Editor’s note: This is a recurring post, regularly updated with new information and offers.

One of the questions people often ask us is, “How much is a point or mile worth?”

The true answer varies from point to point and person to person. It also depends on your travel goals and how well you can maximize a particular loyalty currency. Still, some rewards credit cards are clearly worth more than others, and our goal is to give you a sense of how they stack up.

Historically, TPG has valued points and miles based on a combination of the price at which we would purchase the miles, award costs in the program (factoring in availability and fees) and our own expertise in the inner workings of the programs.

However, we now use extensive data for the top six U.S. airline loyalty programs to better estimate the value you should aim to get from your rewards (you can read our full breakdown of this methodology in our explainer post).

This month, our model showed a bit of variation with these numbers — though none of them were significant compared to previous runs of the data.

Looking for a convenient way to see all of your points and miles in one place? Download the free TPG app!

Note: These valuations are not provided by card issuers.

What are credit card points and miles worth?

| Program | FEBRUARY 2024 (cents) | Latest news |

| American Express Membership Rewards | 2.0 | One Amex business card will lose 3 statement credits this year. You can save up to 50% on Amazon purchases by using just one Membership Rewards point. |

| Bilt Rewards | 2.05 | Bilt adds milestone rewards to its program. |

| Capital One | 1.85 | |

| Chase Ultimate Rewards | 2.05 | Chase opened a new lounge at New York’s John F. Kennedy International Airport (JFK). |

| Citi ThankYou Rewards | 1.8 |

What are airline points and miles worth?

| Program | FEBRUARY 2024 (cents) | Latest news |

| Air Canada Aeroplan |

1.5 | Canadians will be able to earn Aeroplan points for health and wellness activities. |

| Alaska Airlines Mileage Plan | 1.5* (up from 1.4) | Alaska will fly to Toronto Pearson Airport (YYZ) for the first time but is dropping other routes. |

| American Airlines AAdvantage | 1.55* (up from 1.5) | American announced new flights from New York to Tokyo’s Haneda Airport (HND) and new services to Australia and Brazil. |

| All Nippon Airways Mileage Club | 1.4 | |

| Asia Miles | 1.3 | |

| Avianca LifeMiles | 1.7 | |

| Avios | 1.5 | British Airways is aligning Tier Point year-end dates for earning elite status. |

