Looking for business-class flights to Europe from just 50,000 points each way?

British Airways is the largest full-service airline in the United Kingdom and flies to more destinations in the U.S. than any other European carrier.

The airline’s loyalty program is called the Executive Club, and its currency is Avios. With a huge route network and an easily earned and redeemed loyalty currency, it is a program that should be on your radar, even if you aren’t traveling to the U.K.

Rather than dynamic pricing, which can lead to 350,000-plus-point flight redemptions from the U.S. to Europe, British Airways retains an unpublished distance-based award chart that allows you to travel to some of the world’s most expensive markets for reasonable rates. However, you may be on the hook for significant carrier-imposed surcharges. Knowing how to use it can go a long way toward getting maximum value for your Avios.

In this guide, we’ll examine how this works so you can redeem British Airways Avios for your next trip.

How to earn Avios

There are many ways to earn Avios for your next trip, even if you aren’t planning any British Airways (or other Oneworld carrier) flights soon.

Credit cards

Applying for the British Airways Visa Signature® Card is one of the easiest ways to earn a meaningful number of Avios for everyday spending.

This card — issued by Chase and, therefore, subject to the 5/24 rule — is currently offering new applicants 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. TPG values Avios at 1.4 cents each in our August 2024 valuations, making the full bonus worth $1,050.

The British Airways Visa Signature has a $95 annual fee and earns 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia and Level. Plus, you can earn 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. All other purchases earn 1 Avios per $1 spent.

