The Business Platinum Card® from American Express, despite its $695 annual fee (see rates and fees), routinely ranks as one of the best business cards thanks to its outstanding travel benefits.

It’s also offering a welcome bonus of 150,000 Membership Rewards® points after you spend $20,000 on eligible purchases in the first three months of card membership — worth a whopping $3,000, according to TPG’s latest valuations.

But the card also offers a slate of perks that might not be as familiar to cardholders or those considering getting the card. Here’s a list of some of the card’s best benefits, including some you might not have noticed before.

The card’s well-known benefits

As a reminder, here’s the card’s current offer and some of its more notable travel benefits.

The Business Platinum Card is currently offering 150,000 Membership Rewards points after you spend $20,000 on eligible purchases with the Business Platinum Card within the first three months of card membership.

The card’s well-known benefits include:

- Annual airline-fee credit of up to $200 on charges by the airline you select*

- Annual credit of up to $400 with Dell on U.S. purchases*

- Annual credit of up to $150 on Adobe purchases

- Up to $360 in statement credits per year for purchases with Indeed; Up to $90 back per quarter

- Up to $120 in statement credits per year for wireless telephone service purchases made directly with a wireless provider in the U.S. on the Business Platinum Card; Up to $10 back per month

- 35% Pay with Points bonus when booking airfare with points through Amex Travel (up to 1 million bonus points per calendar year)

- Up to $100 fee credit for Global Entry or an $85 fee credit for TSA PreCheck every four years (4.5 years for PreCheck)

- Up to $189 Clear annual statement credit per calendar year

- Access to the American Express Global Lounge Collection, which includes Centurion Lounges, Priority Pass lounges and Delta Sky Clubs (limited to 10 annual visits from Feb. 1, 2025)