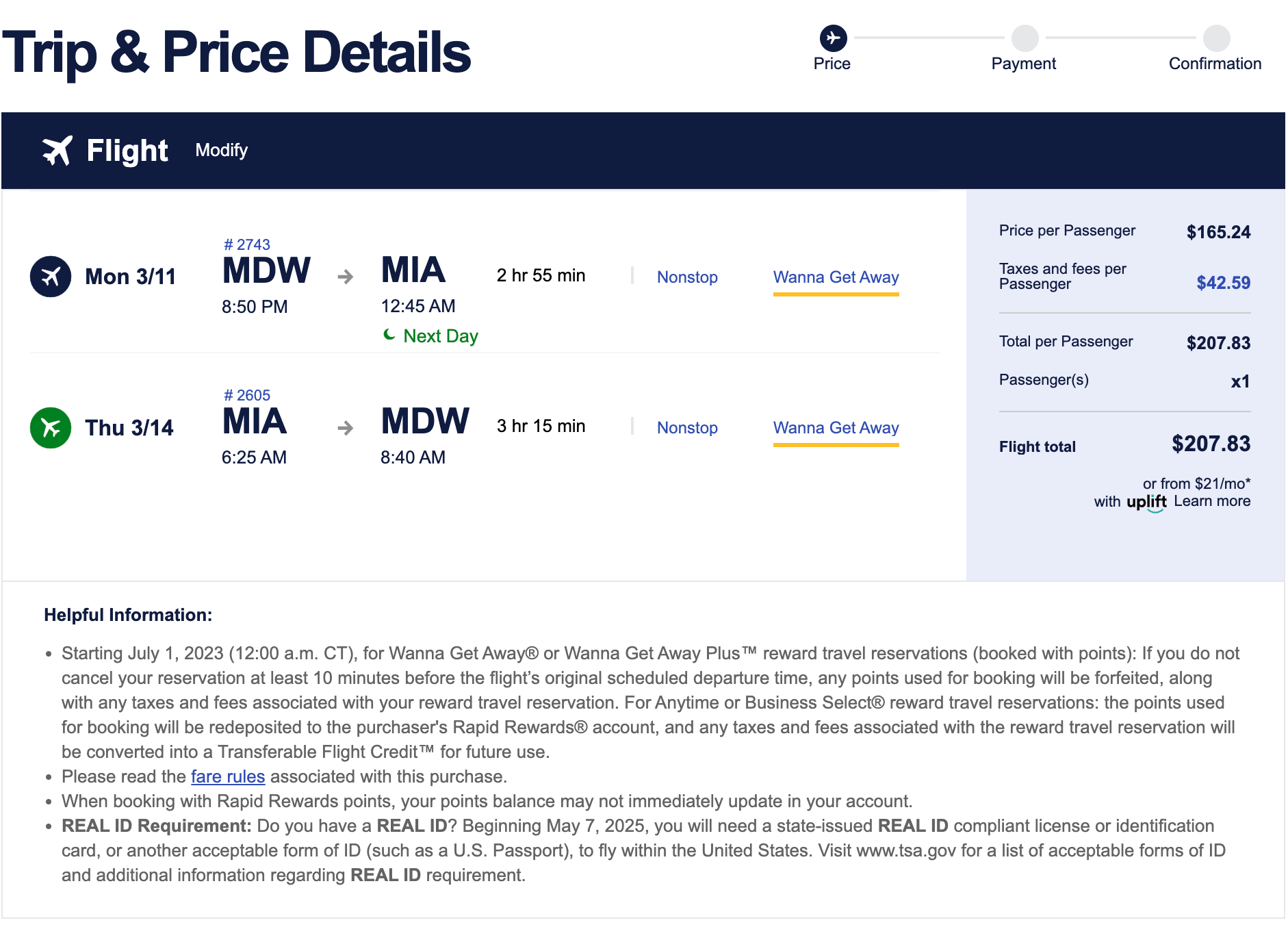

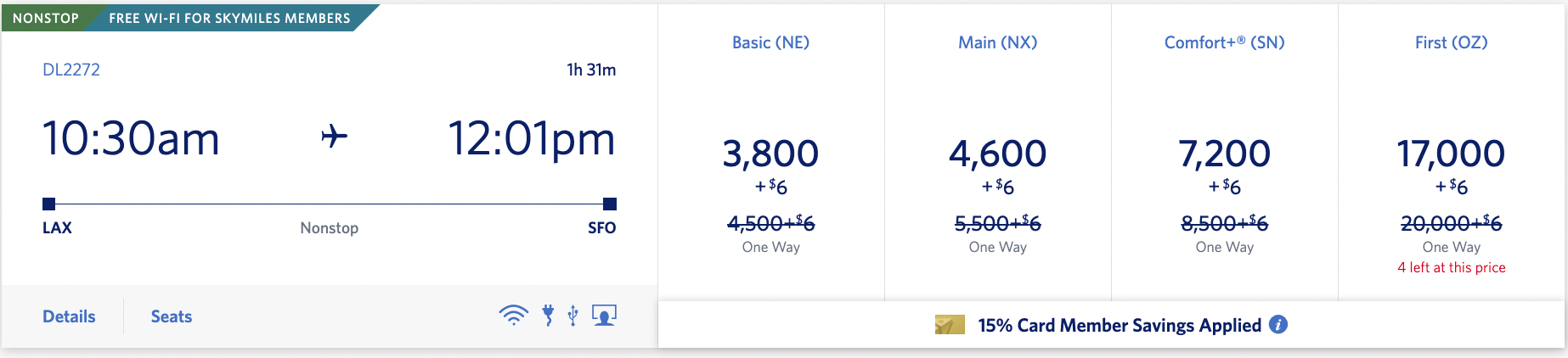

| Delta Air Lines SkyMiles | 1.2* | Delta will add futuristic first-class recliners to Boeing 737 aircraft. The airline’s 2024 status challenge is now live. The DOT is requiring Delta and Aeromexico to end their joint venture. |