Transferable rewards cards

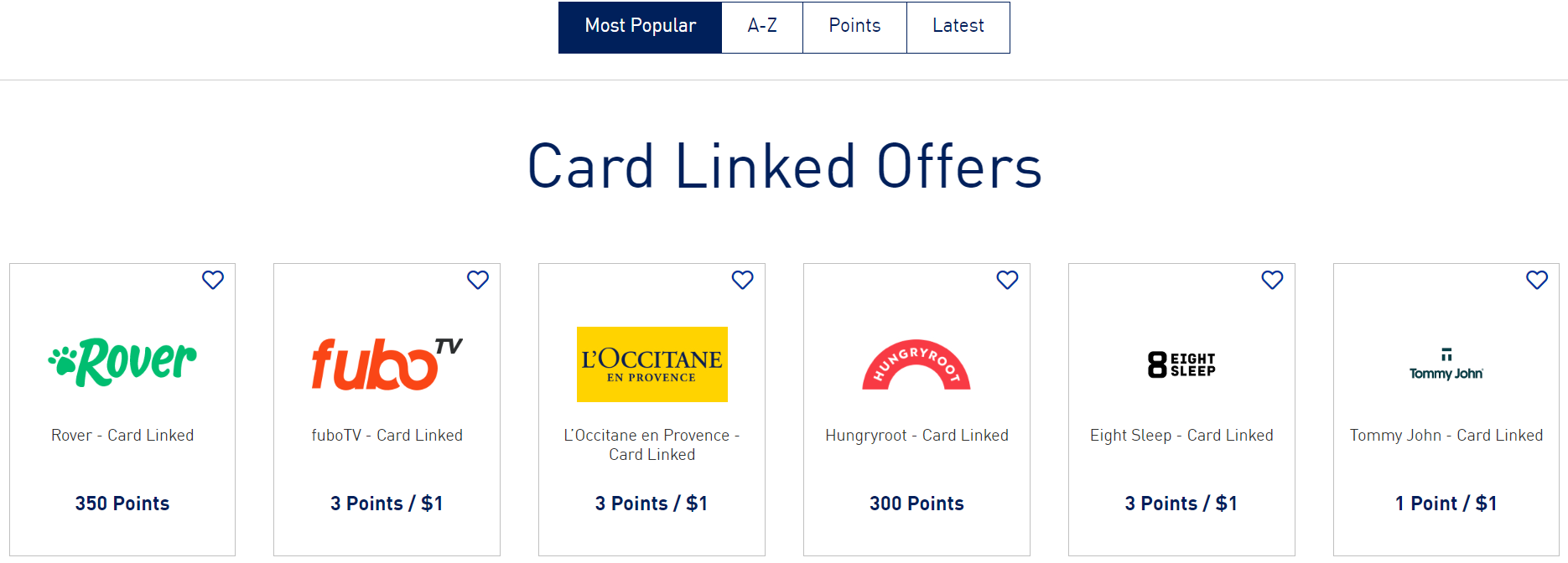

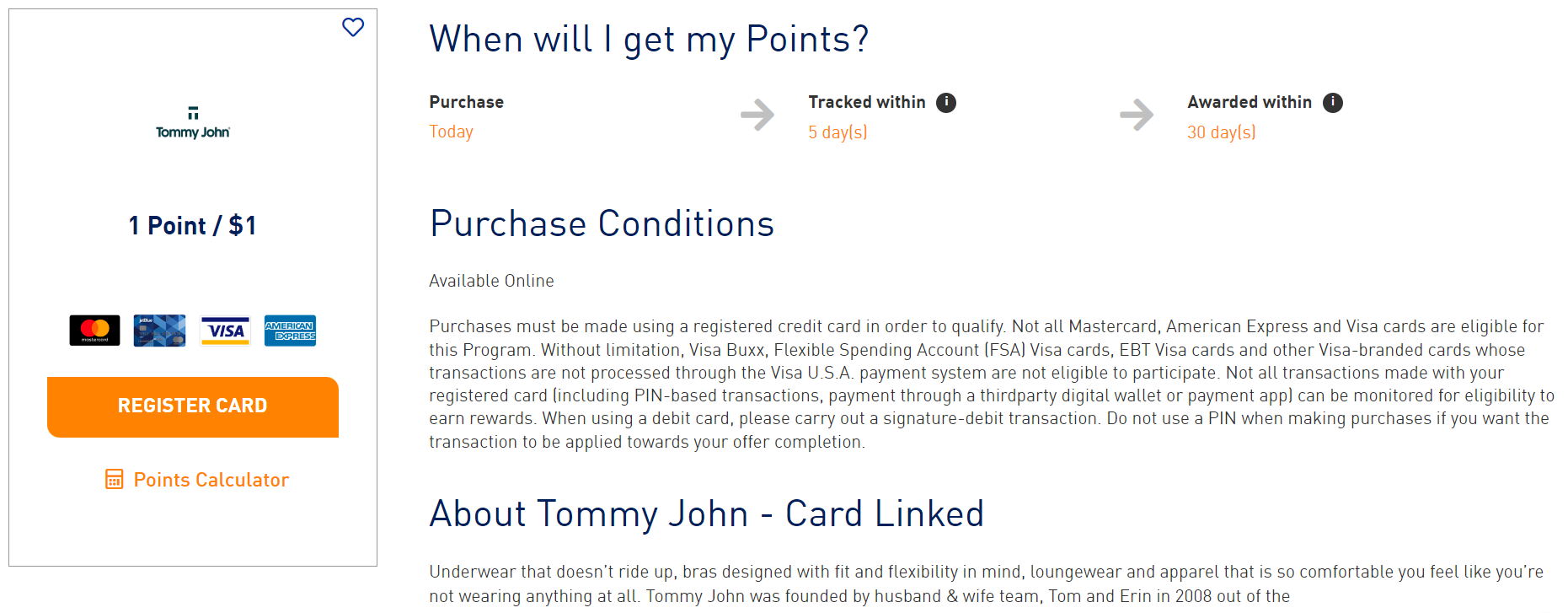

Savvy TPG readers know that we usually recommend sticking with cards that earn transferable points because of their added flexibility. This strategy still applies if you’re trying to accrue Avios. British Airways is a transfer partner of Capital One, Chase Ultimate Rewards, American Express Membership Rewards, Bilt Rewards, Wells Fargo Rewards and Marriott Bonvoy, making Avios one of the easiest currencies to earn.