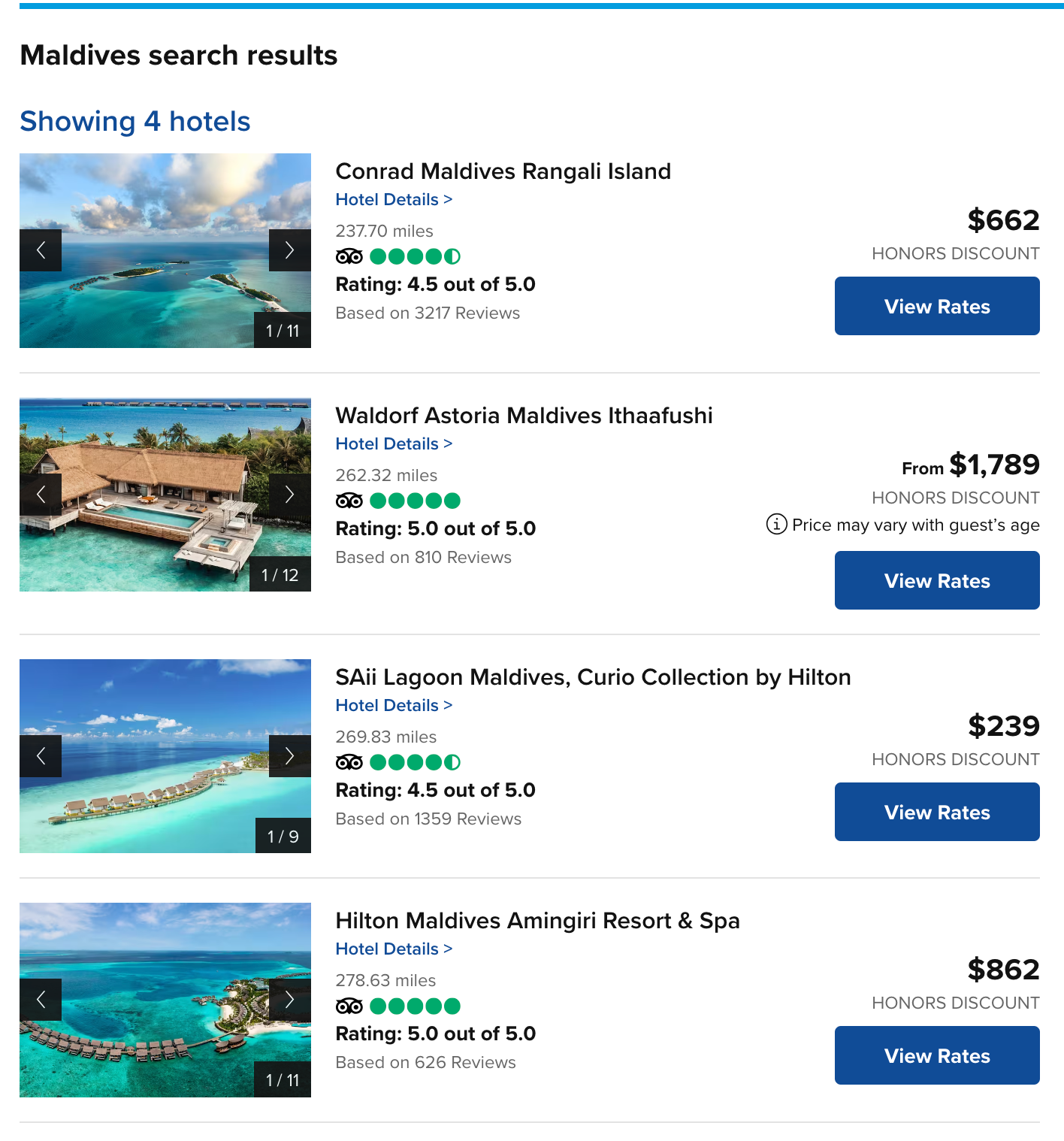

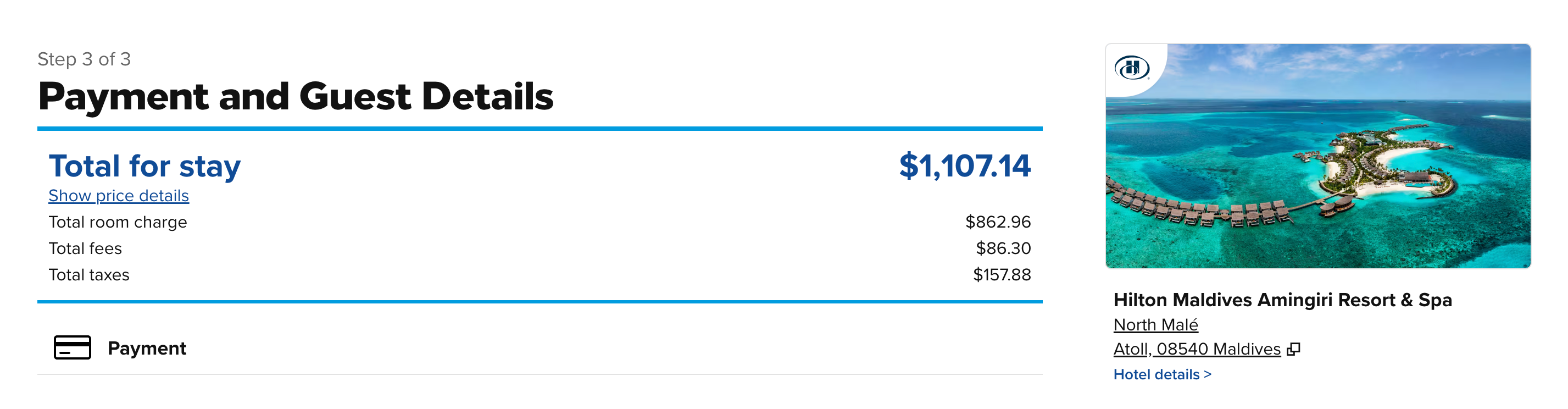

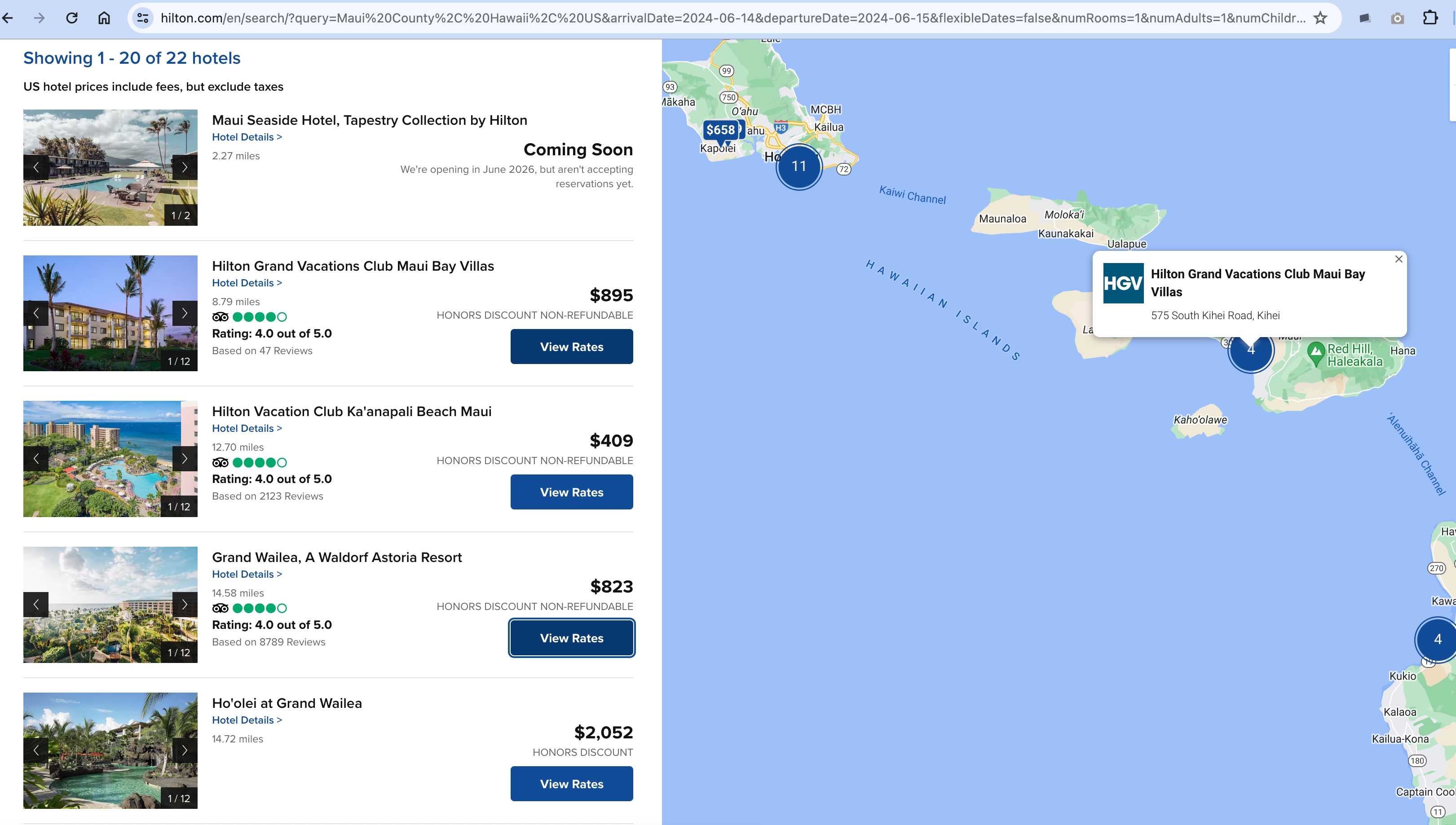

- Register for complimentary Gold elite status at Hilton and Marriott Hotels*