| Emirates Skywards | 1.2 | |

| Etihad Airways Guest | 1.2 | |

| Flying Blue | 1.2 | Air France announced a new route to Phoenix. |

| Frontier Airlines Frontier Miles | 1.1 | Frontier introduced a new business-class fare that includes seat selection and carry-on baggage. The airline announced eight new routes from Philadelphia International Airport (PHL). |

| Hawaiian Airlines HawaiianMiles | 0.9 | |

| JetBlue TrueBlue |

1.4* | JetBlue dropped Baltimore from its route map and cut several routes from New York. The airline suggests the merger agreement with Spirit Airlines could be terminated. JetBlue will introduce a new seat fee. |

| Korean Air SkyPass | 1.7 | |

| Singapore Airlines KrisFlyer | 1.3 | |

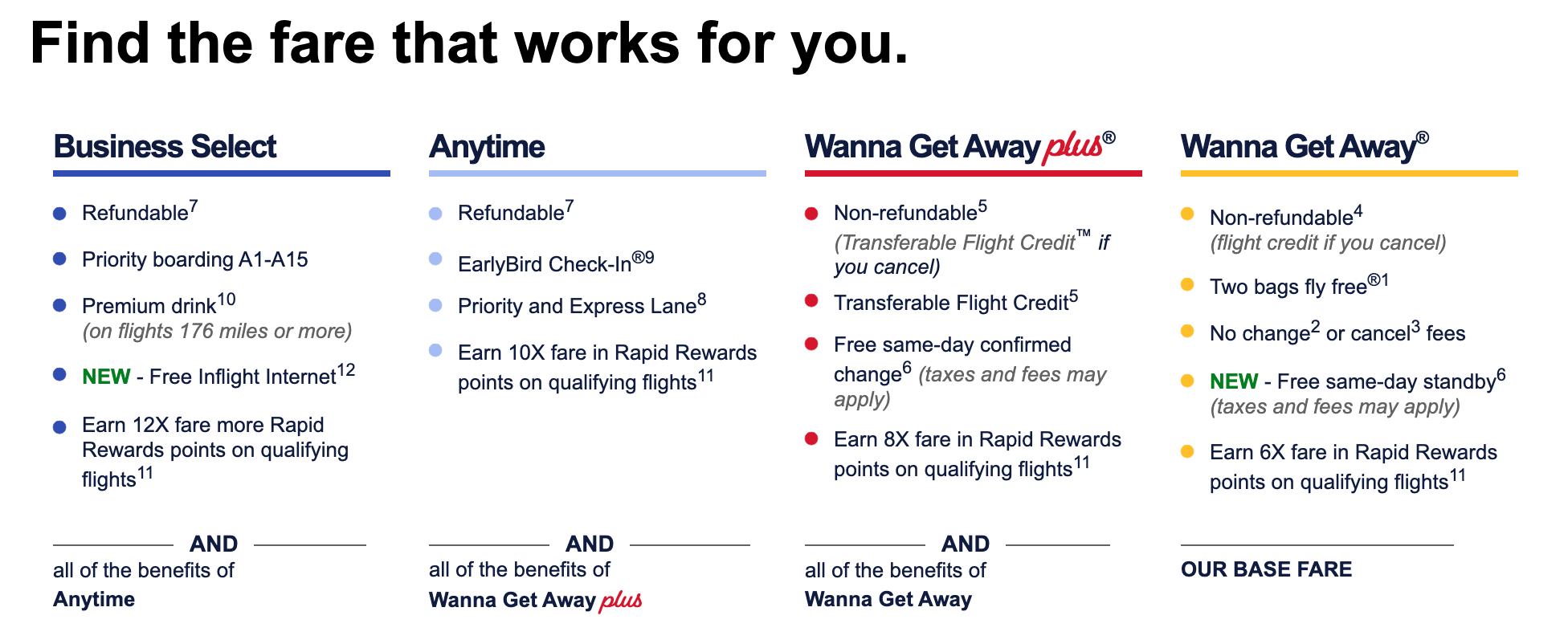

| Southwest Airlines Rapid Rewards | 1.4* | Southwest unveiled new seats and cabin designs. New welcome offers on Southwest personal cards now include a Companion Pass for a limited time only. |

