 20,000 to 87,000 points per night, worth $120 to $522, based on TPG’s June 2024 valuations.

You can browse properties and book stays online by starting at this link and logging into your Choice Privileges account. The standard 100-day booking window requirement isn’t used when you redeem Choice points for stays at Preferred Hotels & Resorts properties.

Related: Stays at Preferred Hotels & Resorts now cost up to 87,000 Choice Privileges points per night

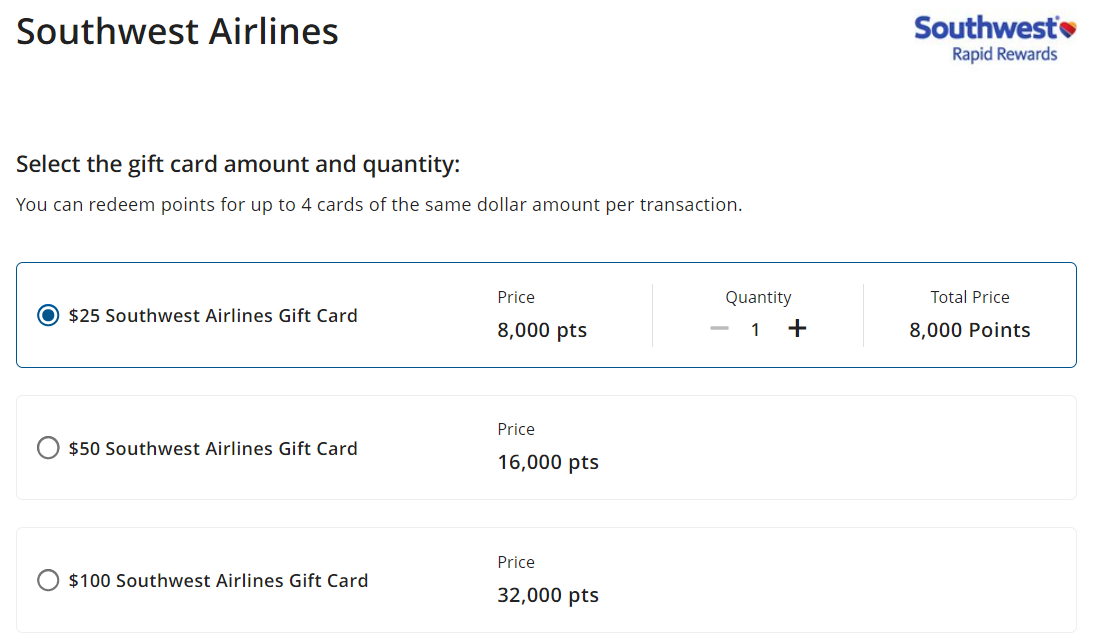

Transfer Choice points to travel rewards partners