Points transfer from Capital One, Chase, Bilt, Wells Fargo and Amex at a 1:1 ratio (in addition to occasional transfer bonuses), while Marriott points transfer to Avios at a 3:1 ratio. Plus, you’ll get a 5,000-Avios bonus for every 60,000 Marriott points transferred.

The following cards all currently offer strong welcome bonuses that you could easily convert to Avios:

- American Express® Gold Card: Earn 60,000 points after spending $6,000 on purchases in the first six months of card membership. Plus, receive 20% back in statement credits on eligible restaurant purchases (up to $100) within the first six months of card membership.

- The Platinum Card® from American Express: Earn 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. Check to see if you’re targeted for a 175,000-point welcome offer through CardMatch (offer subject to change at any time).

- Capital One Venture Rewards Credit Card: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening, plus a $250 Capital One Travel credit in the first cardholder year.

- Capital One Venture X Rewards Credit Card: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.

- Chase Sapphire Preferred® Card: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve®: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred® Credit Card: Earn 120,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

If you don’t have enough Avios, you can also purchase Avios.

The basics

As noted above, British Airways uses an unpublished distance-based formula to calculate the number of Avios needed for a given flight. To maximize value with this chart type, you must take a different approach than zone-based charts or dynamic pricing.

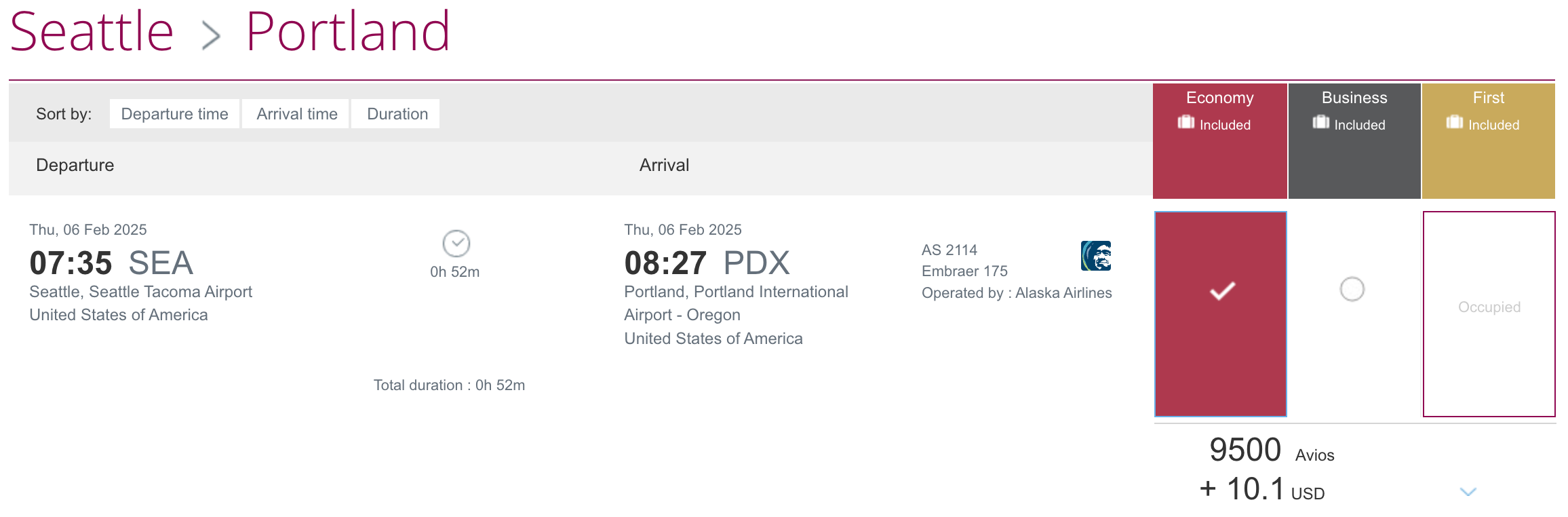

British Airways Avios are typically most valuable on short, nonstop routes where cash fares are expensive. A resource like Great Circle Mapper can calculate the distance of each flight segment to determine its zone.