| Spirit Airlines Free Spirit | 1.1 | |

| Turkish Airlines Miles&Smiles | 1.2 (down from 1.3 last month) | Huge devaluation coming on Feb. 16 with redemption increases of up to 100% — book your awards now. |

| United Airlines MileagePlus | 1.45* | United targets some MileagePlus members to buy up to a higher Premier status. The airline announced several new summer routes to Alaska and Canada. United has begun depositing one-time PQPs for 2023 Premier members into MileagePlus accounts. |

| Virgin Atlantic Flying Club | 1.5 | You can earn up to 10,000 bonus points on cash flights through June 30. |

*Calculated using TPG’s revamped, data-backed valuations methodology launched in September 2023.

What are hotel points worth?

| Program | FEBRUARY 2024 (cents) | Latest news |

| Accor Live Limitless | 2.0 | |

| Best Western Rewards | 0.6 | |

| Choice Privileges | 0.6 | Here are 28 hotels you can stay at for fewer points through April 15. |

| Hilton Honors | 0.6 | Hilton introduced new booking and travel benefits for smaller businesses. Hilton is considering acquiring the Graduate Hotels chain and announced it would begin partnering with Small Luxury Hotels of the World. |

| IHG One Rewards | 0.5 | |

| Marriott Bonvoy | 0.84 | This new Marriott promo offers 1,000 bonus points plus and elite night credit each night. |

| World of Hyatt | 1.7 | Hyatt is losing Small Luxury Hotels to Hilton. |

| Wyndham Rewards | 1.1 | Wyndham announced a new lifestyle hotel concept dubbed Project HQ Hotels & Residences. |

Points and miles news

If you were planning a Turkish Miles&Smiles redemption, you should book it immediately. The program just announced a significant devaluation to commence on Feb. 16, with significant price increases across the board and a frustrating new per-segment structure that means your sweet-spot award to Europe (previously 45,000 miles each way in business class) will cost 85,000-90,000 later this month.

For this reason, we have reduced our valuation of Miles&Smiles from 1.3 to 1.2 cents each this month.

The other big news came from Delta and American Express, as the duo launched major changes to their personal and business cobranded credit cards. With higher annual fees and a slew of new statement credits, it’s another indication of issuers moving their cards to more of a lifestyle value proposition — rather than just focusing on travel benefits.

In more positive news, Chase continues to disrupt the domestic airport lounge scene by opening two new lounges in New York.

First was the Sapphire Lounge by The Club at New York’s LaGuardia Airport (LGA), which TPG’s Zach Griff now considers the best lounge in the airport. It features a 360-degree bar, a photo booth and even a hidden speakeasy-style retro arcade. To elevate the experience even higher, three Reserve Suites can be booked separately, starting at an eyebrow-raising $2,300 for a three-hour slot.

Then, just a week later, Chase opened the Sapphire Lounge by The Club at New York’s John F. Kennedy International Airport Airport (JFK). This second airport takes over the former Etihad Airways lounge in Terminal 4. While not as jaw-droppingly good as the new LaGuardia lounge, it is still a step up from your average Priority Pass effort.

Travelers holding the Chase Sapphire Reserve enjoy unlimited access to these two lounges (including two guests) through the complimentary Priority Pass membership offered with the card. Those with Priority Pass memberships through other cards (or purchased directly from Priority Pass) can access them once per year as a tempting taster, with extra visits (or guests) charged at $75 per visit.

Chase’s impressive investment in these lounges is likely part of a wider strategy to increase the value of the Sapphire Reserve. This card was one of the best options for frequent travelers when it first hit the market, but competition has heated up in the years since. Even it’s lower-priced brethren — Chase’s own Sapphire Preferred Card — carries generous earning rates, solid perks and comparable travel protections.

That said, the Reserve card’s higher annual fee could now be a savvy investment if you live in New York or pass through these airports regularly.

Read more: Chase Sapphire Preferred vs. Sapphire Reserve: Should you go mid-tier or premium?