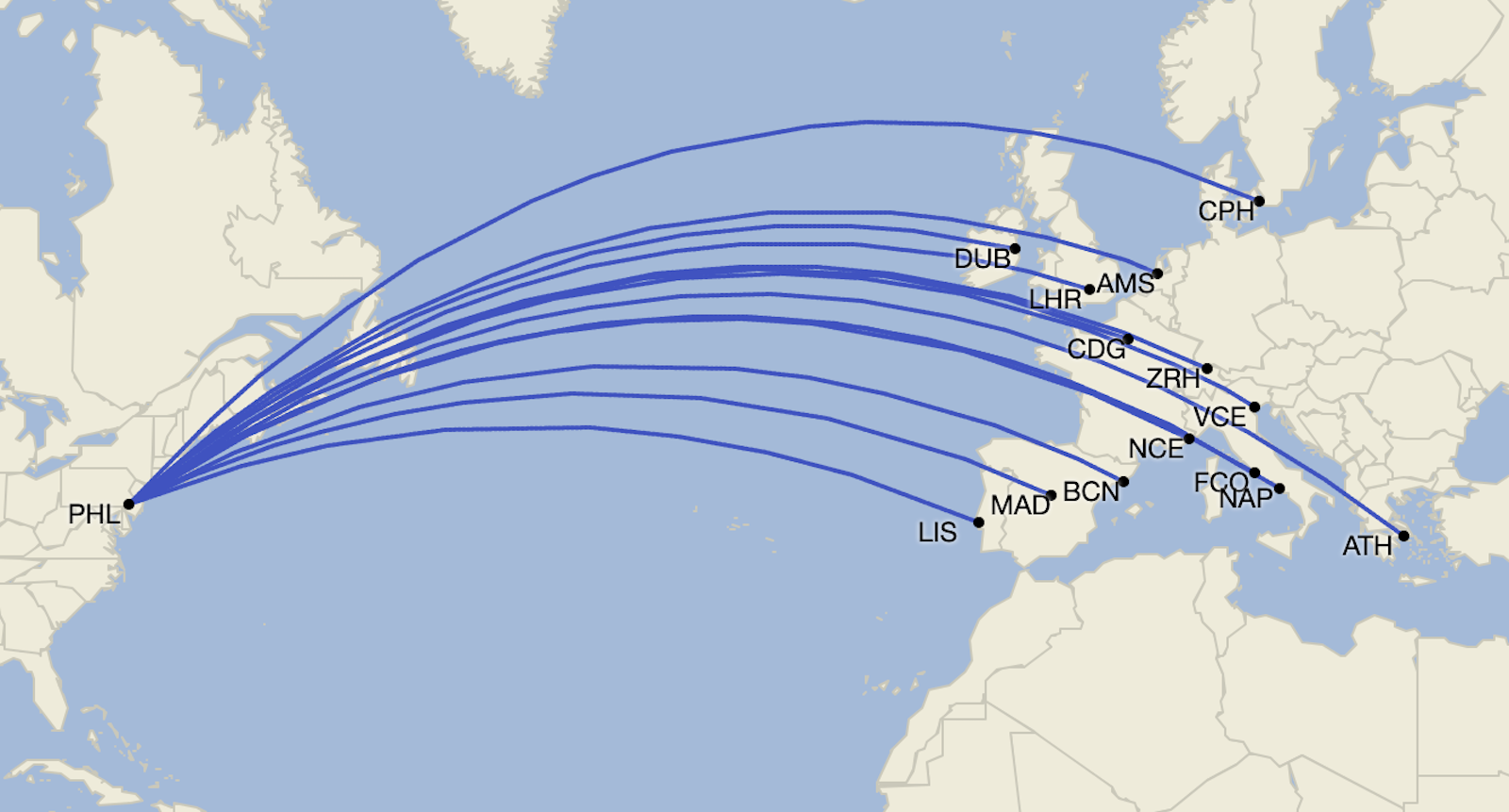

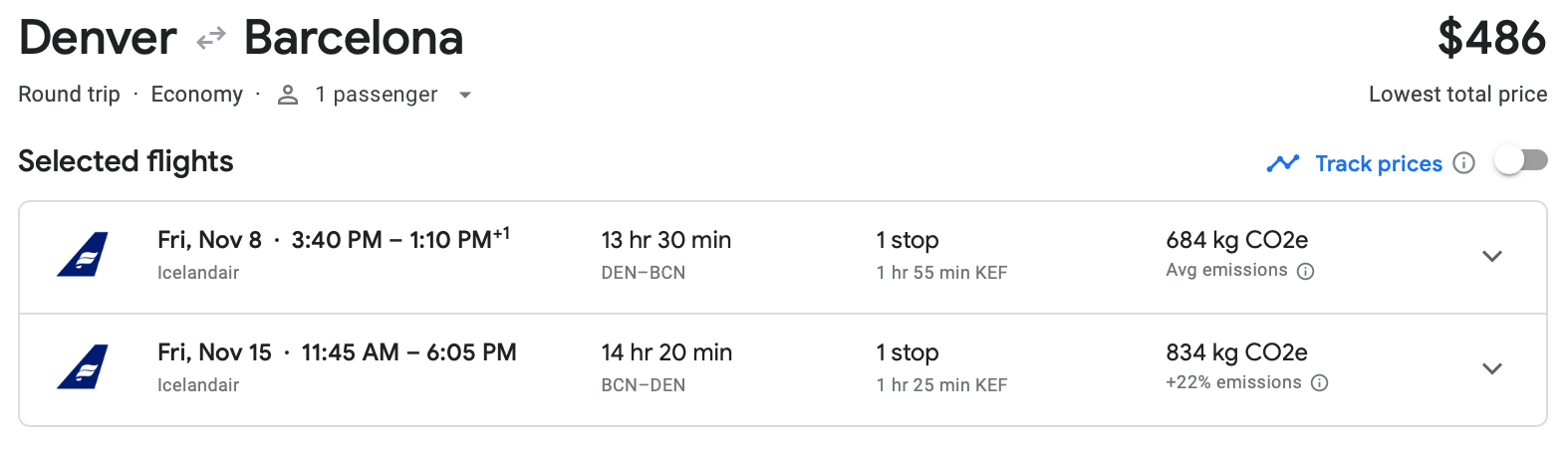

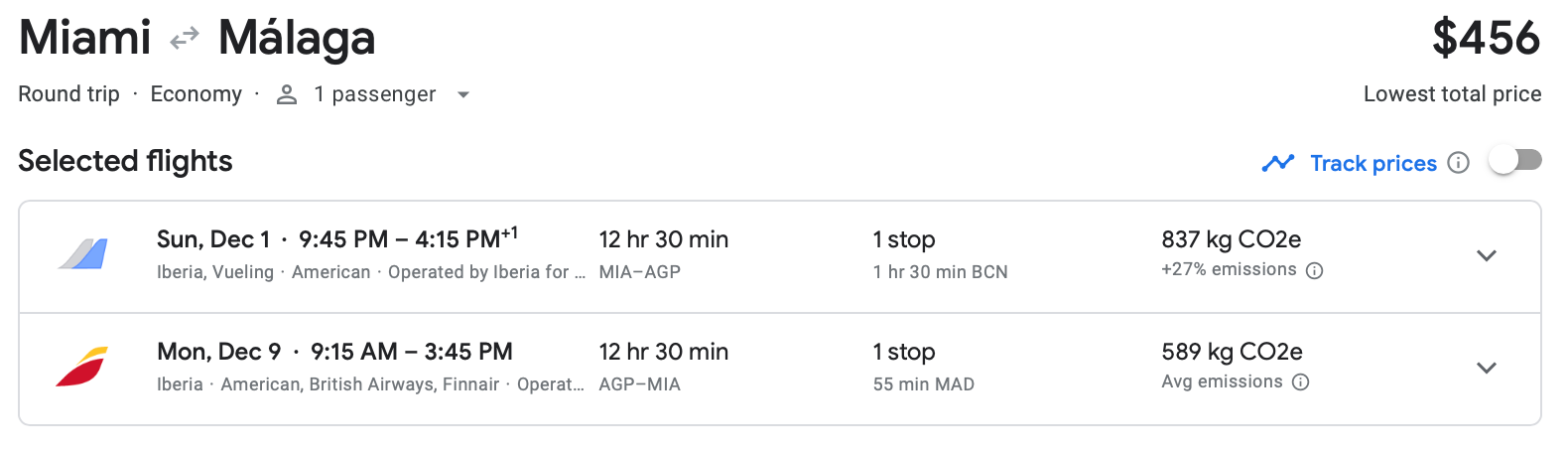

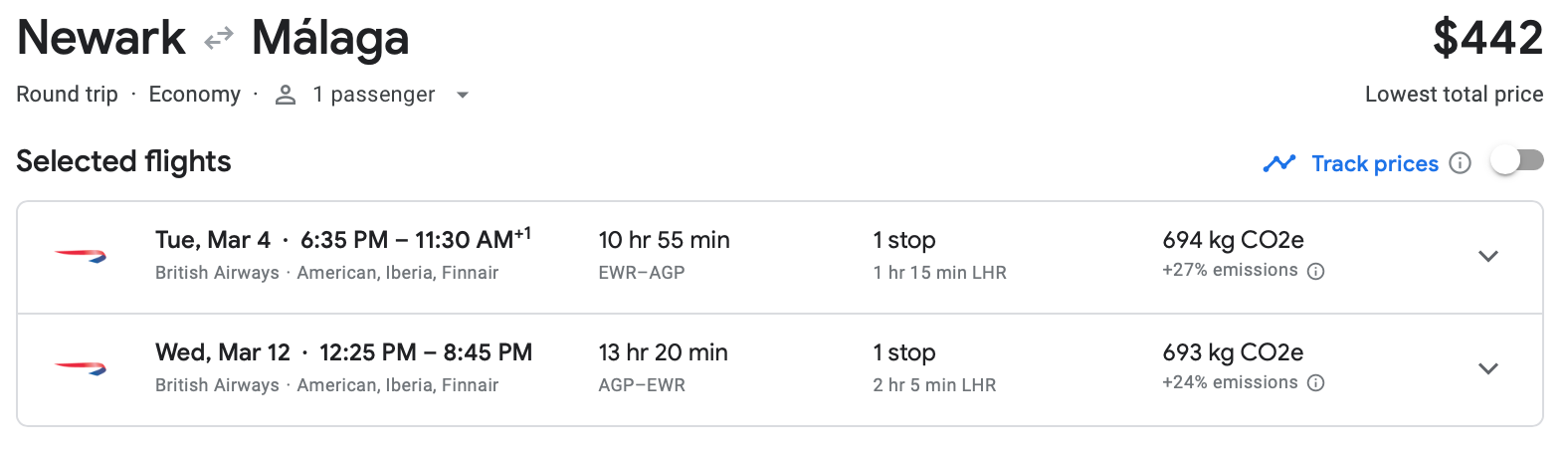

You can use the online Choice Privileges Rewards Exchange to transfer points to the following partners:

- Aer Lingus AerClub: Convert at a ratio of 5,000 Choice points to 1,000 Avios

- Aeromexico Rewards: Convert at a ratio of 5,000 Choice points to 1,000 Aeromexico points

- Air Canada Aeroplan: Convert at a ratio of 5,000 Choice points to 1,000 Aeroplan points

- Air France-KLM Flying Blue: Convert at a ratio of 5,000 Choice points to 1,000 Flying Blue miles

- Alaska MileagePlan: Convert at a ratio of 5,000 Choice points to 1,000 Alaska miles

- British Airways Executive Club: Convert at a ratio of 5,000 Choice points to 1,000 Avios

- Iberia Plus: Convert at a ratio of 5,000 Choice points to 1,000 Avios

- Qantas FrequentFlyer: Convert at a ratio of 2,000 Choice points to 800 Qantas points

- Southwest Rapid Rewards: Convert at a ratio of 6,000 Choice points to 1,800 Southwest points

- Turkish Miles&Smiles: Convert at a ratio of 5,000 Choice points to 1,000 Turkish miles

- United MileagePlus: Convert at a ratio of 5,000 Choice points to 1,000 United miles

- Velocity Frequent Flyer: Convert at a ratio of 2,000 Choice points to 800 Virgin Australia points

Transfers usually take 48 hours, although some may take up to seven days. You can also call Choice Privileges to transfer points to Spirit Airlines Free Spirit, although the transfer may take two to six weeks.

Related: Should you transfer hotel points to airline partners?