British Airways’ sweet spots are different compared to other programs. Instead of focusing on specific countries or even entire continents, distance-based sweet spots tend to be individual city pairs close enough to avoid bumping into the next pricing tier — especially if cash tickets are usually pricey on those routes.

Related: Is British Airways premium economy worth it on the Boeing 777-300ER?

British Airways Avios award charts

With this in mind, let’s dive into specific award charts. We’ll start with the one used for flights operated by British Airways, Iberia and Aer Lingus, though carrier-imposed surcharges often complicate these redemptions. Each price is in Avios and applies to one-way flights.

| Zone (distance in miles) | Economy (off-peak) | Economy (peak) | Premium economy (off-peak) | Premium economy (peak) | Business class (off-peak) | Business class (peak) | First class (off-peak) | First class (peak) |

| Zone 1 (1 to 650) | 4,750 | 5,250 | — | — | 8,500 | 9,750 | — | — |

| Zone 2 (651 to 1,151) | 7,250 | 8,250 | — | — | 13,500 | 15,750 | — | — |

| Zone 3 (1,152 to 2,000) | 9,250 | 10,750 | — | — | 17,750 | 18,350 | — | — |

| Zone 4 (2,001 to 3,000) | 10,000 | 12,500 | — | — | 31,250 | 37,500 | — | — |

| Zone 5 (3,001 to 4,000) | 13,000 | 20,000 | 26,000 | 40,000 | 50,000 | 60,000 | 68,000 | 80,000 |

| Zone 6 (4,001 to 5,500) | 16,250 | 25,000 | 32,500 | 50,000 | 62,500 | 75,000 | 85,000 | 100,000 |

| Zone 7 (5,501 to 6,500) | 19,500 | 30,000 | 39,000 | 60,000 | 75,000 | 90,000 | 102,000 | 120,000 |

| Zone 8 (6,501 to 7,000) | 22,750 | 35,000 | 45,500 | 70,000 | 87,500 | 105,000 | 119,000 | 140,000 |

| Zone 9 (7,001 and up) | 32,500 | 50,000 | 65,000 | 100,000 | 125,000 | 150,000 | 170,000 | 200,000 |

Note that there are different prices for peak and off-peak dates. Peak dates are generally during the summer and school holidays, while off-peak pricing usually applies during the fall and winter months.

You will also be given the option to redeem more Avios toward fees, taxes and carrier-imposed surcharges thanks to the Reward Flight Saver offer.

Next, look at the award chart for flights operated by a single partner airline (other than Aer Lingus and Iberia, who use the chart above, and American Airlines and Alaska Airlines, who we will discuss below):