In other news, the following loyalty programs are also offering bonuses on purchasing points and miles:

- Alaska Airlines MileagePlan: Earn up to a 60% bonus on points purchases by Feb 24 with purchase rates as low as 1.85 cents per point.

- Hilton Honors: Get a 100% bonus on purchased points by March 12, at 0.5 cents per point.

- JetBlue TrueBlue: Earn a 90% bonus when you buy 3,000 or more points before March 31, 2024, at a rate as low as 1.32 cents per point.

- Southwest Airlines Rapid Rewards: Earn up to a 45% bonus on points purchases by Feb. 23 with purchase rates as low as 1.65 cents per point.

Travel credit card offers

Beyond these developments, there is no shortage of great welcome bonuses on many popular cards. Here are a few of our favorites this month.

Chase Sapphire Preferred Card

Right now, the Chase Sapphire Preferred Card is offering a welcome bonus of 60,000 bonus points after you spend $4,000 in the first three months of account opening. Per TPG’s valuation, that’s worth $1,230 when you leverage transfer partners or $750 if you redeem through the Chase travel portal at 1.25 cents per point.

The card comes with a manageable $95 annual fee, along with a variety of travel protections and additional perks — like a $50 annual hotel credit for reservations made through the Chase travel portal and a 10% anniversary points bonus based on your previous year’s spending.

Of course, you may want to spring for the Chase Sapphire Reserve instead. While the card has a hefty $550 annual fee, it includes perks like Priority Pass lounge access, an annual $300 travel credit and a Global Entry or TSA PreCheck credit, among other benefits. Plus, you’ll earn 3 points per dollar spent on travel and dining expenses, so you can quickly rack up rewards for your next big trip.

For more details, check out our full review of the Chase Sapphire Preferred Card.

Official application link: Chase Sapphire Preferred Card

Capital One Venture X Rewards Credit Card

On the higher end of the spectrum is the Capital One Venture X Rewards Credit Card, one of the most exciting travel credit cards on the market, thanks to great earning rates and included perks.

The card is currently offering a welcome bonus of 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening — worth $1,388, according to our valuations, thanks to Capital One’s excellent airline and hotel transfer partners.

For more details, check out our full review of the Capital One Venture X Rewards Credit Card.

Official application link: Capital One Venture X Rewards Credit Card

Capital One Venture Rewards Credit Card

The standard Capital One Venture Rewards Credit Card is currently offering the same welcome bonus as the Venture X. You can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. Like the Venture X, the Venture card earns 2 miles per dollar spent on everything you purchase.

For more details, check out our full review of the Capital One Venture Rewards Credit Card.

Official application link: Capital One Venture Rewards Credit Card

The Platinum Card® from American Express

With the current welcome offer on the Amex Platinum, you’ll earn 80,000 Membership Rewards points after you spend $8,000 on purchases in the first six months of card membership — though you may be targeted for a higher offer through the CardMatch tool (offer subject to change at any time).

Of course, the card is jam-packed with benefits like airport lounge access and hotel elite status. These benefits can make your travel experience smoother and more luxurious than ever before — especially with the most recent additions. The card has a $695 annual fee (see rates and fees). Enrollment is required for select benefits.

For more details, check out our full review of the Amex Platinum.

Official application link: The Platinum Card from American Express

American Express® Gold Card

One of the most popular cards with TPG staffers, the Amex Gold offers 60,000 Membership Rewards points after you spend $6,000 on eligible purchases on your new card within the first six months of card membership. This welcome offer is worth $1,200 based on our valuations — but be sure to check the CardMatch tool to see if you’re targeted for an even higher offer (offer subject to change at any time).

The card is great for many everyday purchases. You’ll earn 4 points per dollar spent at U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar) and 4 points per dollar spent on dining at restaurants. The card has a $250 annual fee (see rates and fees).

For more details, check out our full review of the Amex Gold.

Official application link: American Express Gold Card

The Business Platinum Card® from American Express

The Business Platinum Card offers 120,000 Membership Rewards points after you spend $15,000 on eligible purchases with your card in the first three months of card membership. Per our valuations, this welcome offer is worth at least $2,400, but you can get even more value when redeeming for high-end airfare.