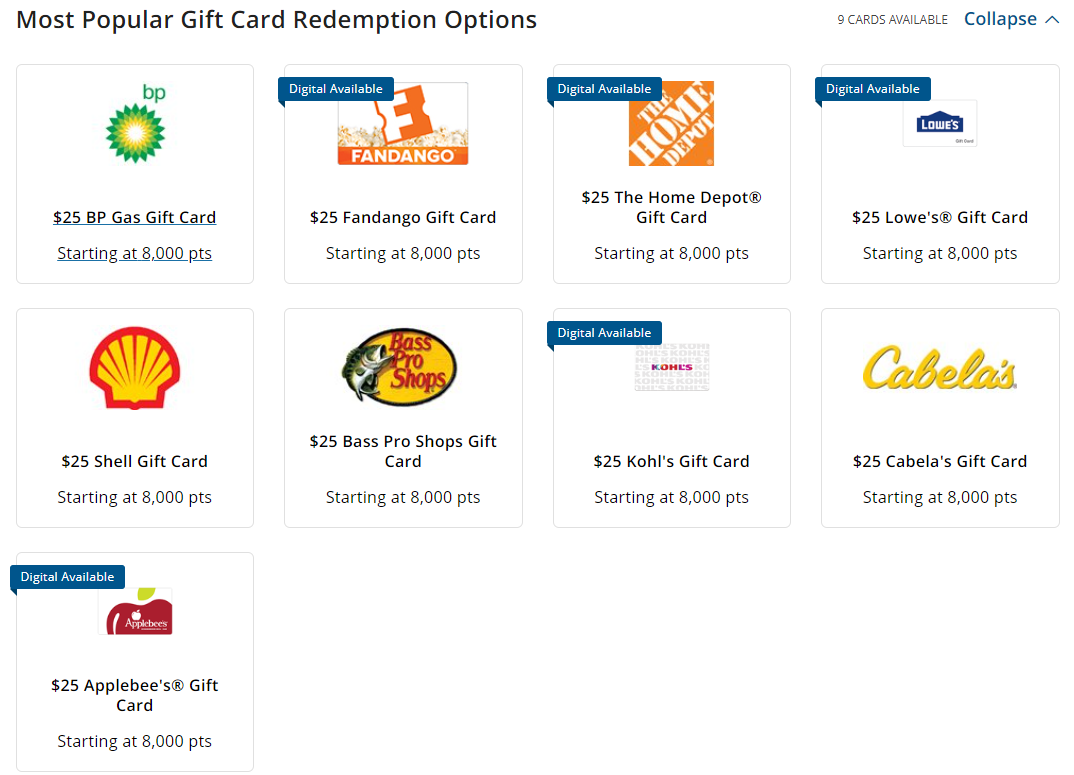

Use Choice points for gift cards

You can’t convert Choice points to cash via Bakkt anymore, as the consumer app was discontinued in early 2023. However, you can still get cash-like value from Choice points when you redeem them for gift cards.

Some retailers only offer $25 gift card cards for 8,000 Choice points. But you may also be able to redeem Choice points for higher-value gift cards with some retailers at a rate of 16,000 points for $50 gift cards or 32,000 points for $100 gift cards.

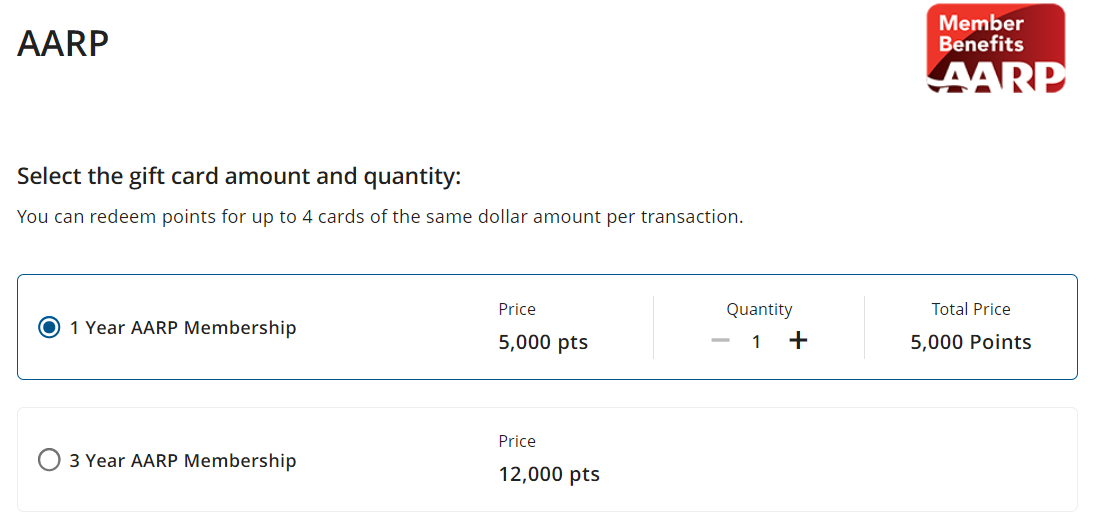

You can also redeem 5,000 points for a one-year AARP membership or 12,000 points for a three-year AARP membership.