| Zone (distance in miles) | Economy | Premium economy | Business | First |

| Zone 1 (1 to 650) | 6,000 | 6,750 | 12,500 | 24,000 |

| Zone 2 (651 to 1,151) | 9,000 | 11,250 | 16,500 | 33,000 |

| Zone 3 (1,152 to 2,000) | 11,000 | 15,000 | 22,000 | 44,000 |

| Zone 4 (2,001 to 3,000) | 13,000 | 25,000 | 38,750 | 51,500 |

| Zone 5 (3,001 to 4,000) | 20,750 | 40,000 | 62,000 | 82,500 |

| Zone 6 (4,001 to 5,500) | 25,750 | 50,000 | 77,250 | 103,000 |

| Zone 7 (5,501 to 6,500) | 31,000 | 62,000 | 92,750 | 123,750 |

| Zone 8 (6,501 to 7,000) | 36,250 | 72,250 | 108,250 | 144,250 |

| Zone 9 (7,001 and up) | 51,500 | 100,000 | 154,500 | 206,000 |

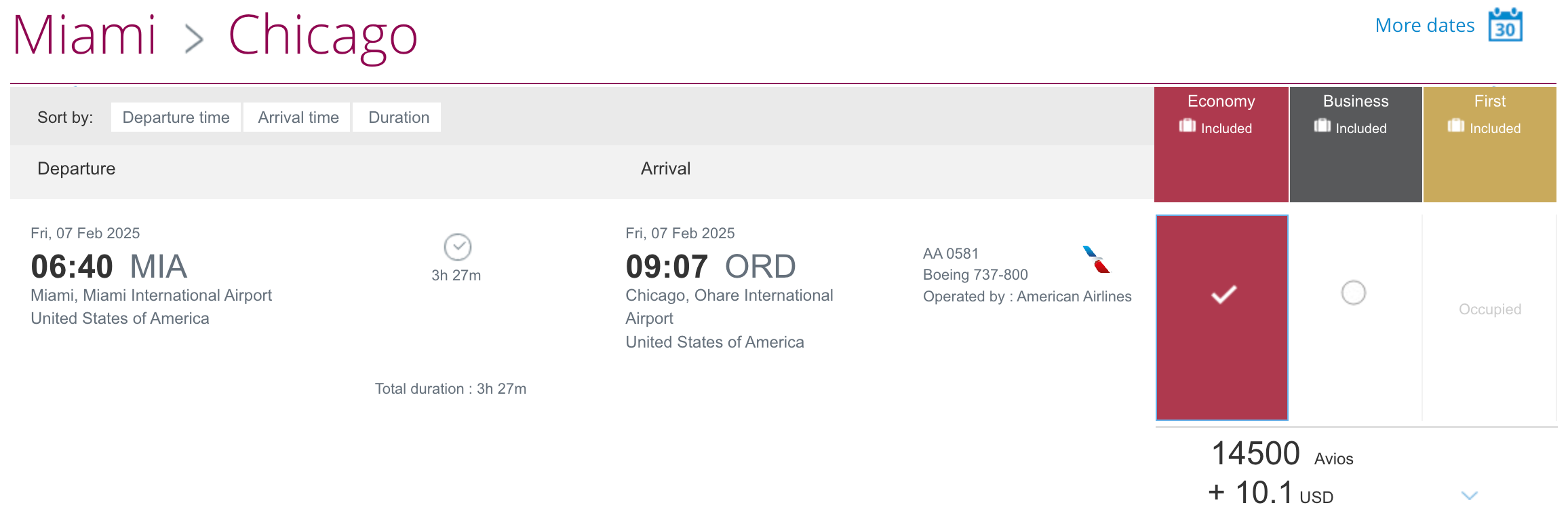

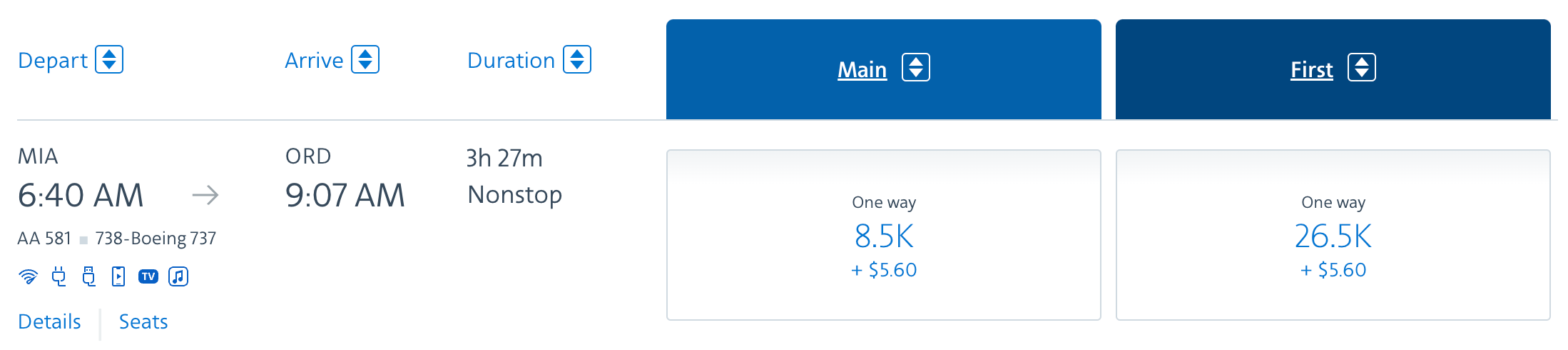

For flights in zones 1-4 operated by American and Alaska, Executive Club prices are as follows:

| Zone (distance in miles) | Main cabin economy | Domestic first class |

| Zone 1 (1 to 650) | 12,000 | 24,000 |

| Zone 2 (651 to 1,151) | 16,000 | 32,000 |

| Zone 3 (1,152 to 2,000) | 18,000 | 40,000 |

| Zone 4 (2,001 to 3,000) | 20,000 | 50,000 |

Follow the regular partner chart above for flights over 3,000 miles operated by American Airlines and Alaska Airlines.

For both of the above award charts, pricing applies to each flight in an itinerary. The distance isn’t cumulative across the entire trip. British Airways prices every segment individually, so you’ll want to stick to nonstop routings whenever possible.

Related: 5 versions of Avios: When to use Aer Lingus, Qatar Airways, Finnair, Iberia and British Airways

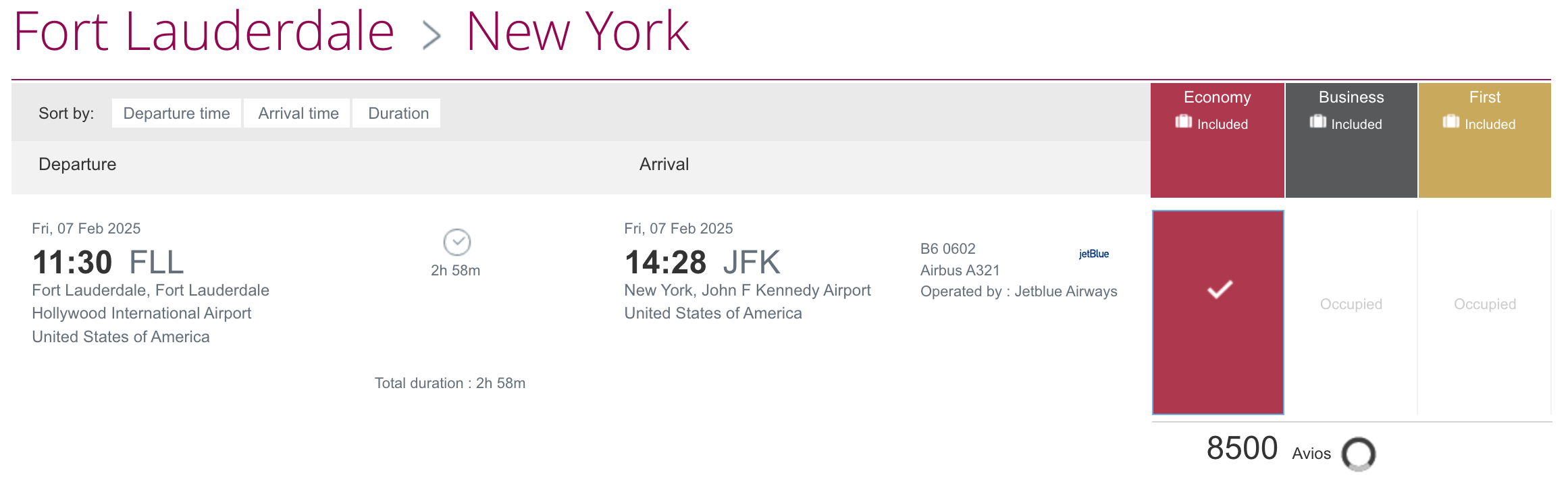

For example, say you wanted to fly from Fort Lauderdale-Hollywood International Airport (FLL) to Philadelphia International Airport (PHL). This flight covers 992 miles and would require 16,000 Avios per the chart above. However, suppose you could only find award availability on a connecting flight through Charlotte Douglas International Airport (CLT). In that case, you’d fly 89 more miles but pay 50% more Avios for your trip.