The card also provides a slew of additional perks similar to (but slightly different from) the personal version — you can compare the two cards in this guide to see which one would be a better fit for your wallet.

For more details, check out our full review of the Amex Business Platinum.

Official application link: The Business Platinum Card from American Express

Capital One Venture X Business

The Capital One Venture X Business card launched in September 2023, and new applicants can now earn a massive welcome bonus of up to 300,000 miles. They’ll earn 150,000 miles after spending $20,000 in the first three months from account opening, plus an additional 150,000 miles after spending $100,000 in the first six months of account opening. While that’s obviously a huge spending requirement, those rewards can go a long way toward your next trip.

The Venture X Business features nearly identical perks to the personal version of the card — including a $300 annual credit for bookings through Capital One Travel, extensive airport lounge access and 10,000 bonus miles on your cardholder anniversary.

For more details, check out our full review of the Capital One Venture X Business.

Official application link: The Capital One Venture X Business card

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card offers a generous 100,000 Ultimate Rewards points welcome bonus after spending $8,000 in the first three months after card opening, worth over $2,000 by our current valuation. This could be a great option for business owners looking to benefit from a six-figure welcome bonus who might not reach the higher spending requirements of the Capital One Venture X Business welcome offer.

This card also offers triple points on the first $150,000 spent in combined purchases each year on travel, shipping purchases, internet, cable and phone services and advertising purchases made with social media sites and search engines. There are also generous cellphone and purchase protections as tell we trip cancellation/interruption and delay reimbursement insurance.

For more details, check out our full review of the Ink Business Preferred Credit Card.

Official application link: The Ink Business Preferred Credit Card

Airline credit cards

In addition to changes on the Delta American Express card portfolio, we also saw the launch of increased welcome offers across the cards:

| Card | Welcome offer | Annual fee | Bonus value* |

|---|---|---|---|

| Delta SkyMiles® Gold American Express Card | Earn 70,000 bonus miles after $3,000 in spending in the first six months of card membership. Offer ends March 27. | $0 introductory fee for the first year, then $150 (see rates and fees) | $840 |

| Delta SkyMiles® Platinum American Express Card | Earn 90,000 bonus miles after $4,000 in spending in the first six months of card membership. Offer ends March 27. | $350 (see rates and fees) | $1,080 |

| Delta SkyMiles® Reserve American Express Card | Earn 100,000 bonus miles after $6,000 in spending in the first six months of card membership. Offer ends March 27. | $650 (see rates and fees) | $1,200 |

| Delta SkyMiles® Gold Business American Express Card | Earn 80,000 bonus miles after $6,000 in spending in the first six months of card membership. Offer ends March 27. | $0 introductory fee for the first year, then $150 (see rates and fees) | $960 |

| Delta SkyMiles® Platinum Business American Express Card | Earn 100,000 bonus miles after $8,000 in spending in the first six months of card membership. Offer ends March 27. | $350 (see rates and fees) | $1,200 |

| Delta SkyMiles® Reserve Business American Express Card | Earn 110,000 bonus miles after $12,000 in spending in the first six months of card membership. Offer ends March 27. | $650 (see rates and fees) | $1,320 |

*Bonus value is based on TPG valuations and is not provided or reviewed by the issuer.

You can also earn a valuable Southwest Companion Pass and 30,000 bonus points after you spend $4,000 on purchases in the first three months from account opening on the Southwest Rapid Rewards Plus Credit Card, Southwest Rapid Rewards Premier Credit Card and the Southwest Rapid Rewards Priority Credit Card.

Check out our list of the best travel credit cards for other options that could fit your wallet.

For rates and fees of the Amex Platinum Card, click here.

For rates and fees of the Amex Gold Card, click here.

For rates and fees of the Delta Gold, click here.

For rates and fees of the Delta Gold Business, click here.

For rates and fees of the Delta Platinum, click here.

For rates and fees of the Delta Platinum Business, click here.

For rates and fees of the Delta Reserve, click here.

For rates and fees of the Delta Reserve Business, click here.

This is The Points Guy’s permanent page for the most up-to-date valuations, so you can bookmark it and check back each month for updates.