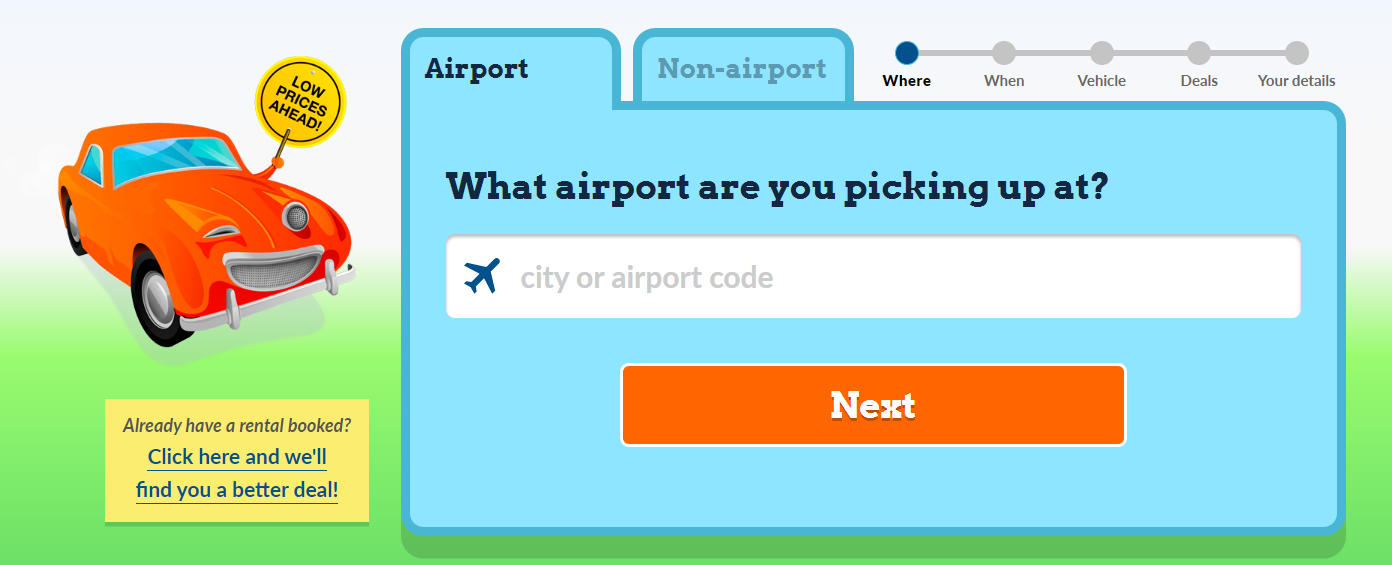

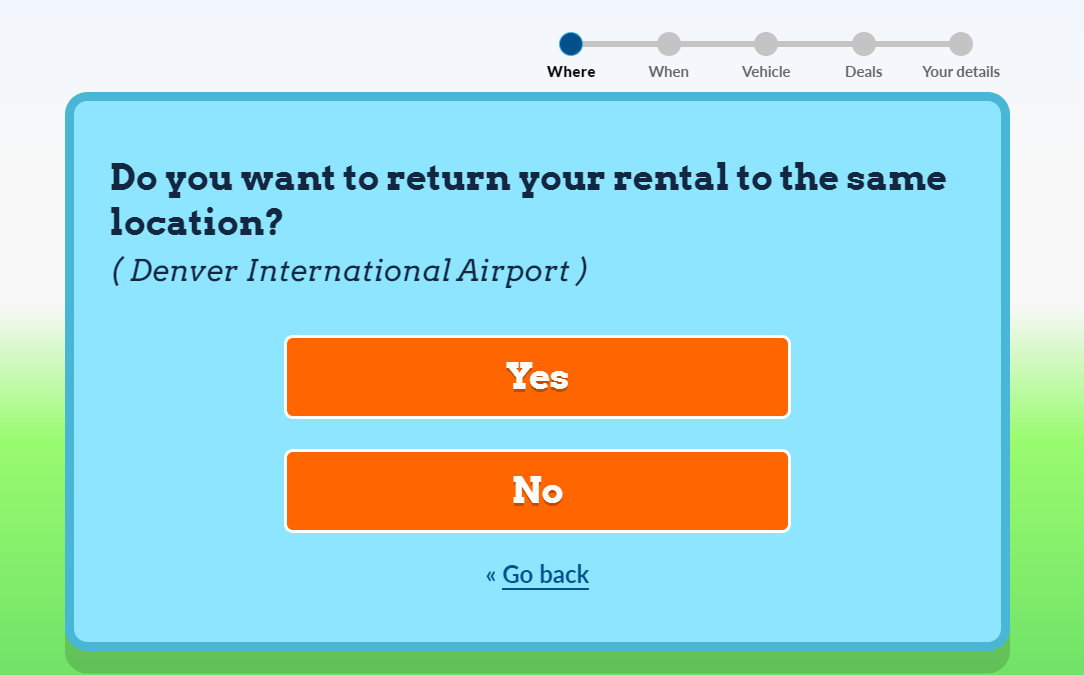

- Complimentary car rental status: Hertz Gold Plus Rewards President’s Circle, Avis Preferred Plus and National Emerald Club Executive*

- Ability to book stays through Amex Fine Hotels & Resorts with value-added perks

- International Airline Program airfare purchase discounts

Terms apply.

*Enrollment required for select benefits.