Here’s how the pricing works:

- Fort Lauderdale to Charlotte: Covers 632 miles (12,000 Avios)

- Charlotte to Philadelphia: Covers 449 miles (12,000 Avios)

- Total cost: 24,000 Avios

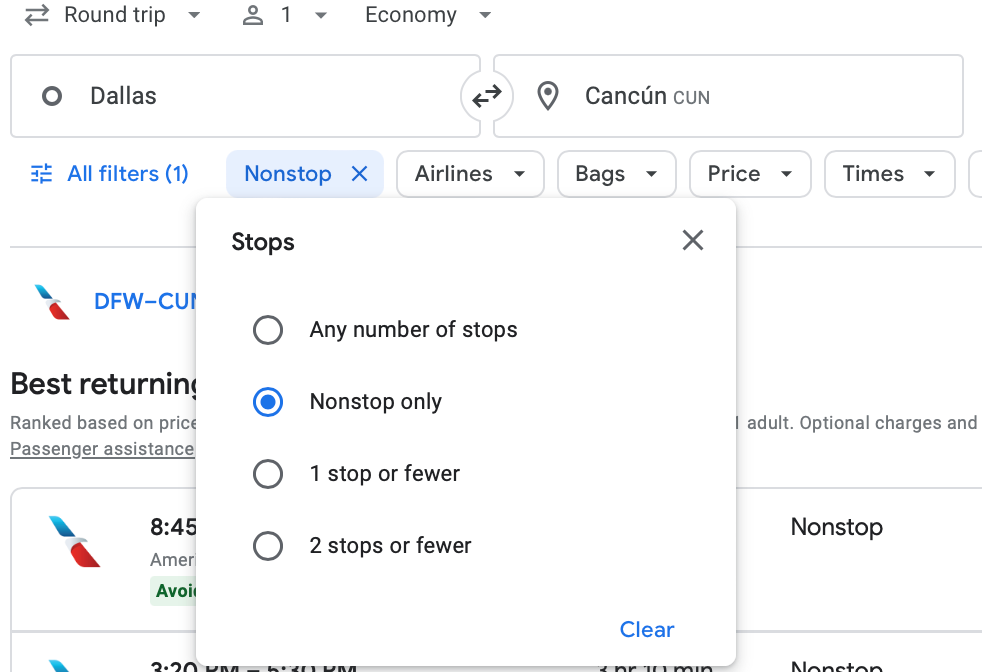

As such, the best value tends to come from nonstop flights.

Redeeming Avios within the US

While short-haul domestic flights are not as good a value as they used to be following several devaluations, you could find good value in short-haul international flights.

For example, you could fly American Main Cabin for just 12,000 Avios from Miami International Airport (MIA) to the following destinations:

- Providenciales International Airport (PLS) in Turks and Caicos

- Henry E. Rohlsen Airport (STX) in St. Croix

- Cozumel International Airport (CZM) in Mexico

Read more: Why Avios are my favorite type of rewards as a South Florida resident

Domestic lie-flat business class

American routinely flies internationally configured, wide-body jets on domestic routes.

For instance, some daily routes between Charlotte Douglas International Airport (CLT) and Miami are often operated by a 777-200. This plane features one of American’s best international business-class products. You can book that flight in business class for only 32,000 Avios.