If you redeem 8,000 Choice points for a $25 gift card, you’ll get a redemption rate of 0.3125 cents per point. This redemption provides well below TPG’s June 2024 valuation of 0.6 cents per point, so we typically don’t recommend redeeming Choice points for gift cards.

Related: How to use points and miles to give gifts with zero out-of-pocket cost

Exchange Choice points for cruise credits

It’s possible to redeem Choice points for cruise credit when you book by phone with Cruises for Choice Privileges (powered by Cruise411) at 800-596-0451. You can redeem 85,000 points for $250 in cruise credit or 160,000 points for $500 in cruise credit.

If you redeem 16,0000 points for a $500 credit, you will get a redemption rate of 0.3125 cents per point. This rate is well below TPG’s June 2024 valuation of Choice points (0.6 cents per point), so we don’t recommend this option.

Related: How to book a cruise using points and miles

Redeem Choice points for experiences

In 2022, Choice Privileges introduced the ability to redeem Choice points for college sports events and experiences. Since then, Choice members have gained the ability to redeem Choice points for NASCAR tickets and redeem Choice points for concerts and other events.

Check the Experiences by Choice website, college sports experiences page and Trackhouse racing page for current opportunities.

Donate Choice points

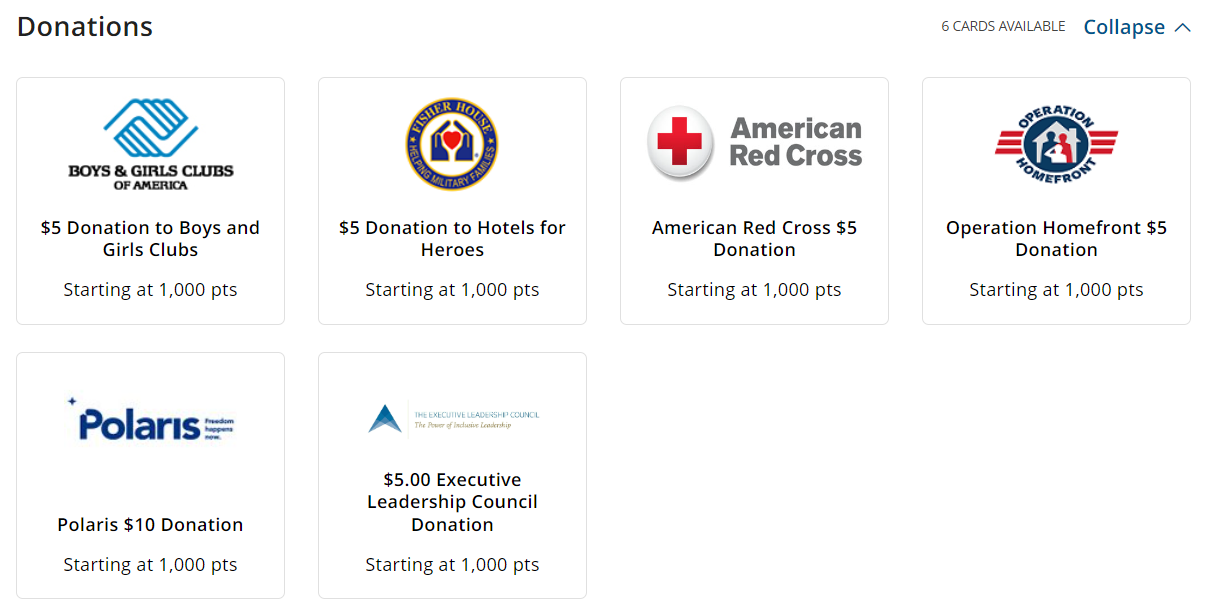

Finally, you can donate Choice points to select charities.

Choice will donate $5 per 1,000 points redeemed to most charities. However, if you donate your points to Polaris, Choice will donate $10 per 1,000 points.

Related: How you can donate your points and miles to charity

Bottom line

You can redeem Choice Privileges points for stays, airline miles, gift cards, donations, experiences and more. To get the best value from your points, I recommend calculating your redemption value and only redeeming when you can get at least 0.6 cents per point. You’ll usually get the best redemption value when using Choice points for hotel stays or unique experiences.