Related: Are the perks worth the price? A review of the Business Platinum Card from American Express

The card’s lesser-known benefits

Now that we’ve got the top-banner travel benefits out of the way, let’s get into the nitty-gritty perks that cardholders might not be taking advantage of, or even know they have:

Trip cancellation and interruption insurance

If you book a round-trip flight entirely with your eligible card* and the flight is canceled for a “covered reason” — including inclement weather, terrorist action, call to jury duty, sudden illness or injury to you or an eligible traveler or physician-led quarantine — you may receive reimbursement of nonrefundable travel expenses of up to $10,000 per trip, with a maximum of up to $20,000 per eligible account for each consecutive 12-month period.

Trip delay insurance

The card’s trip delay protection* covers round-trip flights purchased entirely with an eligible card. (This includes using the card to pay taxes and fees on award tickets or Pay With Points tickets.) If your trip is delayed by more than six hours because of a covered reason, this perk will reimburse unexpected expenses — such as meals, lodging and personal-use items — up to $500 per trip and up to two claims per card per consecutive 12-month period.

Lost or stolen baggage insurance

Like many other travel cards, this one offers insurance for lost or stolen bags**. When you use your card to purchase the entire fare on a common carrier, coverage is provided up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage per person. For New York State residents, there’s a $2,000 limit per bag/suitcase for each covered person with a $10,000 aggregate maximum for all people per trip.

Car rental loss and damage insurance

This is secondary rental insurance, rather than the primary insurance offered by other cards like the Chase Sapphire Reserve®, but will cover you up to $75,000 for damage or theft.

Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc.

Purchase protection**

This oft-overlooked benefit gives cardholders coverage up to 90 days from the date of purchase if an item is stolen, accidentally damaged, etc. The coverage is limited to up to $10,000 per occurrence and up to $50,000 per account per calendar year to repair, replace or reimburse you for the item.

Extended warranty**

This benefit adds up to one extra year to the original manufacturer’s warranty of five years or less. Coverage is up to $10,000 per item and $50,000 per account per calendar year.

Return protection

Return protection provides refunds to cardholders when a merchant won’t take back an eligible item up to 90 days from purchase. The benefit applies to eligible purchases charged entirely to your card up to $300 per item, and up to a maximum of $1,000 per account per calendar year, based on the date of purchase.

Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details.

Pay Over Time feature

This is especially handy for small-business owners whose cash flow might be irregular at times. If eligible, cardholders can enroll and pay certain purchases over time, though they do accrue interest on the balance, as with a credit card.

Concierge

Cardholders have access to a special phone service that can assist with tasks such as booking restaurants and events, or delivering items on demand. You must call to activate this benefit, but you can also sign up for texting for more convenience.

Preferred Seating Program

Thanks to Amex’s connections, its high-end cardholders get access to premium seats for cultural and sporting events based on availability.

Premium Private Jet Program

Cardmembers who purchase a Delta Private Jets Card (now part of Wheels Up) are entitled to a 20% discount off published fares for select fare classes in effect when booked.

Connect to QuickBooks

Amex business cardholders get this perk, which automatically logs transactions using their associated card to their Quickbooks account daily, which makes keeping track of purchases and expenses that much easier.

InCircle

This is Neiman Marcus’s loyalty program. When you enroll your Business Platinum Card with InCircle, you receive 1 point for every dollar of eligible purchases charged on your card at Neiman Marcus, Bergdorf Goodman, Last Call, Horchow or Cusp. For every 10,000 points you earn, you’ll get a $100 InCircle Point Card. Points are not awarded for the costs of sales tax, shipping, alterations, gift packaging, fur services, repair and cleaning of shoes, handbags, optical, precious jewelry, monogramming, salon products and services, and valet parking.

Departures Magazine

This is a digital luxury magazine exclusively for The Platinum Card® from American Express and Business Platinum Card members.

Related: Credit card showdown: Amex Platinum vs. Amex Business Platinum

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

**Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Bottom line

Although the Business Platinum Card comes with plenty of widely advertised perks, several lesser-known benefits can add tremendous value to the card if you maximize them.

These include travel and purchase protections, exclusive access to events, premium travel experiences and more. If you carry the card or are thinking of applying for it, be sure to read the card’s benefits guide in detail to take advantage of all it has to offer.

Apply here: The Business Platinum Card from American Express

For rates and fees of The Business Platinum Card from American Express, click here.

D3SIGN/GETTY IMAGES

D3SIGN/GETTY IMAGES