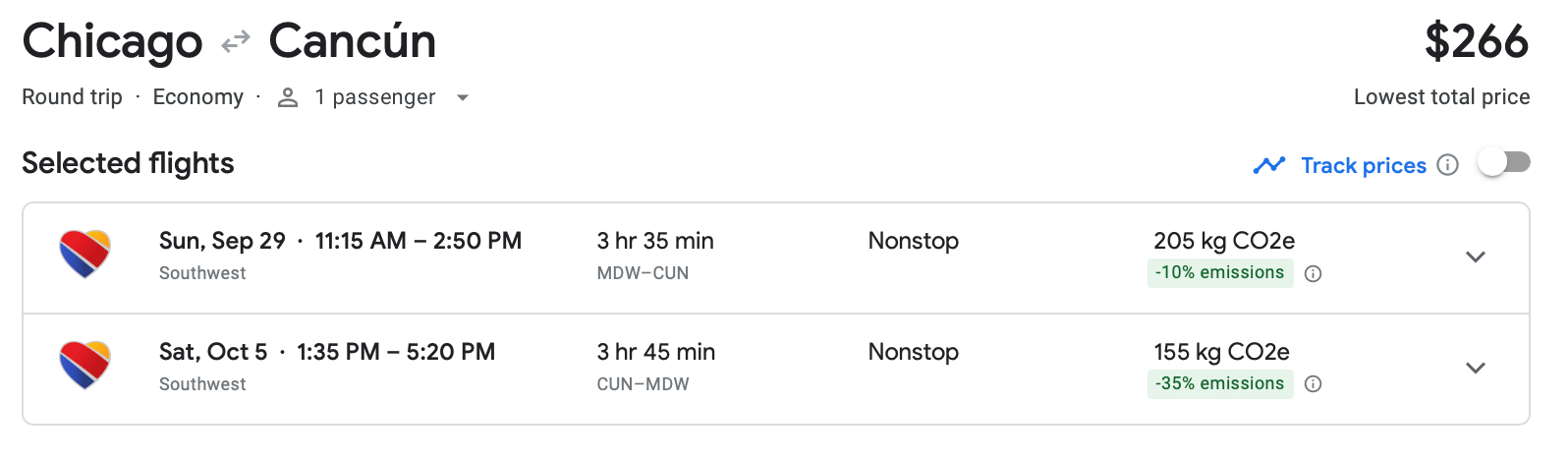

West Coast to Hawaii

Just because we’re talking about flights within the U.S. doesn’t mean you can’t have a tropical vacation. Hawaii is close to several West Coast cities (less than 3,000 miles), and you can book economy awards for only 20,000 Avios each way.

American Airlines serves several Hawaiian destinations from its Los Angeles International Airport (LAX) and Phoenix Sky Harbor International Airport (PHX) hubs. In addition to Los Angeles, Alaska Airlines also flies nonstop to multiple Hawaiian airports from San Diego International Airport (SAN), San Francisco International Airport (SFO), Seattle-Tacoma International Airport (SEA) and Portland International Airport (PDX) — among others.

Redeeming Avios outside the US

British Airways’ international partners span the globe, so some of the best British Airways redemptions are bound to come from international travel.

6,000-Avios awards

These low-priced awards are especially useful in pricey markets, such as European or Asian travel. Generally, you want to look for a Oneworld hub airport like Iberia’s home in Adolfo Suarez Madrid-Barajas Airport (MAD) or Japan Airlines’ hubs in Narita International Airport (NRT) and Haneda Airport (HND).

Air Lingus sweet spots

The British Airways award chart has peak and off-peak pricing, which also applies to flights on Iberia and Aer Lingus. As a result, nonstop flights between the East Coast and Chicago to Ireland have become incredibly attractive, with transatlantic economy awards starting at just 13,000 Avios each way on off-peak dates.

You can book a round-trip, nonstop flight from multiple U.S. cities to Ireland starting at 26,000 Avios, which is phenomenal.

Multicity trips using Avios

As highlighted above, British Airways charges separately for every segment. More stops require more Avios, even if your origin and final destination are the same. However, this pricing approach allows you to book unlimited stopovers or open jaws on your award tickets.

Multicarrier awards exception

It’s important to note that British Airways has yet another award chart that only applies to award tickets with two or more Oneworld airlines. Unlike the standard award prices above, these multicarrier reward flights use cumulative distance to determine how many Avios you need.

While this typically offers a poor value proposition for simple itineraries, there are times when you should use it — like if you’re booking a round-the-world ticket.

Bottom line

When people think of British Airways’ loyalty program, many assume you’d want to use Avios for premium-cabin transatlantic trips to Europe. But that’s not necessarily the best way to use them.

Long-haul flights cost increasingly more under the distance-based Avios chart. Plus, British Airways tacks on large surcharges to those transatlantic flights.

By employing the above tips, you can maximize your Avios and the British Airways chart without spending a lot of cash.